Uniswap has seen record monthly volume across Ethereum L2s, and one analyst says it’s an early hint of Ethereum ecosystem outperformance.

Uniswap has achieved a new monthly volume record on Ethereum layer 2 networks as interest in decentralized finance (DeFi) surges.

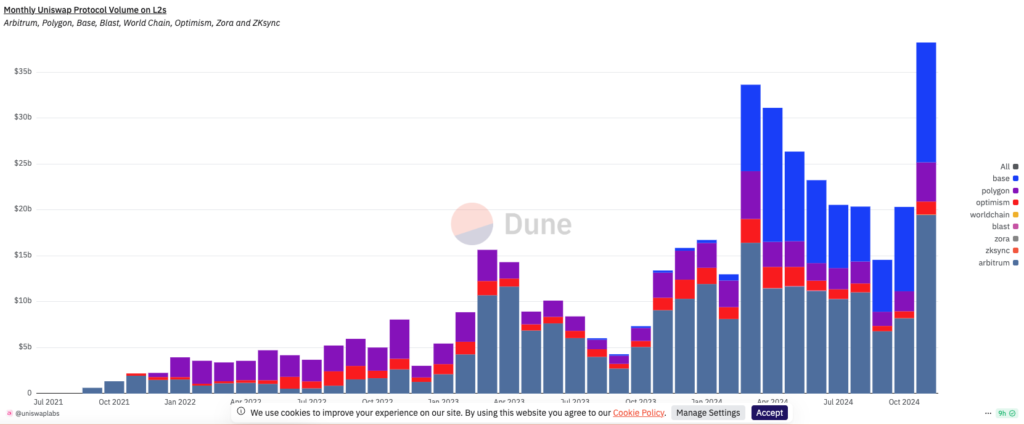

Data from Dune Analytics reveals that Uniswap recorded $38 billion in trading volume across Ethereum layer-2 solutions such as Base, Arbitrum, Polygon, and Optimism.

This November milestone surpasses the previous high set in March by $4 billion.

Henrik Andersson, chief investment officer at Apollo Crypto, attributed the spike in Uniswap’s layer-2 activity to rising demand for assets and stablecoins within the broader DeFi ecosystem. “[This is] in line with the DeFi renaissance and the recent increase in ETH/BTC. Onchain yields are also rising,” Andersson told Cointelegraph.

He also noted that this trend could signal the beginning of a long-anticipated period of outperformance for Ethereum-based projects.

“Every time Bitcoin closes in on 100k, we have seen Ethereum and DeFi coins starting to move,” he added.

Uniswap experienced its highest volume on Arbitrum, which accounted for $19.5 billion, followed by Coinbase’s Base network, which saw $13 billion in trades.

Currently, Uniswap ranks as the sixth-largest protocol by fees, generating over $90 million in the last month.

This places it ahead of several other protocols, including Solana’s Pump.fun memecoin launchpad, as well as major networks like Tron and Maker.

The activity boost has also been reflected in the price of Uniswap’s native token, UNI. Over the past week, UNI has risen by more than 42%, trading at $12.58 at the time of publication, a 10% gain in the last 24 hours.

UNI’s performance has outpaced other decentralized exchange tokens, including Solana-based Raydium, which is down 2.2% for the week, and Jupiter, which has gained 7.7% over the same period.