The main reasons given for wanting to accept crypto payments were to improve the customer experience, grow the customer base, and make their brand seem “cutting edge.”

According to a new survey by Deloitte, three-quarters of US retailers plan to accept crypto or stablecoin payments within the next two years.

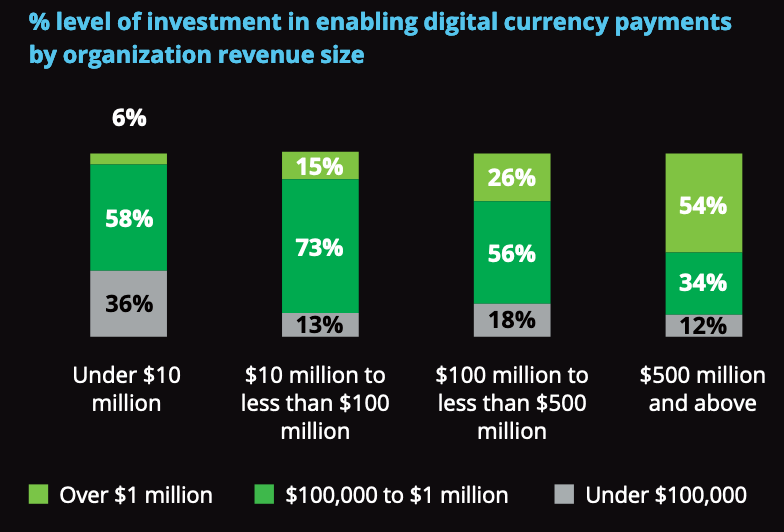

It also discovered that more than half of large retailers with revenues exceeding $500 million are currently spending $1 million or more to build the necessary infrastructure.

The information was revealed in Deloitte’s “Merchants Getting Ready For Crypto” report, which was released on June 8 in collaboration with PayPal.

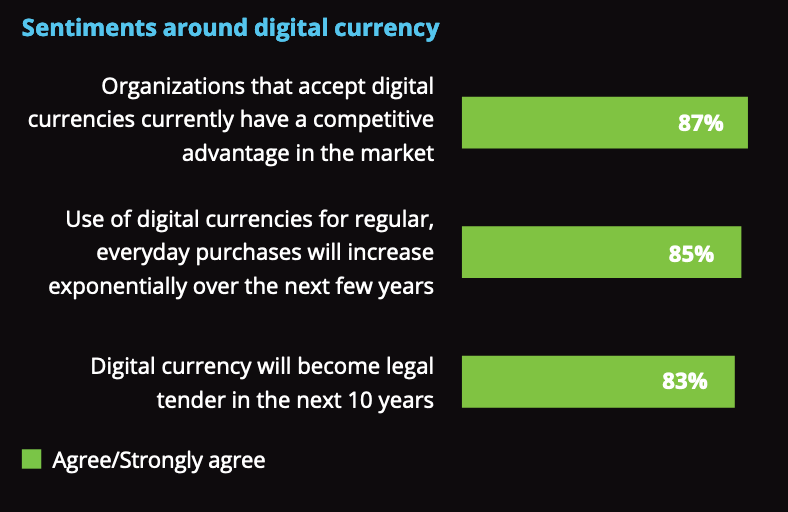

A large majority, roughly 85 percent, of the merchants polled believe cryptocurrency payments will be commonplace in their respective industries within five years.

The survey polled 2,000 senior executives at US retail organizations between December 3 and December 16, 2021, when cryptocurrency prices were still high, but the results were only recently released. Cosmetics, digital goods, electronics, fashion, food and beverages, home and garden, hospitality and leisure, personal and household goods, services, and transportation received an equal distribution of executives.

Small and medium-sized businesses are also getting involved, with 73% of retailers with revenues ranging from $10 million to $100 million investing between $100,000 and $1 million to support the necessary infrastructure.

According to Deloitte, spending will not stop there and is expected to rise further through 2022. More than 60% of retailers expect to spend more than $500,000 to enable crypto payments in the next 12 months to December.

Consumers Push For Crypto Payments

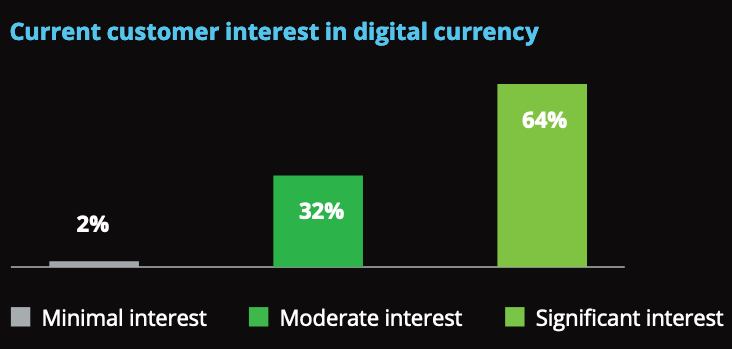

Consumer interest is driving merchant adoption, with 64 percent of merchants reporting that their customers are interested in using cryptocurrency for payments. Approximately 83 percent of retailers anticipate that interest will increase or significantly increase by 2022.

Nearly half believe cryptocurrency adoption will improve the customer experience, roughly the same number believe it will increase their customer base, and 40% hoped their brand would be perceived as “cutting edge.”

93 percent of retailers who accept cryptocurrency have reported a positive impact on their customer metrics.

Carriers and challenges to adoption cited by merchants include payment system security (43%), changing regulations (37%), volatility (36%), and a lack of a budget (36%).

According to 45 percent of respondents, the most difficult challenge was integrating cryptocurrencies with legacy systems and integrating multiple cryptos.

Deloitte expects “continued education” to provide additional clarity for regulators, allowing for wider adoption across a broader range of products and services.