VanEck is extending the fee waiver for its Bitcoin ETF (HODL) until January 2026, covering the first $2.5 billion in assets.

VanEck announced on November 25th that it is extending the fee waiver for the VanEck Bitcoin ETF (HODL) to attract investors in the fiercely competitive exchange-traded fund (ETF) industry for Bitcoin. VanEck reports that the asset manager has waived the management costs for the spot Bitcoin exchange-traded fund (ETF)’s first $2.5 billion in net assets until January 10, 2026.

VanEck asserts that the fee waiver, initially set to expire in the spring of 2025, only applied to the exchange-traded fund’s (ETF) initial $1.5 billion in assets under management (AUM).

Kyle DaCruz, director of digital assets products at VanEck, said in a statement that the company’s HODL exchange-traded fund (ETF) “is approaching the original $1.5 billion threshold we had put in place, amid investor enthusiasm for Bitcoin’s outlook at this time.

He went on to say that VanEck is hoping that this extension of the fee waiver will allow “investors to explore the potential of Bitcoin and digital assets exposure in their portfolios. In the VanEck Bitcoin Exchange-Traded Fund (ETF), the base management fee is 2.00%.

This fee is competitive, even though it surpasses the fees charged by other competitors. The annual sponsor costs for Grayscale Bitcoin Mini Trust are significantly lower, coming in at 0.15%. Overall, the price of all Bitcoin and Ether ETH tickers has dropped by $3,315.

Initially, 26 exchange-traded funds (ETFs) listed in 2025 waived at least some of their management costs. Generally speaking, bitcoin exchange-traded fund (ETF) sponsors will set fee waivers to expire between six months and one year after the start date of a fund.

The VanEck Bitcoin ETF’s website states that the fund has net assets of about $1.28 billion. VanEck is following in the footsteps of perhaps half a dozen other prominent Bitcoin funds. According to BlackRock’s website, the largest Bitcoin trust, iShares Bitcoin Trust (IBIT), has gathered around $46 billion in assets under management (AUM).

Since the introduction of spot Bitcoin exchange-traded funds (ETFs) in January, Bitcoin has emerged as the dominant asset in the exchange-traded fund (ETF) landscape. Immediately following the victory of crypto-friendly President-elect Donald Trump in the elections held on November 5 in the United States, investor interest increased.

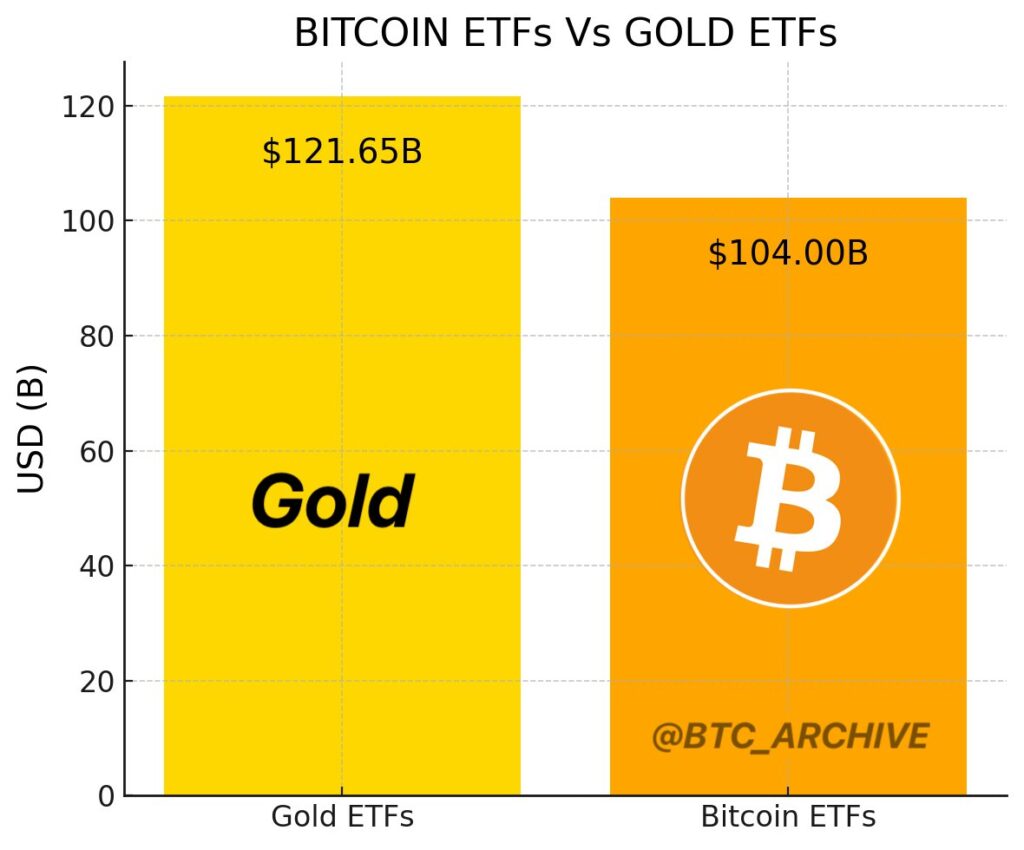

According to data provided by Bloomberg Intelligence, the net assets of US Bitcoin exchange-traded funds (ETFs) surpassed $100 billion for the very first time on November 21. According to Bryan Armour, director of passive strategies research at Morningstar, “[T]he growth of spot Bitcoin ETFs stemmed from two main factors: widespread adoption of Bitcoin and a superior product.

The exchange-traded funds made it possible for new investors to purchase Bitcoin for the very first time,” said Armour. “This included individuals who were unable to create a wallet and purchase Bitcoin on a cryptocurrency exchange. “They “also benefit from cheaper trading, lower fees, and best-in-class Bitcoin storage practices,” according to cryptocurrency experts.