10X Research predicts SEC Chair Gary Gensler will likely resign early in 2025 after Biden’s term, with a potential Trump administration threatening his position.

Markus Thielen, the founder of 10X Research, anticipates that Gary Gensler, the Chair of the United States Securities and Exchange Commission, will resign within the first two months of 2025 after President Joe Biden concludes his tenure at the White House.

Thielen stated in a July 21 market report that the SEC Chair typically resigned when a new administration was elected and that a Trump ticket would be disastrous for Gensler’s function as the agency’s head.

He cited the sudden decision of current President Joe Biden to abandon his election campaign as a near-certainty that Trump would be sworn in as president in November. Nevertheless, other industry commentators have contested this notion.

“With Joe Biden dropping out of the US Presidential race, no credible candidate can seriously challenge Donald Trump. The November election appears to have been decided without a single vote. For Bitcoin, a pro-crypto administration will enter the White House.”

“Even though the term of SEC Chair Gensler expires on June 5, 2026,” Thielen predicted that he would likely tender his resignation by January or February of 2025.

In February, J.D. Vance, Trump’s running mate, criticized Gensler for his “over-politicized” and backward approach to crypto policy, describing him as the “worst person” to regulate crypto assets.

Furthermore, Thielen identified a broad array of bullish catalysts for the cryptocurrency market in the upcoming weeks, stating that “multiple reports and rumors” suggest that Trump may make a surprise announcement at the Bitcoin conference in Tennessee on July 25.

According to Thielen, there is considerable speculation that he will declare Bitcoin as a strategic reserve asset, which could result in a precipitous increase in its value.

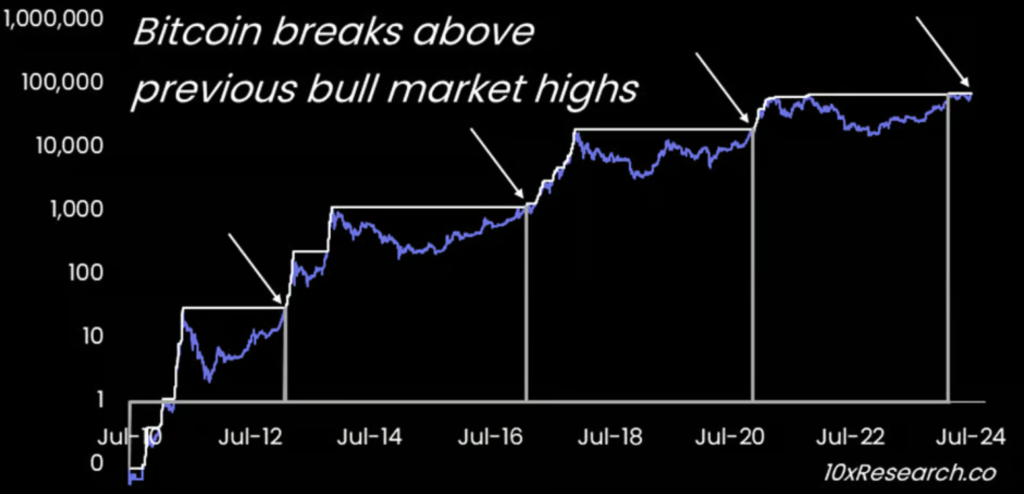

He warned investors against taking profits or attempting to short BTC prior to Trump’s speech, stating that Bitcoin’s previous bull market all-time high of $68,300 could be “defined as a line in the sand” and that it would trade above it following an anticipated “parabolic move” in the coming months.

In the interim, numerous analysts informed Cointelegraph that the future of Bitcoin and the broader crypto market appears promising despite the ongoing political unrest in the United States.

Following the tumultuous price action caused by a flood of “forced selling” from the German government and the collapse of crypto exchange Mt. Gox, analysts predicted that the worst of Bitcoin’s price action was now in the past.