This article talks about the pivotal role of oracles in informing DeFi asset decisions and addressing challenges and future innovations.

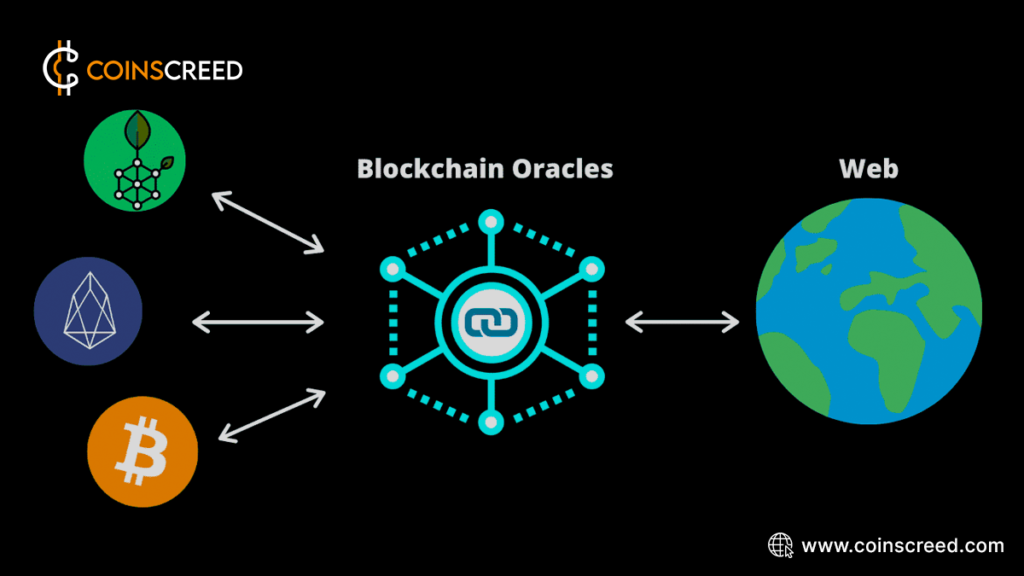

Oracles are fundamental in informing DeFi asset decisions, acting as vital conduits between blockchain networks and real-world data sources. By supplying accurate and timely information to smart contracts, oracles enable DeFi platforms to make informed choices regarding asset allocation, trading strategies, and risk management. Their role is indispensable in ensuring the integrity and efficiency of decentralized finance ecosystems.

Understanding Oracles

Oracles act as data feed providers for DeFi applications, ensuring that the information received by smart contracts is reliable and up-to-date. They facilitate the seamless execution of various financial transactions on the blockchain by supplying essential data inputs. Oracles can source data from multiple off-chain sources, including APIs, websites, IoT devices, and other data feeds.

Types of Oracles Used in DeFi

Several types of oracles commonly provide accurate and reliable data for asset decisions. Some common types include:

Price Oracles

These oracles provide real-time price data for various assets, including cryptocurrencies, commodities, and traditional financial assets. They are essential for determining asset prices for trading, lending, and borrowing.

Time Oracles

Time oracles ensure that smart contracts and protocols can accurately timestamp transactions and events on the blockchain. They help synchronize actions and ensure that time-sensitive transactions execute correctly.

Random Number Oracles

Random oracles generate secure and unpredictable random numbers, essential for various DeFi applications such as gaming, lotteries, and other random-based processes.

Event Oracles

Event oracles provide data about real-world events, such as weather conditions, sports outcomes, or economic indicators. They can use this information in prediction markets, insurance contracts, and other DeFi applications.

External Data Oracles

These oracles fetch data from external sources such as APIs, websites, or other blockchain networks to provide additional information for decision-making in DeFi.

The Role of Oracles in DeFi Asset Decisions

The roles of oracles in DeFi asset decisions are multifaceted and crucial for the smooth functioning of decentralized finance platforms. Below are some of them:

Price Feeds and Asset Valuation

Oracles provide real-time price feeds for various assets in the DeFi ecosystem. This data is crucial for determining the value of cryptocurrencies, tokens, and commodities, enabling users to make informed decisions regarding trades, loans, and other financial transactions. By sourcing price information from multiple exchanges, oracles help ensure accurate asset valuations and prevent price manipulation.

Risk Management and Collateralization

Oracles are vital in assessing risk and determining collateralization ratios in DeFi lending and borrowing protocols. By delivering up-to-date asset price data, oracles assist platforms in calculating the appropriate collateral required to secure loans based on asset values. It helps platforms mitigate the risk of defaults and maintain stability within the ecosystem.

Automated Trading and Market Analysis

Oracles facilitate automated trading strategies and market analysis by providing users with timely market data and signals. Users can execute trades based on predefined conditions or algorithms without direct human intervention, enhancing trading efficiency, reducing transaction costs, and increasing market liquidity on decentralized exchanges and platforms.

