Digital asset management firm Bitwise has registered a statutory trust for a proposed spot Solana exchange-traded fund (ETF) in Delaware.

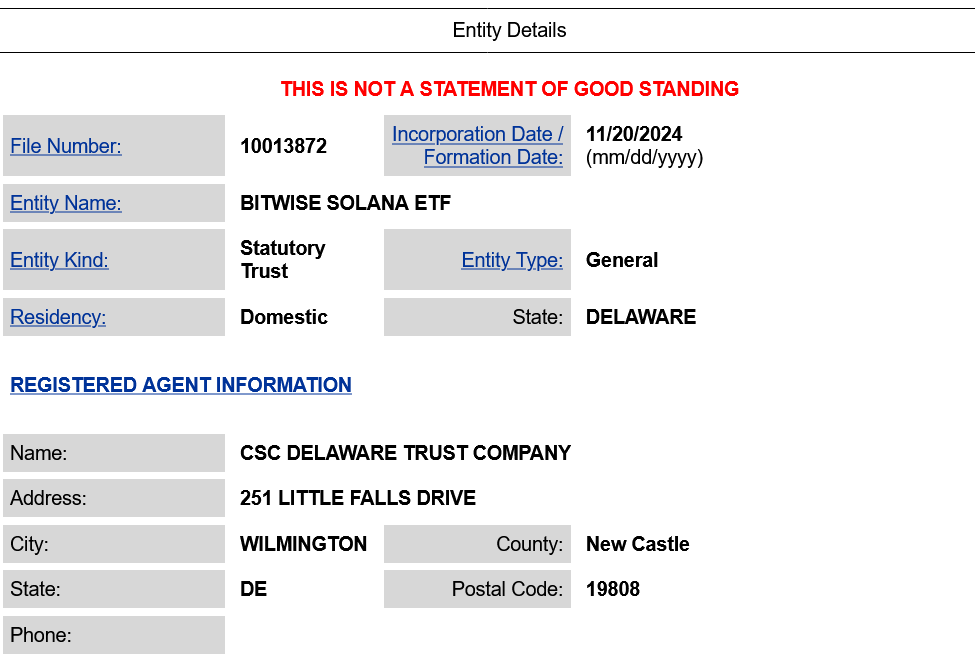

The Bitwise Solana ETF was incorporated on Nov. 20, according to the State of Delaware’s Division of Corporations website. The registered agent was CSC Delaware Trust Company, headquartered in Wilmington, Delaware.

Bitwise would still need to submit a 19b-4 filing and S-1 registration statement to the US Securities and Exchange Commission to officially put its name in the race with VanEck and Canary Capital.

On Oct. 1, Bitwise filed to register a spot XRP ETF in Delaware and submitted its S-1 form to the US securities regulator the next day.

If approved, the Bitwise Solana ETF would seek to track the price movement of the world’s fourth-largest cryptocurrency.

The filing didn’t state which stock exchange would list the Solana product — however, the Bitwise Bitcoin ETF and Bitwise Ethereum ETF are listed on the New York Stock Exchange Arca.

A proposed ticker wasn’t listed for Bitwise’s Solana ETF either.

VanEck’s Head of Digital Asset Research Matthew Sigel expects the odds of a US-approved spot Solana ETF will be “overwhelmingly high” by 2025’s end.

Part of Sigel’s rationale was based on a more crypto-friendly regulatory environment under the Trump administration, which enters office on Jan. 20.

Many industry pundits expect inflows into the approved spot Solana ETF would be small relative to what’s been seen with the Bitcoin and Ether ETFs.

Solana has been one of the top performers this bull cycle, increasing 2360% to $236.91, CoinGecko data shows.

However, Solana was one of the worst performers in the bear cycle compared to other large-cap coins, and it still hasn’t set a new all-time high this cycle.

It comes as the Securities and Exchange Commission delayed its decision to approve the Franklin Templeton Crypto Index ETF until early 2025.

Asset managers have also submitted filings for spot Litecoin ETFs.