The crypto asset manager has filed for a spot Solana ETF, following earlier filings for XRP and Litecoin ETFs in October.

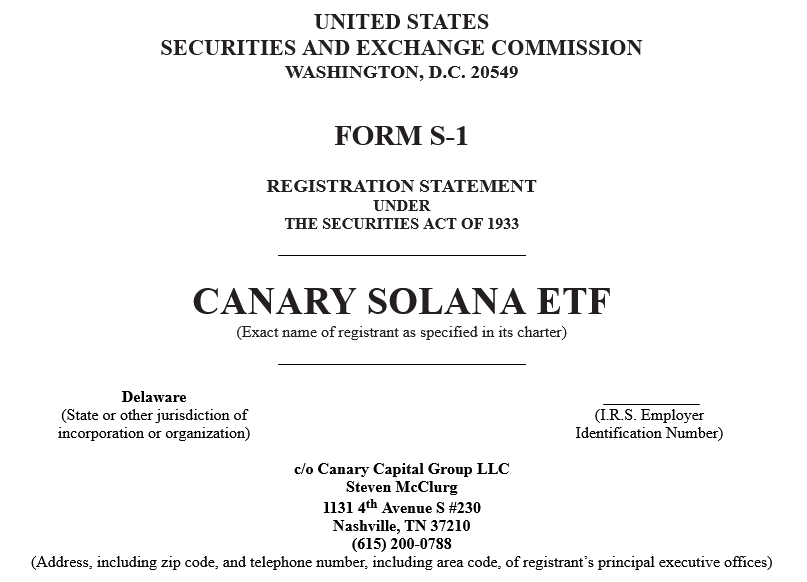

Crypto asset manager Canary Capital has filed with the U.S. Securities and Exchange Commission for a spot Solana exchange-traded fund (ETF), following similar applications by VanEck and 21Shares.

The proposed spot Solana ETF would track SOL’s price using the Chicago Mercantile Exchange CF Solana index, which provides a real-time price benchmark, according to Canary’s S-1 registration statement filed on Oct. 30.

The ETF would offer investors access to the Solana market via a traditional brokerage account, eliminating the direct risks of holding SOL.

Solana is anticipated to be the next cryptocurrency to gain a spot ETF, following SEC approvals of Bitcoin and Ether spot ETFs in January and July.

VanEck and 21Shares are the other asset managers that filed for a spot SOL ETF on June 27 and 28, respectively, and Franklin Templeton is reportedly also considering a similar move.

Canary’s filing did not specify a custodian for the ETF or the ticker under which it would be listed.

This latest application follows previous S-1 filings by Canary Capital for a spot XRP ETF on Oct. 8 and a spot Litecoin ETF on Oct. 15.

Solana’s price saw a slight uptick in response to the news, though it remains down 2.3% over the last day at $174.6, according to CoinGecko data.

In an Oct. 29 post, Canary highlighted Solana’s dominance in active address market share, surpassing both Ethereum and Binance Chain, even when accounting for layer 2 chains.

Founded by Steven McClurg, a co-founder of Valkyrie Funds and former managing director at Galaxy Digital under Mike Novogratz, Canary Capital stated on Oct. 1: “We founded Canary to lead the way for the next iteration of actively managed and passive crypto-related offerings with a focus on risk management and adaptive, strategic foresight.”

This came shortly after the launch of Canary’s first trust offering, the Canary HBAR Trust.