Pro-XRP lawyer John Deaton calls out SEC’s Gary Gensler for ties to FTX’s SBF as SEC secures $8.2 billion in FY2024 remedies.

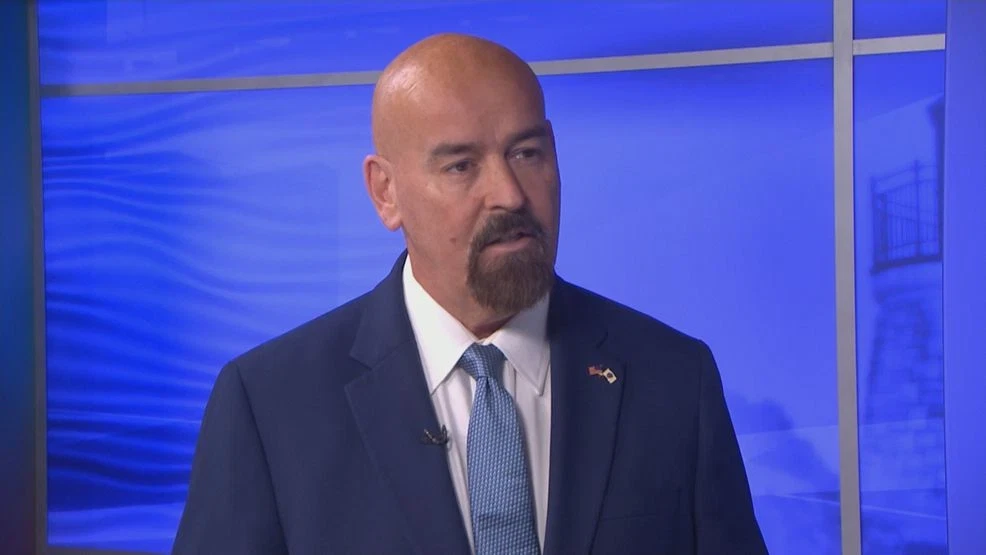

Pro-XRP attorney John Deaton has raised questions about the connection between U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler and FTX founder Sam Bankman-Fried (SBF).

Deaton’s remarks were prompted by the SEC’s announcement of record-breaking financial penalties during its fiscal year 2024 enforcement activities.

John Deaton Accuses SEC of Favoritism Toward Sam Bankman-Fried

In a recent post on X, Deaton criticized Gensler for holding private meetings with FTX’s Sam Bankman-Fried while reportedly denying similar access to U.S.-based crypto leaders, such as Coinbase CEO Brian Armstrong and Kraken’s Jesse Powell. According to Deaton, this behavior reflects favoritism by the SEC.

Deaton also highlighted the $10 million in political contributions made by Bankman-Fried, suggesting this financial influence might have facilitated FTX’s involvement in regulatory discussions.

He argued that this connection likely influenced the SEC’s favorable treatment of the offshore crypto exchange.

Deaton’s criticism comes as Gensler announced he will step down as SEC Chair on January 20, 2025, coinciding with Donald Trump’s inauguration as the 47th President of the United States.

The resignation was confirmed in an SEC press release and by Gensler himself in a post on X.

SEC Secures Record $8.2 Billion in Financial Penalties

The SEC reported $8.2 billion in financial remedies for fiscal year 2024, marking the largest amount in its history.

However, the agency also noted a 26% decline in total enforcement actions compared to the previous fiscal year, filing 583 cases. Of these, 431 were “stand-alone” actions, representing a 14% drop from 2023.

Significantly, $4.6 billion of the financial recoveries came from the SEC’s case against Terraform Labs and its founder, Do Kwon. This judgment accounted for over half of the year’s total financial remedies.

Calls for Regulatory Reform

Deaton has used the SEC’s recent enforcement actions to renew his push for regulatory reform. He argued that the agency relies on outdated laws to govern emerging technologies like blockchain.

Following Gensler’s announced resignation, Deaton has endorsed Brad Bondi as a potential successor.

He emphasized the importance of having leadership that will establish “a clear and fair regulatory framework” to encourage innovation in the blockchain industry.