RedStone Oracles, a significant provider of oracle data to smart contracts, has introduced staking oracles designed explicitly for Bitcoin staking.

The new implementation allows users to stake their Bitcoin in exchange for Bitcoin-based liquid-staking tokens (LSTs) such as Lombard Staked BTC (LBTC) on the Ethereum blockchain.

Marcin Kaźmierczak, the co-founder and chief operating officer of RedStone said on October 8 that this is the first time BTC LSTs can be employed in decentralized finance (DeFi) for lending and other purposes.

Staking Oracles

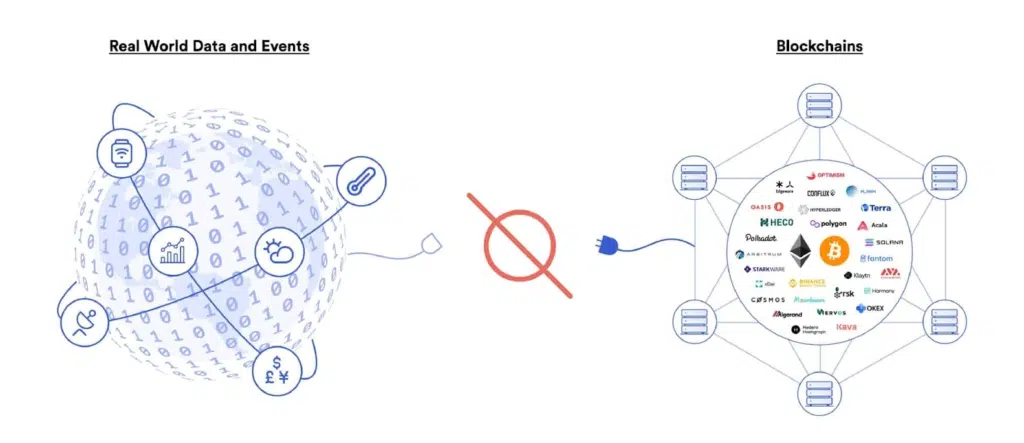

Blockchain oracles are services that serve as intermediaries between blockchains and real-world data and events. Their objective is to authenticate real-world off-chain data on the blockchain.

Lending and staking are two of the many DeFi protocols that utilize Oracles. Lending allows users to borrow using their crypto possessions, while staking will enable them to generate rewards by locking crypto assets into smart contracts.

Staking is a crypto-economic model becoming more prevalent in the smart contract ecosystem and is directly pertinent to Oracle networks.

Staking oracles collect and verify critical inputs, including slashing events, staking rewards, and other data essential for the correct operation of LSTs, such as Lido Staked Ether (stETH).

The sole purpose of Bitcoin LSTs is to provide liquidity on DEXs in the absence of oracles.

Kaźmierczak informed Cointelegraph that RedStone’s new Bitcoin staking oracles enable users to utilize Bitcoin LSTs, such as LBTC, in a manner comparable to the use of wstETH from Lido.

For instance, Morpho and Compound enable users to integrate LBTC into DeFi lending. They can also generate composable leverage by utilizing the oracles and LBTC on the Gearbox Protocol.

“As a Bitcoin holder, you can stake your Bitcoin through Babylon or through Lombard to receive LBTC, their LST token on the Ethereum mainnet,” Kaźmierczak stated. He also added:

“Without oracles, LBTC can be only used to provide liquidity on decentralized exchanges, as this doesn’t require oracles.”

He stated that implementing Bitcoin staking oracles could result in an “immediate change” in adopting the DeFi ecosystem surrounding Bitcoin LSTs, similar to the development of the Ethereum LST ecosystem.

Kaźmierczak stated that even a small percentage of yield on a large underlying value is significant due to the nature of Bitcoin, which can grow with market enthusiasm.

Arrington Capital, a prominent crypto investment firm, headed the Series A funding round in which RedStone Oracles raised $15 million a few months ago. The announcement is timely.