As the US SEC and Ripple prepare to appeal the XRP lawsuit, institutional investors upped their buying by 266%.

XRP experienced a significant surge in institutional buying as the legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) advanced to the Second Circuit Court of Appeals.

Following Ripple’s recent victory in a district court and its advantageous position in the circuit court, investors are showing increased optimism about a potential major rally in XRP’s price.

Institutional Investors Heavily Buying XRP

According to a CoinShares report from October 14, XRP saw $1.1 million in institutional purchases last week, a sharp increase from $0.3 million the previous week.

This represents a 266% rise in buying activity as Ripple and the SEC gear up for the appeals in the circuit court.

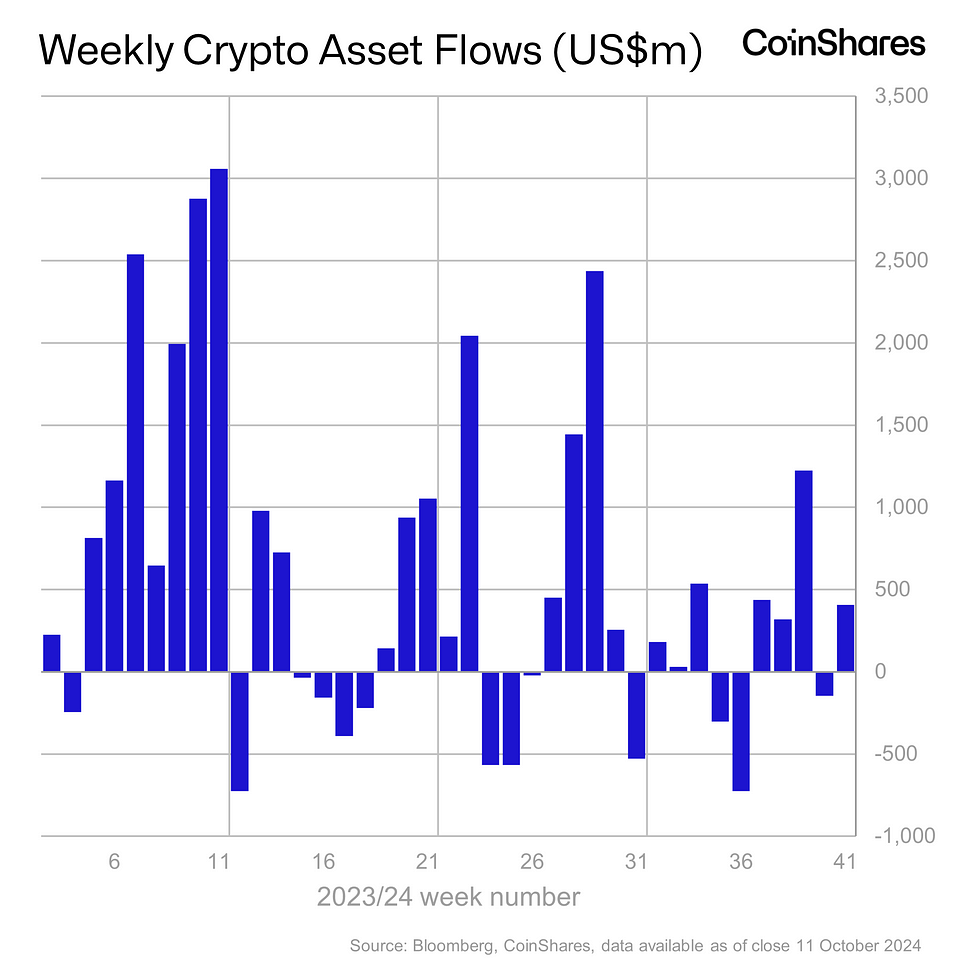

Overall, digital asset investment products witnessed $407 million in net inflows for the week, as investors remained optimistic about an “Uptober” rally, especially with the upcoming U.S. elections.

However, investors shrugged off rising U.S. inflation indicators, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), and continued to buy the dips.

In the last 24 hours, XRP’s price has risen over 1%, currently trading at $0.54. The 24-hour low and high are $0.525 and $0.540, respectively.

Moreover, trading volume has surged by 45%, indicating growing interest among traders.

Amid major XRP news, XRP futures open interest also increased by over 3% in the past 24 hours, reaching a total value of $1.39 billion, or $750.53 million.

Ripple vs. SEC Lawsuit Heads to Second Circuit Court

The SEC has appealed Judge Torres’ decision, which imposed a $125 million penalty during the remedies phase, a far cry from the nearly $2 billion in fines the SEC had initially sought.

Filings related to Form C and Form D, containing full details of the appeal, are expected this week.

The crypto community has criticized the SEC for prolonging the case.

Meanwhile, Ripple filed a notice of cross-appeal, signaling its intent to challenge the SEC’s appeal of Judge Torres’ ruling.

Ripple CEO Brad Garlinghouse expressed confidence that the cross-appeal would conclude the SEC’s “regulation-by-enforcement agenda” under Chair Gary Gensler.

Former SEC attorneys Marc Fagel and James Farrell anticipate the SEC will focus on programmatic sales and secondary market sales in its challenge.

The SEC has already begun targeting crypto firms for secondary market sales, an issue not covered by Judge Torres in her previous summary judgment.

Additionally, Bitnomial has filed a lawsuit against the SEC over its classification of XRP as a security, despite the clarity provided by the court.

Lawyer Bill Morgan also questioned the SEC’s logic in labeling XRP futures as security futures contracts, criticizing the inconsistency in regulatory enforcement, particularly in comparison to the SEC’s handling of similar cases involving Ethereum (ETH) futures.