TradFi appears to be safe on the international payments market for the foreseeable future, despite advances in blockchain solutions.

In its annual Future of Payments survey, the Official Monetary and Financial Institutions Forum (OMFIF) has revealed a notable decline in enthusiasm among central bankers for central bank digital currencies (CBDCs) despite increasing research efforts in the area.

CBDCs Lose Favor Among Central Banks

Interlinking instant payment systems, such as the U.S. Federal Reserve’s FedNow service, remains the most favored approach among central banks for enhancing cross-border payments.

Nearly half (47%) of respondents preferred this option, a slight increase from last year. Meanwhile, stablecoins garnered no support for the second consecutive year.

Support for CBDCs dropped significantly, falling from 31% in 2023 to just 13% in 2024. This may reflect differing levels of interest in CBDCs among various central banks.

The Bank for International Settlements’ (BIS) decision to exit Project mBridge in October was widely seen as a response to geopolitical concerns, given the project’s association with China and other nations not aligned with the West. However, the BIS denied any political motives behind its decision.

The survey also concluded that the U.S. dollar remains the preferred settlement currency, with only 11% of central banks indicating plans to reduce its usage.

The report noted, “For now, many players searching for a safe haven in the face of geopolitical tensions will increase holdings of the dollar, reinforcing the dominance of incumbent payments systems.”

Tokenization and TradFi Offer Promising Alternatives

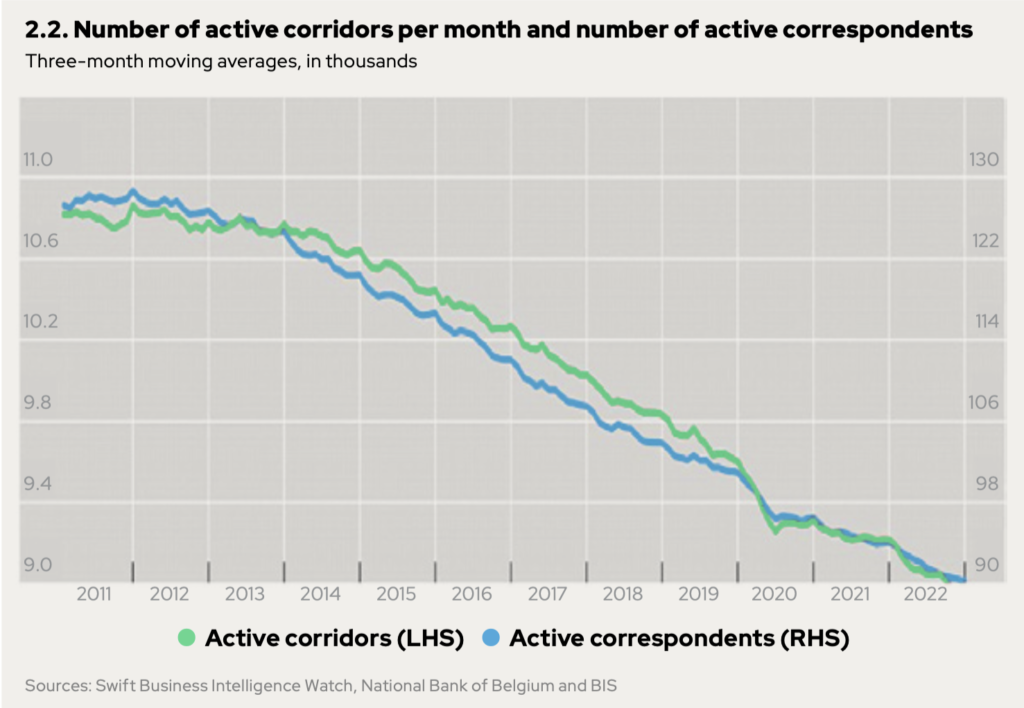

The traditional correspondent banking system, where large international banks facilitate settlements for smaller local banks, has steadily declined due to rising costs and increasingly stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

The adoption delays of the new ISO 20022 messaging standard could accelerate this decline.

Amid these challenges, central banks are showing growing interest in tokenization, which could simplify compliance checks.

Over 40% of central banks in developed markets see tokenization as promising, with plans to explore it within the next three to five years.

Projects like the BIS’s Project Agora, involving central banks from France, Japan, South Korea, Mexico, Switzerland, the United Kingdom, and the U.S. Federal Reserve Banks, are leading efforts toward tokenized financial transfers, relying heavily on wholesale CBDCs.

However, the preference for established instant payment systems suggests that blockchain-based solutions for cross-border payments are unlikely to dominate soon.

The BIS is prepared for this scenario through initiatives like Project Nexus, which aims to develop a shared platform for instant payment systems, utilizing the ISO 20022 standard.