On Monday, Fantom transactions surpassed those of Ethereum for the first time, as investors seek new ways to harvest returns and accumulate wealth.

According to data from blockchain tracker Fantomscan, over 1.2 million transactions were executed on the Fantom network in the last 24 hours. According to data from Ethereum tracker Etherscan, this was slightly more than Ethereum’s 1.1 million transactions.

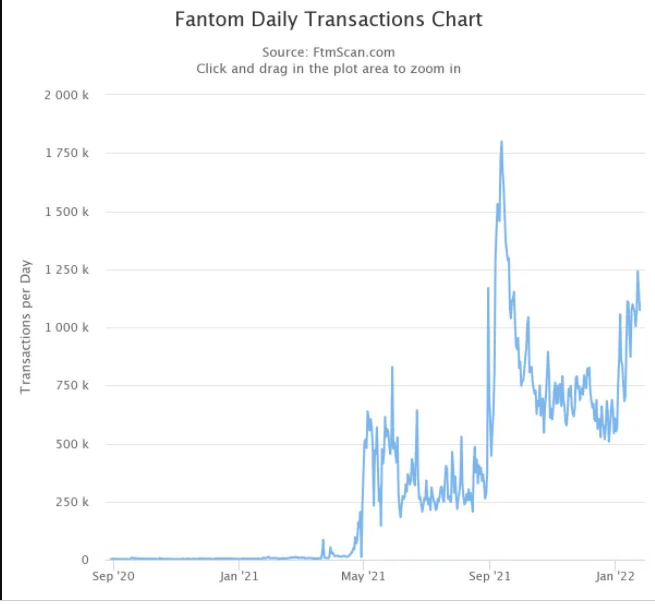

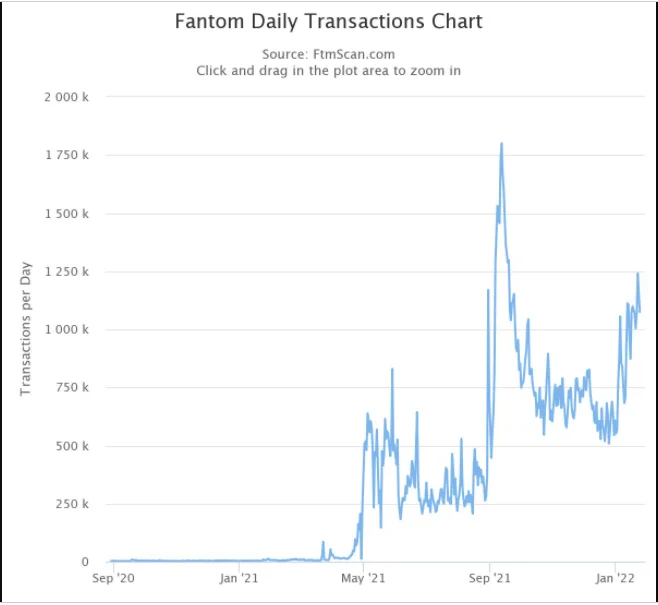

On Monday, Fantom transactions surpassed those of Ethereum, but they are still much below their September highs. (Fantomscan)

On Monday, Fantom completed upwards of eight transactions per second (tps) with fifty-five validators, compared to Ethereum’s current rates of under 2 tps, according to statistics. Ethereum transactions are already at levels seen in August 2021, a long cry from the 1.7 million daily transactions seen in May 2021.

Since its introduction in December 2019, Fantom has registered around 170 million transactions, a fraction of Ethereum’s 1.4 billion transactions since its creation in 2015.

However, the number of transactions on Fantom on Monday was still lower than the all-time high of 1.8 million in September 2021, a month before the price of FTM tokens peaked at $3.46.

In recent months, Fantom tokens have outperformed Ethereum as investors bet on layer 1 projects — protocols with their own blockchains, such as Fantom or Solana – as an alternative to Ethereum.

According to reports, Fantom over the weekend became the third-largest decentralized finance (DeFi) ecosystem by locked value. It began 2022 at eighth place in the rankings, but has since risen to third due to increased developer engagement and consumer interest in Fantom-based products.

DeFi refers to financial services that rely on smart contracts rather than third parties, such as trading, lending, and borrowing. As of Monday, 129 Fantom-based DeFi apps had a total value of about $12.2 billion.

What is the reason for the increase in transactions?

According to analysts, the Fantom network’s expansion is being fueled by additional items and high-yield prizes. “Many projects, such as Radial, veDAO, and 0xDAO, launched liquidity mining campaigns in which vampires targeted other protocols in order to earn TVL.

“These initiatives have a striking resemblance to DeFi summer proposals in 2020,” crypto research company Delphi Digital noted on Tuesday in a note. Users that provide liquidity to DeFi apps and receive rewards for doing so are referred to as liquidity miners.

“Mercenary money flowed over to Fantom to farm these projects since they were generating great rates on single-sided staking,” the analysts said, implying that present activity may be short-lived when yields decline and investors seek higher yields elsewhere.

For the time being, FTM traders are ecstatic. The token was one of the biggest gainers in Asian hours on Tuesday, increasing 8% to $2.30 in the previous 24 hours. However, profit-taking occurred, with prices plummeting seven cents as of this writing.