Robinhood Markets’ crypto division has reached a $3.9 million settlement with the California Justice Department in response to allegations that it discontinued crypto withdrawals between 2018 and 2022.

According to California Attorney General Rob Bonta, the California Department of Justice’s initial public action against a crypto company occurred on September 4.

Bonta had claimed that Robinhood Crypto LLC had violated the state’s commodities laws by permitting customers to purchase cryptocurrency without delivering the assets to them.

As a result, customers were compelled to sell their cryptocurrency to Robinhood to exit the platform.

Bonta also stated that Robinhood misled its users by claiming to hold customer crypto-assets when, in certain instances, other trading venues possessed them.

He accused the trading platform of deceiving more customers by advertising that it would connect to numerous trading venues to provide users with competitive prices, which was only sometimes the case.

In its August 31 settlement agreement, Robinhood did not acknowledge or deny any misconduct.

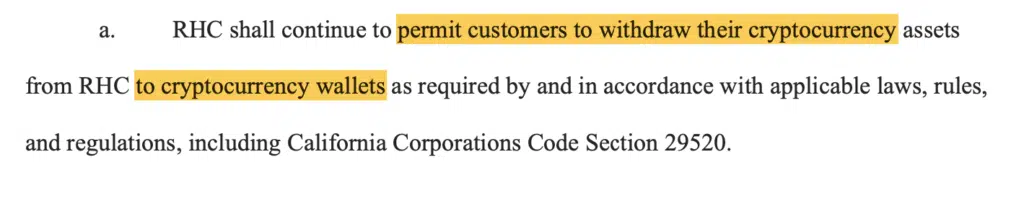

The agreement required Robinhood to permit consumers to withdraw their cryptocurrency from their wallets in addition to a monetary penalty.

In addition, it is necessary to provide users with a clear understanding of its trading, order management, and custody representations and to follow them.

“Our investigation and settlement with Robinhood should serve as a clear reminder that it is imperative to comply with California’s consumer and investor protection laws, regardless of whether one operates a brick-and-mortar store or a cryptocurrency company,” Bonta stated.

Lucas Moskowitz, Robinhood’s general counsel, stated in an email to Cointelegraph, “We are delighted to have resolved this issue.”

“The settlement fully resolves the Attorney General’s concerns related to historical practices, and we look forward to continuing to make crypto more accessible and affordable to everyone.”

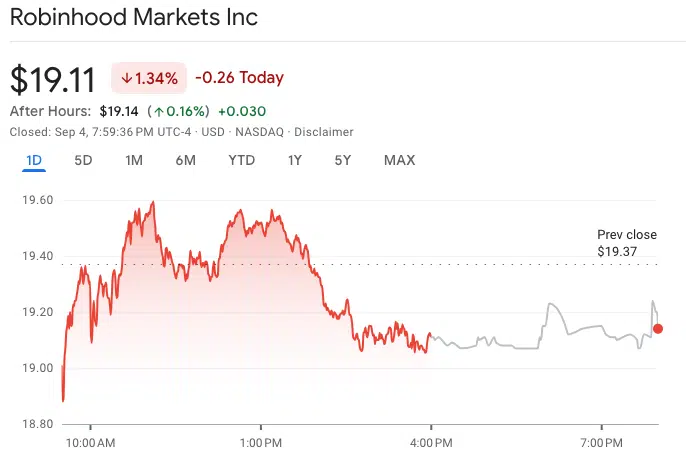

The Robinhood shares (HOOD) closed at $19.11 on September 4, down 1.34%. However, they experienced a minor 0.16% increase to $19.14 after after-hours trading, according to Google Finance.

The retail trading rebound that occurred earlier this year, which was bolstered by the return of veteran meme stock trader Keith Gill, who had yet to post since 2021 publicly, has resulted in a growth of approximately 54.5% for HOOD so far this year.