RedStone is the first major oracle provider to adopt Ethereum’s restaking protocol via EigenLayer, currently in testnet phase.

With the launch of a data-validation service on EigenLayer, RedStone has established itself as the first major oracle provider to use the Ethereum restaking protocol. RedStone has stated in a statement that it intends to develop a “scalable framework that dynamically adjusts cryptoeconomic security as DeFi [decentralized finance] grows,” despite the service currently being in the testnet phase.

Redstone’s oracles operate on more than fifty blockchain networks and safeguard nearly three and a half billion dollars’ worth of cryptocurrencies, according to information on its website. In a statement, Alan Curtis, chief operating officer of developer Eigen Labs, said that the launch of the product on EigenLayer “showcases a mature Oracle system enhancing its security with restaked guarantees.

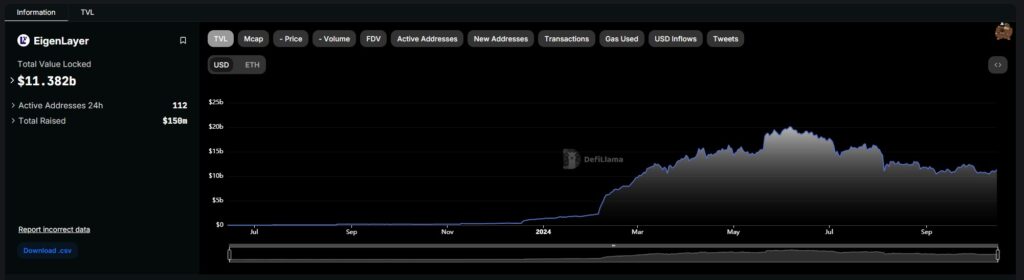

Decentralized oracles connect the blockchain networks to external data sources, including data from the financial market. A token that has been staked and posted as collateral with a validator for incentives is called “restaking”. It is used to secure other protocols too. EigenLayer, according to DefiLlama, is in charge of protecting dozens of third-party protocols, also known as actively verified services (AVSs), with collateral worth roughly eleven billion dollars.

According to the website of EigenLayer, another Oracle service known as eOracle has already gone online on EigenLayer and is secured by about $9 billion worth of Ether as of the 22nd of October. Large oracle providers such as RedStone and Chainlink are increasingly assuming a significant role in traditional financial markets. This trend is expected to continue.

Chainlink said on October 21 that it intends to use artificial intelligence and decentralized oracle technology in order to construct an on-chain record of company actions.

After the unlocking of its native token, EIGEN, on October 1st, EigenLayer is increasingly prioritizing the process of onboarding consumer Web3 applications. According to Kannan, EigenLayer will initially focus on applications that are natural to crypto-native markets, such as gaming and decentralized finance, before moving outside Web3.

We are beginning with the inside-out approach, concentrating on high-throughput consumer applications such as gaming and DeFi,” Kannan said. However, once we achieve critical mass and expand slightly, we will expand outward and start focusing on broader consumer markets.

A programmed incentives program, which was published by the protocol on September 17th, is another strategy that EigenLayer intends to use in order to attract restakers. EIGEN emissions, which make up about 4% of the token’s total supply, will reward initiative participants.