Innovation and Interoperability

Oracles foster innovation within the DeFi ecosystem by facilitating the establishment of new financial products and services. By providing access to real-world data, oracles facilitate the creation of decentralized derivatives, prediction markets, and synthetic assets, among other innovative applications.

Data Accuracy and Integrity

The fundamental role of oracles in DeFi asset decisions is to ensure data accuracy and integrity. Oracles must source information from reputable and reliable sources to prevent inaccuracies, manipulation, or errors that could result in financial losses or disrupt the integrity of the decentralized ecosystem. By delivering accurate and trustworthy data, oracles enhance the reliability and efficiency of DeFi asset decisions.

Challenges Facing Oracles in DeFi Asset Decisions

Despite their crucial role in the DeFi ecosystem, oracles face several challenges that they must address to ensure their effectiveness and reliability in informing asset decisions. Some of the key challenges include:

Data Accuracy and Reliability

One of the primary challenges facing oracles is ensuring the accuracy and reliability of the data they provide. Oracles depend on external data sources, which may be prone to errors, manipulation, or inaccuracies. Ensuring the integrity of data feeds is essential for making informed decisions within DeFi platforms.

Security Risks

Oracles are susceptible to various security risks, including manipulation, tampering, and unauthorized access. Malicious actors might attempt to exploit vulnerabilities within Oracle networks to manipulate data feeds or trigger undesirable outcomes within DeFi protocols. Securing Oracle networks against these threats is critical to maintaining the trustworthiness and integrity of DeFi platforms.

Centralization Concerns

Centralization poses a significant risk to the decentralization and trustlessness of DeFi platforms. Reliance on a single oracle provider or a small group of centralized oracles introduces a single point of failure and increases the likelihood of manipulation or collusion. Reducing dependence on centralized oracle providers and promoting decentralization within oracle networks is essential for preserving the integrity of the DeFi ecosystem.

Oracle Sybil Attacks

In a Sybil attack, malicious actors create multiple fake identities to manipulate the consensus process and influence the outcome of data feeds. Oracles must implement robust mechanisms to detect and mitigate Sybil attacks, such as reputation systems, identity verification, and cryptographic proofs. Protecting against Sybil attacks is crucial for maintaining the accuracy and reliability of data feeds within DeFi platforms.

Scalability

As the DeFi ecosystem grows and evolves, scalability becomes an increasingly pressing concern for Oracle networks. Scaling Oracle infrastructure to accommodate the growing demand for real-time data feeds while maintaining high throughput and low latency is essential for ensuring the smooth functioning of DeFi platforms. Implementing scalable solutions and optimizing network architecture is crucial for addressing scalability challenges within Oracle networks.

Best Practices for Utilizing Oracles in DeFi Asset Decisions

To maximize the benefits of oracles in informing DeFi asset decisions, it is essential to follow best practices:

- Diversification

- Transparency

- Security Audits

- Continuous Monitoring

- Community Engagement

Diversification

Utilizing multiple oracles from different providers helps mitigate the risk of data manipulation and inaccuracies. Users can enhance the reliability of information used for asset decisions by aggregating data from various independent sources.

Transparency

It is crucial to choose transparent Oracle providers that openly share their data sources and verification methodologies. Understanding how data is collected and validated builds trust and confidence in the accuracy of the information provided.

Security Audits

Regular security audits of Oracle solutions are essential to identify and address potential vulnerabilities. Collaborating with security experts can help ensure the integrity of data feeds and protect against malicious attacks.

Continuous Monitoring

Monitoring data feeds for anomalies or irregularities can help detect potential issues promptly. Implementing automated monitoring systems can provide real-time alerts and enhance the overall security of DeFi asset decisions.

Community Engagement

Engaging with the Oracle provider’s community and contributing to data reliability and security discussions can foster a collaborative environment. Sharing insights and best practices with other users can help improve the overall integrity and effectiveness of Oracle data in guiding DeFi asset decisions.

Future of Oracles in DeFi Asset Decisions

As the landscape of DeFi continues to evolve, advancements in Oracle technology are poised to drive innovation and enhance the reliability of data feeds. Projects exploring decentralized oracle networks, cross-chain interoperability, and secure data transmission protocols are shaping the future of oracles in DeFi asset decisions. By addressing existing challenges and leveraging cutting-edge solutions, the DeFi ecosystem can unlock new opportunities for decentralized finance.

Conclusion

Oracles are pivotal in shaping decision-making within the DeFi ecosystem by providing accurate and reliable data for asset valuation, risk management, and automated trading. Despite facing challenges such as data accuracy, security risks, and centralization concerns, best practices such as diversification, transparency, security audits, continuous monitoring, and community engagement are vital to maximizing the benefits of oracles.

As Oracle technology continues to evolve with advancements in decentralization and security, the future holds promising opportunities for innovative solutions that enhance the reliability and integrity of data feeds in DeFi asset decisions.