The popularity of decentralized banking has exploded in the last year—but what exactly is DeFi, and how do you discover DeFi tokens with potential? We will explain.

Decentralized finance (DeFi) is a subset of the bitcoin business dedicated on decentralized financial services.

It consists of a number of developer-created financial services that anyone can use.

These services differ from centralized alternatives in that they are managed by decentralized organizations and provide users more control over their money.

Decentralized finance, or DeFi, is at the heart of the recent cryptocurrency bull market.

DeFi is the hottest topic in crypto right now, similar to how Initial Coin Offerings (ICOs) were all the rage in 2017.

According to metrics site DeFi Pulse, only $1 billion was invested on DeFi protocols in June 2020.

DeFi degens had deposited over $20 billion in bitcoins into DeFi smart contracts by January 2020.

Every week, new decentralized and non-custodial financial services are launched to the DeFi industry, which is a hub of innovation.

Even billionaire investors aren’t immune to risk when it comes to decentralized finance, or DeFi, despite having potentially more resources.

Mark Cuban, for example, stated on Wednesday evening that he was trading a DeFi coin called titan from Iron Finance, which crashed to zero in one day.

On Wednesday, Cuban, the owner of the Dallas Mavericks and an investor on ABC’s “Shark Tank,” tweeted, “I got struck like everyone else.”

Some in the crypto community assumed it was the consequence of a rug pull, a form of fraud in which creators abandon a project and walk away with investors’ monies.

Those allegations were refuted by Iron Finance.

According to the project’s blog post, the crash was caused by a “bank run,” or panic selling, as well as the token’s mathematical programming.

These services are available to everyone, wherever in the world.

The DeFi ecosystem is built on top of public distributed networks and leverages smart contracts, which are self-executing agreements defined in lines of code that ensure democratized access to financial services.

What exactly is DeFi?

So, what exactly is DeFi, this powerful, savage beast? Isn’t crypto, after all, decentralized finance? In certain ways, yes.

The DeFi movement refers to a type of financial product that prioritizes decentralization and employs profitable incentive systems to entice investors to participate.

The decentralized finance world is made up of a slew of non-custodial financial products built around a culture of high-risk, high-reward crypto initiatives that have piqued the interest of major firms and venture capitalists—as well as a few con artists.

How does Decentralized Finance work?

The lending protocols Aave, Maker, and Compound are among the most popular initiatives.

These are protocols that allow you to borrow cryptocurrency instantly, and frequently in big amounts, if you can demonstrate that you can repay the loan in a single transaction.

Lending out bitcoins can potentially earn you money in the form of interest.

Then there’s Uniswap, a decentralized exchange that allows you trade any Ethereum-based currency you choose while also allowing you to make money by adding liquidity to the market.

Synthetic assets, such as Synthetix’s tokenized equities or Maker’s decentralized stablecoin, DAI, whose value is established algorithmically by the protocol, are also part of DeFi.

Other services include non-custodial Bitcoin to Ethereum conversions and decentralized price oracles, which allow synthetic assets to accurately peg themselves to their non-synthetic counterparts, among other things.

The fact that these protocols are decentralized and non-custodial, at least in principle, gives them the DeFi moniker.

The term “non-custodial” refers to the fact that the teams do not manage your cryptocurrency on your behalf.

Unlike depositing money in a bank or lending your crypto to a crypto loan firm (such as Cred), you always have ownership over your cryptocurrency with DeFi protocols.

The inventors of these protocols have distributed authority over their smart contracts to the community, and in the spirit of the hacker ethic, they have voted themselves out of power as soon as feasible, allowing users to vote on the network’s future.

The facility has a history of falling short of its grandiose ambitions. Close examination of the smart contracts of even the largest DeFi protocols reveals that teams wield enormous power or that the contracts are open to manipulation.

However, for some traders, it can be quite profitable. Many of these lending protocols charge exorbitant interest rates, which are inflated even further by the phenomena of yield farming, in which these lending protocols reward lenders with more tokens.

These so-called governance tokens, which may also be used to vote on network improvement proposals, are available on secondary markets, meaning that some yearly percentage returns can reach 1000 percent. (Of course, it’s debatable if the protocols in question will endure a year.)

What are DeFi protocols and how can I use them?

The majority of DeFi protocols are developed on top of Ethereum or Binance Smart Chain, and the number of rival blockchain networks that allow smart contracts is expanding all the time.

It’s critical to pick a network before selecting to use DeFi services.

The majority of large protocols now support multiple blockchains, with the main differences being ease of use and transaction fees.

Etheruem, Binance Smart Chain, and Polygon are all accessible through wallet extensions like MetaMask, and switching networks is as simple as changing a few parameters.

Users can access their monies straight from their browsers using these wallet extensions.

They are installed similarly to other extensions, and frequently require users to either import an existing wallet (through a seed phrase or private key) or build a new one.

They’re also password-protected for added security. These wallets are built-in to some web browsers.

Furthermore, these wallets frequently include smartphone apps that can be used to access DeFi initiatives.

These apps are wallets with built-in browsers that can be used to communicate with DeFi apps.

Users can synchronize their wallets by creating them on one device and then importing the seed phrase or private key to the other.

These mobile applications frequently incorporate the open-source WalletConnect protocol to make things easier for users.

