The weekly gain for BTC buyers is minimal, as Saturday’s progress returns to square one the next day.

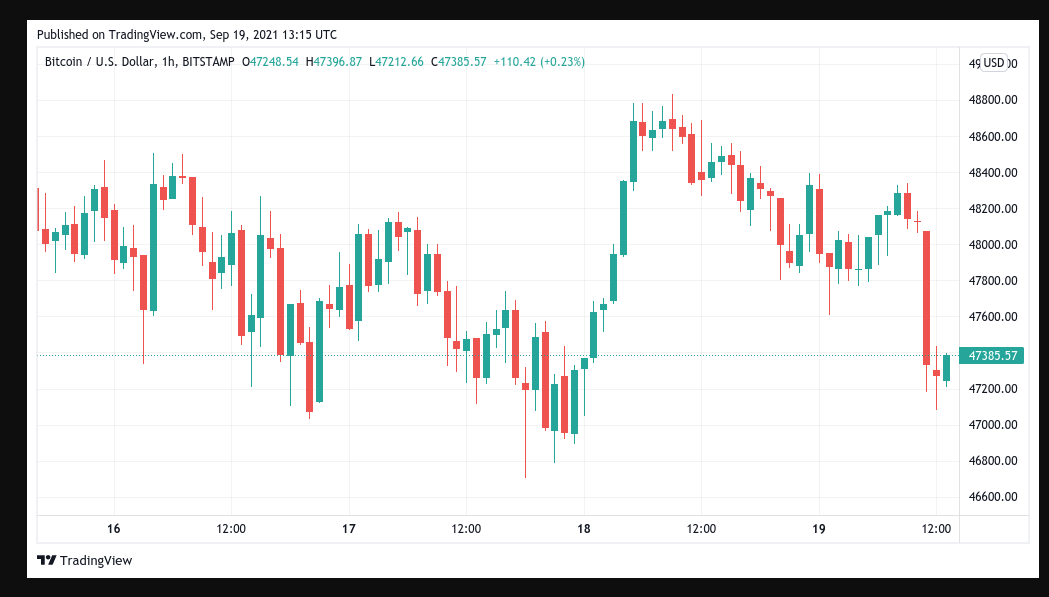

On Sept. 19, Bitcoin (BTC) retested $47,000 as the weekly close appeared to be hinged on the CME futures gap.

Following the erasure of profits, Bitcoin has come full circle

As the week came to a conclusion, data from Cointelegraph Markets Pro and TradingView revealed that the BTC/USD pair was showing contradictory indications.

The pair had witnessed a stronger surge on Saturday, which had later given way to range-bound behaviour despite a lack of apparent direction on Sunday.

This is something that happens pretty frequently in the markets, according to Cointelegraph contributor Michael van de Poppe.

“Slight rally on Saturday for Bitcoin, coming back down to CME close on Sunday. CME closed at $47,490 on Friday, seems to be that we’re going to open there too later today.”

The closing price of Bitcoin futures could thus bring to a close what has been a cautiously optimistic week for hodlers, with the cryptocurrency’s close last week coming in at closer to $46,000.

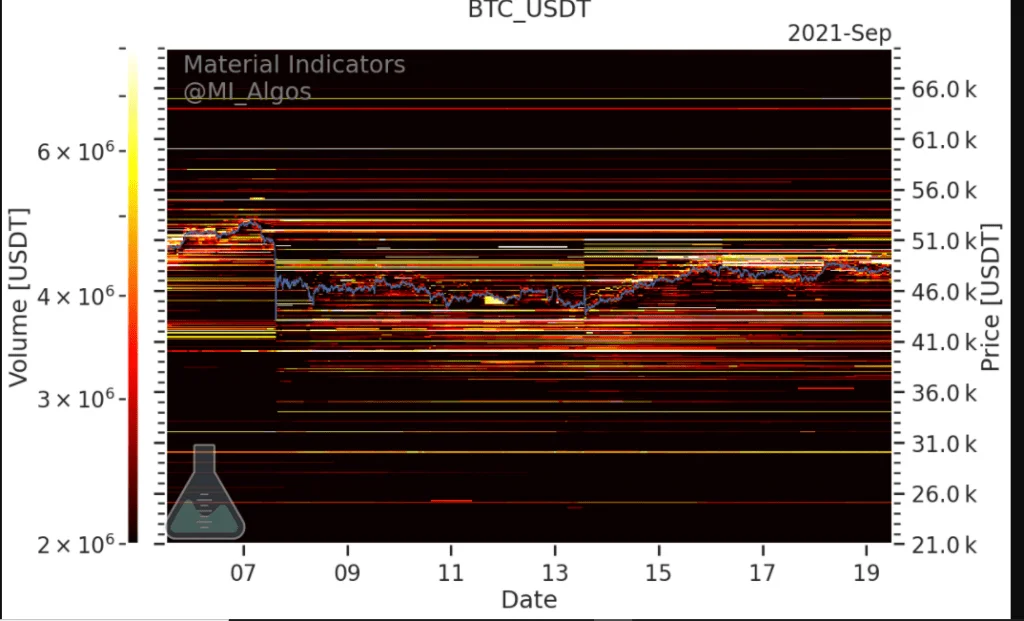

The buy and sell levels on major exchanges are examined. Binance, on the other hand, has revealed significant resistance at $49,000, which has gained credibility over the weekend. Buy support, on the other hand, was still valued at $44,000.

Altcoins perform copycat moves as the week draws to an end

In a similar vein, altcoins had a down day, with the top ten cryptocurrencies all suffering losses of approximately 2.5 percent, mirroring Bitcoin’s performance.

With a minor increase in losses, the Ethereum token (ETH) is currently trading around $3,350 — around 2 percent lower than it was at the same time a week ago (see chart below).