The CFTC filed for an emergency stay, citing concerns about not having enough time to decide whether to appeal.

The United States regulator has submitted an urgent emergency move to stop Kalshi, a U.S. based prediction market company, from offering election betting contracts.

The submission came just a few hours after the judge decided to reverse an earlier judgment that had halted Kalshi’s election markets.

The United States Commodity Futures Trading Commission (CFTC) submitted a court filing on September 6th, requesting an “emergency stay” of the court’s ruling that overturned its order to prevent Kalshi from offering its election contracts for trading on the same day.

The regulatory body requests that the court “stay the vacatur” for a period of fourteen days following the issuance of its comprehensive opinion supporting the decision to deny the order.

In its argument, the Commodity Futures Trading Commission (CFTC) stated that it is unable to make an informed choice “whether to appeal, nor is it able to fully brief a motion for stay pending any forthcoming appeal” so long as it does not have the “benefit of the Court’s reasoning.

Once the court issues a stay of proceedings, time becomes crucial. According to the explanation provided by the Commodity Futures Trading Commission (CFTC), “the CFTC anticipates that Plaintiff Kalshi will immediately list the relevant election contracts, and that trading will begin as soon as the contracts list.

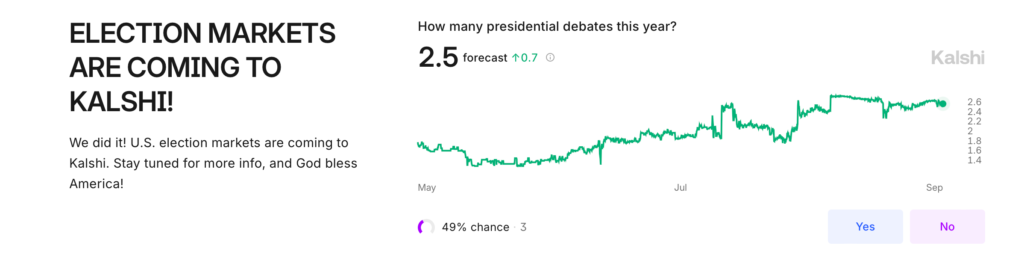

To support its logic, the argument cited Kalshi’s announcement on its webpage that Election Markets are Coming to Kalshi on the same day as the filing, Judge Jia Cobb of the United States District Court for the District of Columbia issued a finding in favor of Kalshi.

The ruling was in favor of Kalshi marketing goods that allow consumers to bet on who will win the election in the United States on November 4. Jake Chervinsky, chief legal officer of Variant Fund, indicated in a post on September 7 X that Kalshi had a “HUGE win,” but he also stated that he would prefer to see the judicial ruling first.

However, this is even more evidence that the best approach to dealing with regulatory excess is to file MORE LAWSUITS, as Chervinsky noted. “I want to see the opinion before I start dancing on the grave of the administrative state,” Chervinsky said.

In its initial submission of the order in September of 2023, the CFTC stated that the contracts involve gaming and activity that is unlawful under state law and is contrary to the public interest.