The Crypto Fear & Greed Index remained in “Fear” for most of August, with sentiment reaching a yearly low of 17 on August 6.

The Crypto Fear & Greed Index has reached its highest level since July, remaining above a score of 60 for two consecutive days.

The update on September 28 showed a score of 64, placing it in the “Greed” zone as Bitcoin’s price briefly approached $66,000, according to CoinMarketCap.

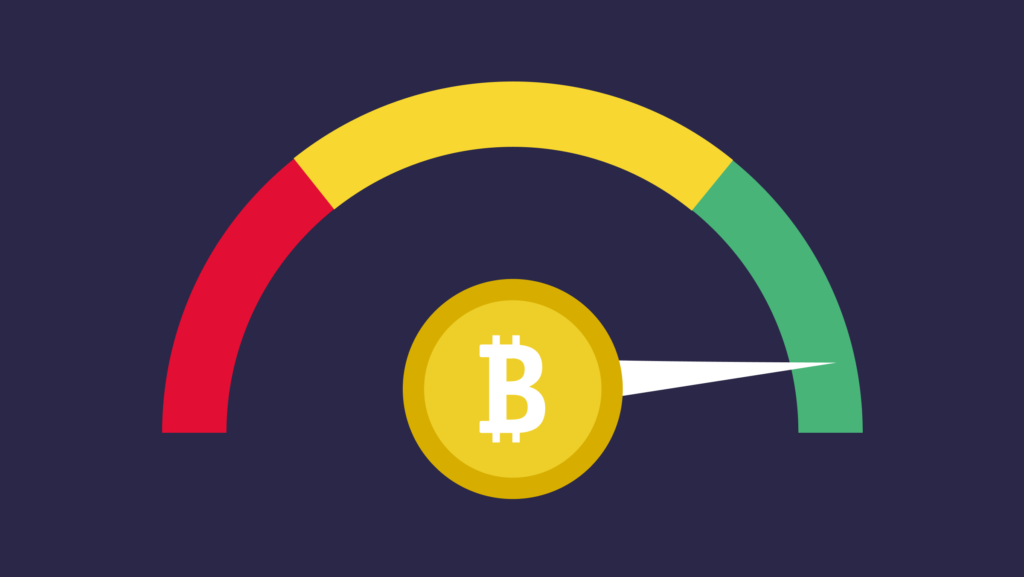

The Crypto Fear & Greed Index was designed to quantify the current “emotions and sentiments” regarding Bitcoin and the broader cryptocurrency market, with a maximum score of 100 and a minimum of 0.

Throughout August, the index predominantly lingered in “Fear,” hitting its lowest point of 2024 at 17 on August 6, when Bitcoin was priced around $53,000.

The last instance of the index exceeding a score of 64 occurred on July 30, when Bitcoin was similarly around $66,000.

The index derives from various factors influencing traders’ and investors’ behaviors, including Google Trends, surveys, market momentum, market dominance, social media activity, and market volatility.

According to the Crypto Fear & Greed Index data sources, the score is determined by 25% market volatility, 25% market momentum, and 15% social media trends and other indicators.

Markus Thielen, an analyst and head of research at 10x Research, noted in a report on September 27 that there could be a crypto rally in the fourth quarter, as Bitcoin’s rebound above the $65,000 mark may induce a fear of missing out (FOMO) among investors.

CoinMarketCap data indicates that Bitcoin has gained approximately 11.18% over the past month, marking its best performance since March.

Meanwhile, Charles Edwards, founder and CEO of Capriole, anticipated substantial capital inflows as traders shift away from gold and other stocks.

“The capital flows back into Bitcoin from gold and stocks over the next 6 months will be relentless,” Edwards stated in a September 27 post on X.

Asset management giant VanEck has identified Bitcoin as the top-performing asset of 2024, significantly outperforming traditional assets, with spot BTC prices experiencing a 124% increase over the last 12 months.

However, the asset manager also mentioned that a recent downturn has left investors feeling “spooked.”