Candlestick patterns are used by traders to predict the future direction of price movement. In this article, you’ll learn 10 of the most common candlestick patterns and how you can use them to identify trading opportunities.

What is a candlestick?

A candlestick is a method of displaying information regarding the price movement of an asset. Candlestick charts are one of the most widely used components of technical analysis, allowing traders to swiftly evaluate price information from a small number of price bars.

This article focuses on a daily chart in which each candlestick represents a single trading day. It has three basic characteristics:

- The body depicts the range from open to shut.

- The wick, or shadow, denotes the intraday high and low.

- The color discloses the direction of market movement — a green (or white) body suggests a price increase, whereas a red (or black) body indicates a price decline.

Individual candlesticks develop patterns over time that traders can use to identify necessary support and resistance levels.

There are numerous candlestick patterns that signal an opportunity inside a market; some reveal the equilibrium between buying and selling pressures, while others reveal continuation patterns or market hesitation.

Before you begin trading, it is essential to understand the fundamentals of candlestick patterns and how they might affect your judgments.

Exercise the interpretation of candlestick patterns

The best approach to learn how to interpret candlestick patterns is to practice entering and quitting trades based on their signals.

You can backtest them on a Demo account before trading with real money.

When applying any candlestick pattern, it is essential to keep in mind that while they are excellent at predicting trends quickly, they should be used in conjunction with other forms of technical analysis to confirm the overall trend.

Bullish candlestick patterns

After a market decline, bullish patterns may arise and imply a reversal in price movement. They are a sign that traders should consider starting a long position in order to profit from any rising trend.

- Hammer

- Inverse hammer

- Bullish engulfing

- Piercing line

- Morning star

Hammer

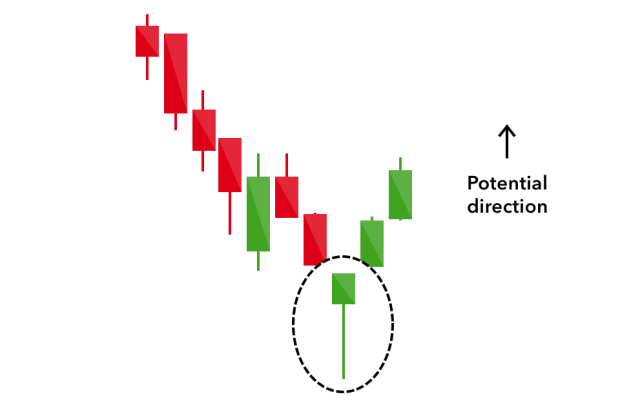

The hammer candlestick pattern has a short body and a lengthy lower wick, and appears at the bottom of a downtrend.

Even though there were selling pressures throughout the day, a strong buying pressure ultimately drove the price back up. However, green hammers indicate a stronger bull market than red hammers.

Inverse hammer

Inverse hammer

Similarly bullish is the inverted hammer pattern. The sole distinction is that the upper wick is longer than the lower wick.

It suggests that there was a buying push, followed by a selling pressure that was insufficient to move the market price lower. The inverse hammer indicates that the market will soon be controlled by buyers.

Bullish engulfing

The bullish engulfing formation consists of two candlesticks. A larger green candle totally envelops a shorter red candle.

Even if the second day opens lower than the first, the bullish market drives the price upward, resulting in a clear victory for buyers.

Piercing line

Also a two-stick pattern, the piercing line consists of a long red candle followed by a long green candle.

There is typically a substantial disparity between the closing price of the first candlestick and the opening price of the green candlestick. It implies a strong buying pressure when the price is pushed to or over the previous day’s middle price.

Morning star

In a bearish market decline, the morning star candlestick pattern is a sign of optimism. It is a three-stick pattern consisting of one short-bodied candle between a long red and long green candle. Customarily, the’star’ will not overlap with the longer bodies, as the market gaps on both open and shut.

It indicates that the selling pressure of the first day is diminishing and that a bull market is imminent.

Bearish candlestick patterns

After an uptrend, bearish candlestick patterns typically appear and indicate a point of resistance. When traders are extremely pessimistic about the market price, they frequently terminate their long bets and start short ones to profit from the declining price.

Five bearish candlestick patterns

- Hanging Man

- Shooting Star

- Bearish Engulfing Pattern

- Evening Star.

- Three black crows.

Hanging man

The hanging man is the bearish version of a hammer; it forms at the end of an uptrend and has the same shape.

It suggests that a large sell-off occurred during the day, but buyers were able to bring the price back up. The significant decline is frequently interpreted as a sign that bulls are losing control of the market.

Shooting star

The shooting star has the same shape as the inverted hammer, but is constructed in an upward direction: its lower body is short, while its top wick is lengthy.

Typically, the market will gap slightly higher on opening, surging to an intraday high, and then close just above the starting price — like a falling star.

Bearish engulfing

At the conclusion of an upswing, a bearish engulfing pattern will develop. The first candle has a small green body that is devoured by a lengthy red candle that follows.

It indicates a peak or pause in price movement and is indicative of an imminent market decline. The trend is likely to be more important the lower the second candle falls.

Evening star

The evening star is an analogous three-candlestick pattern to the bullish morning star. It is comprised of a short candle, a long green candle, and a giant red candlestick.

It denotes a reversal of an uptrend and is particularly significant when the third candlestick erases the first candle’s gains.

Three black crows.

Three consecutive long red candles with short or nonexistent wicks make up the three black crows’ candlestick motif. Each trading session begins at a price comparable to the previous day’s, but selling pressures cause the price to decline with each closing.

The traders view this pattern as the beginning of a bearish slump, as sellers had surpassed buying for three consecutive trading days.

Conclusion

Trading candlestick patterns may be quite successful and provides a greater advantage in market analysis.

However, it requires constant monitoring of the chart every minute to determine whether the patterns have changed.

Despite this, candlestick patterns are regarded as one of the most effective trading tactics.