The United States Securities and Exchange Commission has evidently “dug in” on its stance on a rule that would restrict crypto custody services for regulated financial firms.

SEC chief accountant Paul Munter addressed a banking conference on September 9 and addressed the agency’s regulatory posture on crypto asset accounting. He addressed SEC Staff Accounting Bulletin No. 121 (SAB 121) and its applications.

“The [SEC] staff’s opinions regarding SAB 121 have not changed,” he stated.

“The staff believes that an entity should record a liability on its balance sheet to reflect its obligation to safeguard crypto-assets held for others, absent particular mitigating facts and circumstances,” Munter added.

In a post on September 10, Nate Geraci, the President of ETF Store, stated that the SEC “appears dug in” on SAB 121.

“They simply do not wish to grant regulated financial institutions the capacity to custody crypto,” he continued.

In March 2022, the Securities and Exchange Commission (SEC) implemented SAB 121, which delineated its accounting standards for institutions that wished to manage cryptocurrency assets.

The rule was contentious in political circles, as it effectively prohibited banks and regulated financial institutions from custodying crypto assets on behalf of clients.

The SEC believes that entities with such safeguarding arrangements should record a liability on their balance accounts for digital assets.

Munter stated that the SEC had evaluated a variety of accounting scenarios involving blockchain and crypto assets and recognized that not all arrangements adhere to the proposed guidelines outlined in SAB 121.

He stated that bank-holding companies that protect crypto assets through bankruptcy protection might not be required to register a liability on their balance sheets.

Furthermore, “broker-dealers” that facilitate crypto transactions but do not possess cryptographic keys may also be exempt from the requirement to document liabilities.

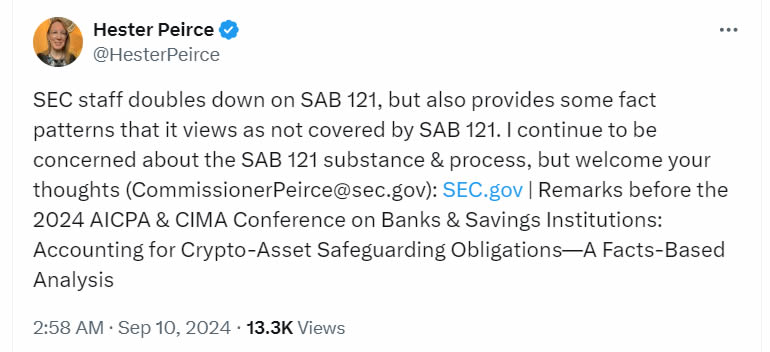

In the interim, SEC Commissioner Hester Peirce, who has been outspoken in her opposition to the rule, expressed her persistent “concern regarding the substance and process of SAB 121” during her appearance on X.

The US House of Representatives voted in May to revoke the controversial SEC guidance. The repeal was, however, vetoed by President Biden the following month.