Mike McGlone, a Bloomberg Intelligence commodity strategist, expects the US Securities and Exchange Commission (SEC) will approve the country’s first Bitcoin ETF next month.

McGlone claimed that Canada is increasing a competitive edge over the US after licensing Bitcoin ETFs from 3iQ and Coinshares in April in an interview with Stansberry Investor host Daniela Cambone on Sept. 21.

He noted that money is pouring from the United States to institutional crypto products in Canada, notably Cathie Wood’s Ark Invest. He believes, however, that US lawmakers will not want to be left out for much longer.

McGlone stated a prospective Bitcoin ETF clearance in the United States might happen “potentially by the end of October” when questioned about a timetable.

He insisted that it would most likely be a futures-backed product first and that it would provide a “legitimization window for a tremendous infusion of money.”

McGlone also reaffirmed Bloomberg Intelligence’s recent analysis, which indicated that Bitcoin values might reach $100,000 this year if an ETF is approved, adding that this would be driven by the establishment of an ETF.

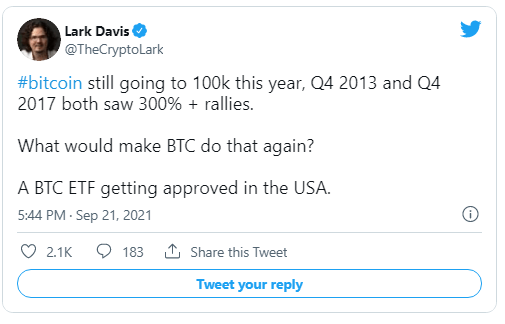

Lark Davis, a crypto YouTuber, agrees with McGlone’s price forecasts, noting that the last quarter of prior bull markets in 2013 and 2017 saw massive price increases.

Despite the fact that the number of applications it has received from potential issuers continues to grow, the SEC has yet to approve a crypto ETF.

Fidelity Investments, a worldwide financial services corporation, pushed the SEC earlier this month to establish an ETP, claiming that Bitcoin markets have already matured by the regulator’s own standards.