Earlier this week, the Bitcoin trade volume increased as the cryptocurrency’s price fell below $40,000.

Bitcoin trading volume drops precipitously after a brief surge

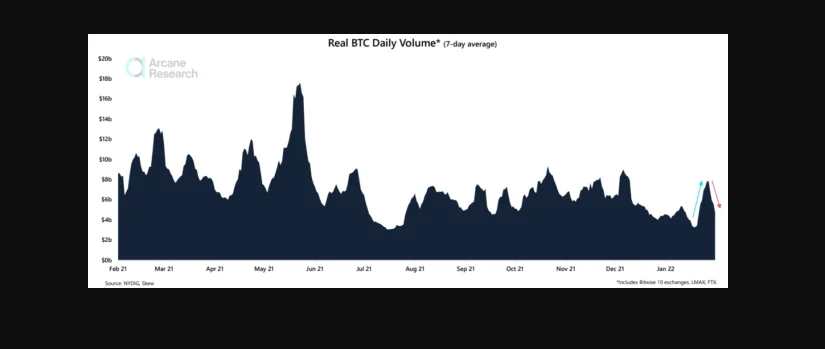

According to Arcane Research’s most recent weekly analysis, BTC trade volume has lately dropped sharply and is now returning to “normal” levels following the previous rise.

The “daily trade volume” is an on-chain statistic that shows us how much Bitcoin was transacted on any particular day.

When the value of this indicator falls, it indicates that activity on the BTC network is decreasing since fewer coins are being exchanged on the chain. Such a pattern could exist because investors are currently waiting for the price to reach a specific level before making a decision. It could also indicate a general lack of interest in cryptocurrency at the moment.

When the trading volume, on the other hand, increases, it indicates that the chain is getting more active. High values of the measure usually create an excellent setting for large changes in the coin’s price.

This is because such changes require a large number of traders to be sustained, and an idle network does not have enough of them. It does, however, work both ways. Large price movements naturally draw additional volume as specific traders’ aims are met and their coins are moved accordingly.

Here’s a graph that displays the trend in Bitcoin trading volume over the last year:

As shown in the graph above, Bitcoin trading volume recently spiked to high levels as the coin’s price plunged below $40,000.

However, over the last week, the signal has dropped to relatively low levels as the cryptocurrency has primarily moved sideways.

According to the study, if the coin manages to break $40k, trade volume may increase in the same way as BTC did when it fell below this level.

Bitcoin Price

At the time of writing, the price of Bitcoin is hovering around $36.7k, down 0.5 percent in the last seven days. The chart below depicts the price trend of BTC over the previous five days.