CoinTracker, a tax calculator for cryptocurrencies has been dubbed a “unicorn” after obtaining $100 million in Series A funding. The funds will be used to address the growing need for complex tax reporting solutions in the crypto business.

General Catalyst, Initialized Capital, Y Combinator Continuity, 776 Ventures, Coinbase Ventures, Intuit Ventures, and Kraken Ventures all participated in the Series A investment round, which was led by California-based venture capital firm Accel.

Former Stripe COO Hughes Johnson, Coinbase board member Gokul Rajaram, and Jeremy Liew, an early investor in Affirm and Snapchat, were among the individual investors in the round.

CoinTracker’s overall valuation increased to $1.3 billion as a result of the capital raising, making it the latest crypto unicorn to be anointed. Unicorns are companies with a market capitalization of at least $1 billion in the startup industry.

The funds will be used by CoinTracker to address the growing need for complex tax reporting solutions in the crypto business, according to the company. It will also increase its human resources and expand its exchange, chain, and wallet coverage.

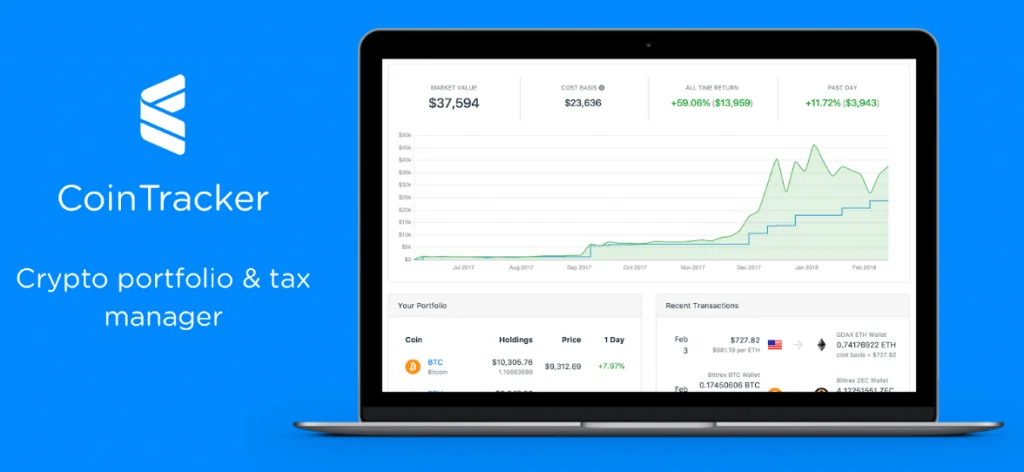

About CoinTracker

According to the company, it has over 500,000 users and tracks over $20 billion in cryptocurrency assets across 25 blockchains and 300 exchanges. Since April 2020, when it first reached 100,000 members, its user base has risen fivefold.

When asked about the major obstacles crypto holders face in terms of tax compliance, CoinTracker co-founder and CEO Jon Lerner told Cointelegraph that keeping track of transactions across several exchanges makes it difficult to appropriately calculate taxes. He explained, “Complexity is exploding.”

“Calculating that capital gain or loss can be difficult, especially considering it could have been acquired from a variety of places and transferred across exchanges and wallets over time. To make matters worse, users are increasingly using cryptocurrency across more exchanges, decentralized tools, and chains, as well as use cases like a store of value, DeFi, NFTs, payments, and more. Complexity is exploding.”

CoinTracker’s platform was made available to users of Coinbase, one of the world’s most popular digital asset exchanges, in January 2021, just as the Internal Revenue Service (IRS) was pressuring the exchange to take a tougher stance on tax evasion. CoinTracker’s platform makes it easier for users to report the purchase and sale of thousands of cryptocurrencies.

With the passage of the Infrastructure Investment and Jobs Act in November 2021, crypto was once again in the crosshairs of the IRS and government officials. Due to changes in how authorities define brokers and other reporting requirements, the new law is estimated to raise $28 billion in tax revenue from the crypto business over the next ten years.

“Most of the top tier technology investors have recognized that the cryptocurrency business is here to stay, given its immense potential and upside,” Lerner said of venture capital’s continued interest in the crypto area despite the current market downturn. Because they focus on companies with good fundamentals, these investors don’t let volatility affect their investment selections.