“We’re simplifying the process by showing each customer a personalized summary of their taxable activity on Coinbase, broken out over time by realized gains/losses and miscellaneous income,” says Coinbase.

Crypto investors are already reeling from a rocky start to 2022, and now they must figure out how to calculate the tax they owe by April 18th, the IRS filing date.

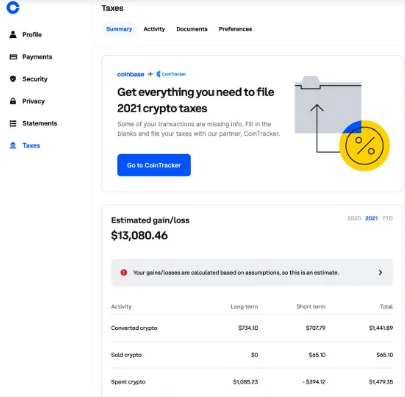

Owners of Coinbase will have it a little easier this year than in previous years, thanks to a new “tax centre” the firm has developed, which will consolidate all of their taxable activity, both short and long term profits and losses, in one spot.

The new service is crucial since cryptocurrency owners previously had to manually determine how much they made and what tax rate applied to their profits. (The government taxes crypto at different rates based on whether you owned it for a year or longer before selling it, much like other assets.)

“We’re making it easier by providing each user with a personalized summary of their taxable activities on Coinbase, broken down by realized gains/losses and miscellaneous income over time. Customers can use these funds to prepare and submit their taxes with their own accountants or with tax preparation software such as TurboTax “In a blog post unveiling the tax centre, the business stated.

The company also provided a screenshot of the new tax centre product, which appears to be as follows:

Coinbase also stated that consumers who utilize its Pro product or have done transactions using an external wallet can get free crypto tax reports from CoinTracker, which is a Coinbase partner. All of this comes as the US government considers crypto taxes as a crucial new income stream to fund a new trillion-dollar infrastructure bill and other responsibilities.

Previously, the government’s primary focus was on locating crypto whales who were attempting to avoid paying taxes. However, in the previous two years, the IRS has attempted to cast a far wider net, including asking every American if they possess cryptocurrency using the usual 1040 form.

As a result of the government’s increased scrutiny, a part of the crypto industry is developing tax and compliance solutions similar to those used in other investment sectors.

While Coinbase’s new tax center may make tax filing easier for many of its users, the business will not issue a 1099—the document used by banks and brokerages to inform customers of how much money they made from dividends and investments.

A Coinbase spokeswoman told Decrypt that the business is not required by law to provide 1099s, but that it will do so for users who earn a lot of money through fees and rewards.

“We do not issue 1099s for the sale of crypto assets, as it is not required by the IRS. Coinbase will provide 1099-MISC IRS forms to customers who earned more than $600 in fee income and rewards for the 2021 tax year,” said the spokesperson.