Despite the retraction from Paypal, the crypto community argued the policy shows why decentralization and self-custody are crucial.

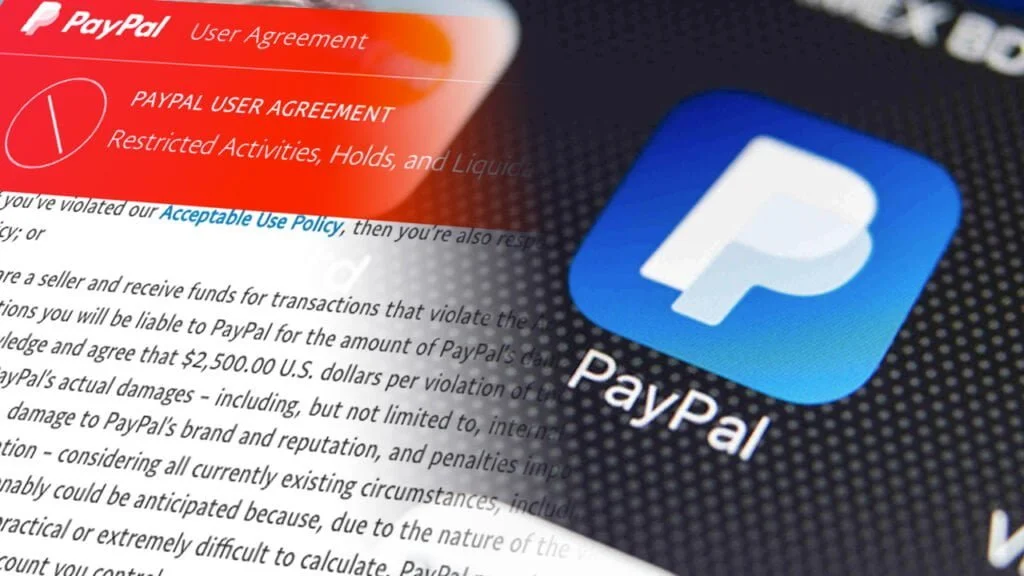

PayPal, an online payment network, has backtracked on a contentious policy that could have resulted in customers being fined $2,500 for disseminating “misinformation,” stating the policy update was made “in error.”

The now-retracted disinformation section in PayPal’s Acceptable Use Policy (AUP) was scheduled to go into effect on November 3 and would have added “the sending, uploading, or publication of any messages, content, or materials” that “promote misinformation” to the list of prohibited behaviors.

PayPal later clarified that it will not penalize its users for disseminating false material, stating that the amended AUP was sent out in error and contained inaccurate information.

“PayPal is not fining people for misinformation and this language was never intended to be inserted in our policy […] Our teams are working to correct our policy pages. We’re sorry for the confusion this has caused.”

Both crypto and non-crypto observers have been discussing the matter on Twitter like wildfire, and some have done so even after the retraction.

It is “insanity,” according to David Marcus, CEO of Lightspark and former president of PayPal, that “a private firm now gets to decide to take your money if you say anything they disagree with.”

Elon Musk, the CEO of Tesla and a former co-founder of PayPal, agreed in response to Marcus’ post.

Sid Powell, a co-founder of Maple Finance, claimed that the current situation serves as a prime illustration of why it is crucial to have control over your own money.

Michal van de Poppe, the founder and CEO of the cryptocurrency consultancy and teaching platform Eight, kept his response succinct and simple, labeling it “The end of PayPal.”

However, not everyone believed that PayPal’s now-retracted condition was disrespectful to its users.

Without giving reasons, Chief Strategy Officer Meltem Demirors of digital asset investment firm CoinShares asserted that businesses have the freedom to decide who can utilize their services:

“And if you think crypto is immune you’re either naive or willfully ignorant,” she said, adding:

“Currently, 31% of post-merge Ethereum blocks are OFAC-compliant, meaning they censor transactions associated with specific contracts and addresses on a state-sponsored list.”

Although imposing a punishment would have been a first for PayPal, the payment giant is not new to deplatforming customers who don’t share its political views; in fact, in October 2020, it severed connections with domain registrar Epik, which served the Proud Boys and other conservative organizations.

According to Yahoo Finance, the price of PayPal (PYPL) has dropped 64.65% over the past 12 months, mirroring the general stock market.

It remains to be seen whether the clause and its subsequent removal will affect PayPal’s share price as the NASDAQ is scheduled to reopen on September 10 at 9:30 am Eastern Time.