Matthew Sigel noted that Bitcoin’s spot price surpassed $69,000, suggesting a potential push toward all-time highs.

During an interview with CNBC on October 28, Matthew Sigel, who is the head of digital assets research at VanEck, stated that the performance of Bitcoin is generating a “very bullish setup” for the digital asset.

This comes as investors prepare for the presidential election in the United States, which will occur in November. “Our bet is that this is a very bullish setup for Bitcoin going into the election,” Sigel said, adding that the spot price of Bitcoin broke $69,000 on October 28, signaling that there is a possibility of a push toward all-time highs going into the polls.

“We saw the same pattern in 2020: Bitcoin was quiet before rallying with high volatility once a winner was announced.”

In the past year, Bitcoin has increased by 100 percent, according to Sigel. It would appear that the recent increase in Trump’s odds on betting sites is due to the fact that his position has improved from $57,000 to approximately $70,000.

Year 2050 former US President Donald Trump has a wide margin of favor on betting platforms like Polymarket and Kalshi. As of the 28th of October, the platforms estimate that Trump’s chances of winning are 62% and 66%, respectively, according to both websites.

During the election in November, the Republican nominee, Donald Trump, who has stated that he wants to make the United States “the crypto capital of the world,” will face off against the Democratic candidate, Kamala Harris, who has been relatively quiet on the subject of the cryptocurrency business.

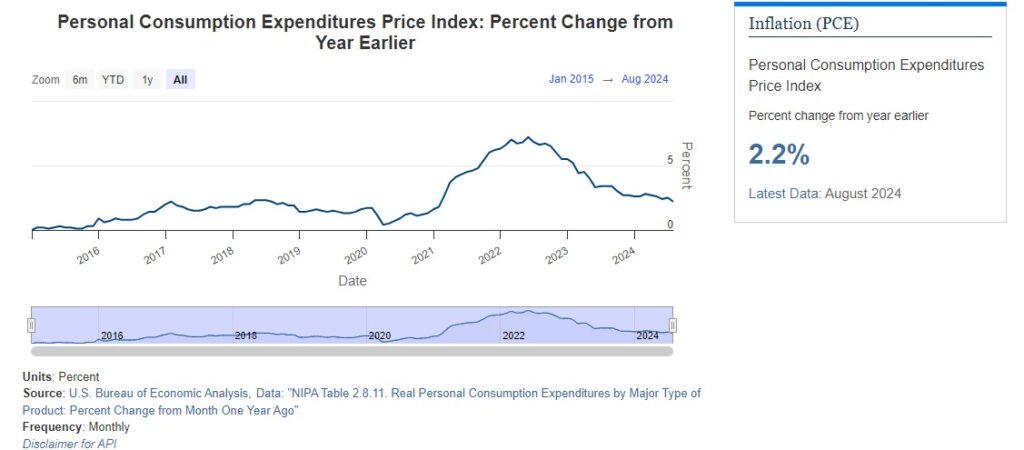

According to Sigel, “Trump is typically considered the more pro-crypto candidate, whereas Vice President Harris has not demonstrated a significant amount of interest in it. On October 22, hedge fund manager Paul Tudor Jones told CNBC that rising inflation will be beneficial to BTC and other commodities.

He asserted that inflation is inevitable regardless of the outcome.”I probably have some basket of gold, Bitcoin, commodities, and Nasdaq [technology stocks], and I would own zero fixed income,” Jones, who founded Tudor Investment Corporation, said.

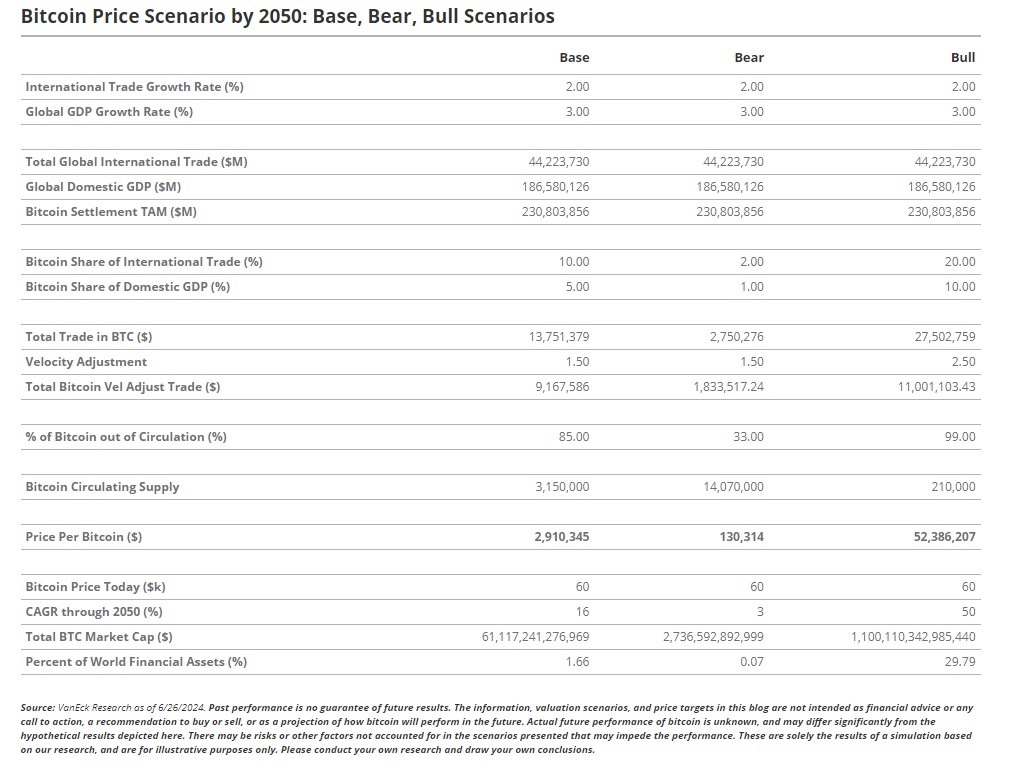

VanEck anticipates that the price of one BTC could potentially reach approximately $2.9 million by the year 2050. This is due to the massive demand for the decentralized currency as collateral for trade settlement and as a reserve for central banks, as stated in a report that was published on July 24.

Sigel stated that they have a long-term model that estimates Bitcoin may become a reserve asset by the year 2050. This implies that central banks would hold it and utilize it in international trade.

“If Bitcoin reached a modest 2% weight in global central bank reserves, our model projects a price of around $3 million per Bitcoin.”