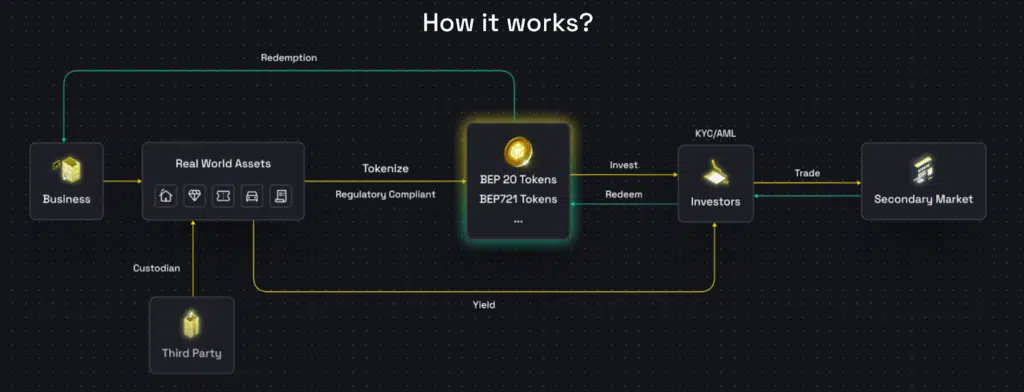

BNB Chain has recently introduced a new real-world asset (RWA) tokenization service that offers a no-code solution for individuals and enterprises to tokenize real-world assets in minutes.

The announcement states that the new service simplifies the asset tokenization process by providing guidance and in-built compliance tools for each stage, including asset securitization and onchain token-minting.

Outsourcing the tokenization process to the BNB Chain’s tokenization solution significantly reduces the cost, time, and labor required to tokenize assets, lowering the barrier to entry for small businesses interested in utilizing real-world tokenization.

There are numerous advantages for businesses to tokenize physical assets, such as the fractional ownership of assets such as art, securities, antiquities, and carbon credits. Tokenization can also generate cost savings in customer loyalty and rewards programs, which can drive consumer engagement.

Real-world asset tokenization: a significant application of cryptocurrency

One of the numerous initiatives to introduce real-world assets onchain is BNB Chain’s new tokenization solution. This market sector has the potential to expand to include $600 billion in assets under management by 2030.

The stablecoin market is the most prominent example of the increasing trend in real-world asset tokenization. The United States Treasury Department emphasized on October 29, 2024, that stablecoin issuers are increasing the demand for US debt.

Stablecoin firms are bolstering demand for the US dollar in response to de-dollarization efforts by sovereign holders of US debt by purchasing US Treasury bills and other short-term currency equivalents to back their digital fiat tokens.

Early in November 2024, the Monetary Authority of Singapore (MAS), the SWIFT interbank messaging system, Oracle network Chainlink, and banking behemoth UBS announced the successful completion of a pilot program to evaluate tokenized fund settlement between entities.

The pilot program enabled traditional financial institutions to capitalize on tokenized assets without the necessity of maintaining any cryptocurrencies by introducing transactions that could be resolved in fiat currencies or non-blockchain funds.