SynFutures is developing a foundation and governance token, raising three investment rounds since launching its Oyster AMM.

SynFutures is developing a foundation and governance token to accompany its decentralization. Following the debut of its Oyster automated market maker (AMM) one year ago, it has successfully completed three rounds of investment.

The goal of the exchange is to establish a permissionless derivatives market that all retail traders will have access to. During its first introduction, it claimed that it would offer “anything with a price feed.

At the moment, it provides a listing of 330 trading pairs and has witnessed a total trading volume of $235.1 billion, with $71 billion of that volume occurring during the third quarter of this year. SynFutures locked in a total value of $26.5 million in the third quarter of the year, a decrease from the $44.3 million locked in during the first quarter.

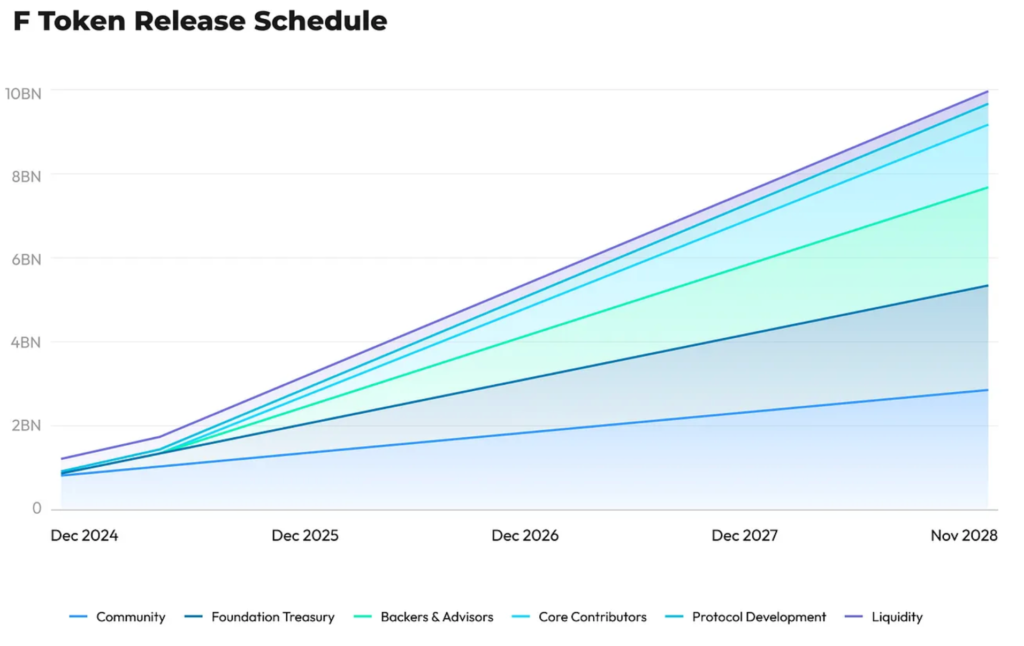

The Ethereum mainnet will support the ERC-20 token that will be known as the F Token (F). The foundation has not yet decided on the date of the token generation event, but expects to distribute the entire quantity of 10 billion tokens between December 2025 and November 2028.

The platform will introduce specifics of its governance structure and announce stake incentives during “Season 2.” The allocation process will distribute a portion of the token to the community, backers and advisers, the treasury, core contributors, protocol development, and liquidity.

In January of 2021, SynFutures made its debut with a seed round campaign that raised a total of $1.4 million. In June 2021, Polychain Capital led a Series A round, which raised an additional $14 million. Additionally, Pantera Capital, Framework, and Wintermute were involved in the project.

The platform launched on the Ethereum layer-2 Blast network the month after its initial development. Additionally, it was deployed on base in July of this year. With the help of Susquehanna International Group and HashKey Capital, SynFutures was able to successfully raise $22 million in Series B funding in October of 2023. Pantera Capital was the lead investor in this round.

The company also unveiled Oyster AMM, which allows users to place bids on perpetual futures and incorporates an on-chain order book without the need for administrators, at the same time as its version 3 testnet. It appears that the SynFutures community will receive F Tokens through a points program named Oyster.