Users can connect their wallets to DeFi applications on desktop machines using this protocol by simply scanning a QR code with their phones.

Before we get started, it’s important to note that this is a very experimental environment with a lot of hazards.

Exit scams, bogus ventures, rug pulls, and other types of scams are frequent, so do your homework before investing.

To avoid falling prey to these ruses, use these steps to beef up your security: It’s a good idea to see if the projects have been audited.

Finding this information may require some effort, but a direct search for the project’s name plus “audits” will usually disclose whether or not it has been audited.

Audits aid in the identification of potential vulnerabilities as well as the deterrence of bad actors. Projects that aren’t doing so well are unlikely to waste time and money getting audited by respected firms.

What are the most popular DeFi Protocols?

Protocols for decentralized financing and yield farming

The primary DeFi lending protocols include Aave, Compound, and Maker, which have billions of dollars of value locked up in their smart contracts.

The concept is simple: you can lend or borrow cryptocurrency tokens.

Because all of the major protocols are built on Ethereum, you may lend or borrow any ERC20 token.

As previously stated, they are all non-custodial, which means that the protocols’ designers have no influence over your assets.

Interest rates fluctuate. On Compound, you can lend out Maker’s decentralized stablecoin, DAI, for 7.75 percent or borrow it for 10.78 percent at the time of writing.

On Aave, lending costs 9.59 percent and borrowing costs 17.46 percent. However, the percentage points change greatly from day to day, so take everything with a grain of salt.

The so-called “yield farming” craze began as a result of these practices. Compound released $COMP, a governance token that allows holders to vote on how the network operates, in the middle of June.

People that lent cryptocurrencies on Compound were rewarded with $COMP, which worked like loyalty points.

They might vote on proposals to upgrade the network with these governance tokens. This was only one of the token’s applications.

The other was to gain $COMP for speculative reasons, which brought DeFi both fame and infamy in equal measure.

The numbers show why. On the day of the debut, June 17, $COMP was worth $64. A single $COMP was worth $346 on June 23.

Developers of other lending protocols began to take note and launched their own governance tokens.

Aave, like a slew of other DeFi protocols, features one called $LEND.

In the middle of September 2020, the price of a single $YFI, the governance token for DeFi yield aggregator yearn.finance, reached at $41,000, quadrupling the price of Bitcoin at the time and near to its current all-time high.

(At the time of writing, there were only 29,967 YFI in circulation, compared to 18 million-plus Bitcoin.)

And it’s all for a token that yearn.finance’s developers described as having “zero worth.” “Don’t buy it,” they wrote when the token was first released. “You have to work for it.”

Liquidity providers and decentralized exchanges

Another prominent DeFi protocol is decentralized exchanges. By far the largest is Uniswap.

The daily trading volume on Uniswap reached $426 million at the end of August 2020, surpassing the volume of centralized exchange Coinbase, which saw dealers exchange $348 million worth of cryptocurrency.

Balancer, Bancor, and Kyber are among the others. 1inch is a platform that brings together all of the decentralized exchanges into one place.

All of these exchanges are “automatic market makers.” Unlike, instance, Binance, a controlled exchange, or IDEX, a decentralized exchange, where traders buy and sell crypto among themselves, these automated market makers have liquidity pools.

Let’s break it down: liquidity simply refers to the ease with which money can be moved across a market.

When a token’s market is highly liquid, it suggests that trading it is very simple. It’s difficult to find customers for your tokens if it’s illiquid.

Liquidity pools are large vaults of token pairings that traders can use to make trades—for example, a liquidity pool for ETH and BTC.

So, if someone invests $1 billion in ETH and $1 billion in BTC in a liquidity pool, there will be enough money flowing through the exchange for traders to trade the assets without difficulty.

The DeFi element is that it’s all non-custodial, which means that any ERC-20 token can be added to these exchanges.

Because centralized exchanges won’t offer certain tokens owing to legal concerns and because many tokens are, well, scams, this gives the market more options.

The incentive structure is the second DeFi aspect of this. Those who fund these liquidity pools are paid fees every time a trade is made, as well as various yield farming prizes offered by some of the protocols.

Synthetic stablecoins and decentralized stablecoins

The centralized universe of synthetic assets looks like this: Tether, the biggest US dollar-pegged stablecoin, with a market capitalization of around $24 billion.

Tether says that its tokens are fully backed by US dollar cash reserves.

However, the answers to these allegations are kept behind closed doors, and the corporation has previously stated that these tokens were only 74% backed by the US dollar at one point.

The New York Attorney General is now investigating the company.

The pressing issue is that those trading US dollar stablecoins must have faith in the companies that develop them to keep their promises and that these tokens will always be redeemed for US dollars.

Companies, on the other hand, break their users’ confidence; individuals are fallible.

The decentralized stablecoin, whose peg to the asset it represents is established by a complicated, self-sustaining algorithm, was inspired by Lawrence Lessig’s maxim “Code is Law.” DAI, made by Maker, is the most popular.

Another notable synthetic asset platform is Synthetix. It allows users to trade a variety of derivatives, including synthetic US dollars, Australian dollars, Bitcoin, and gold. Stocks, ETFs, and indexes will all be available soon.

Wrapped Bitcoin, or WBTC, is the last synthetic asset.

It works like this: you plug your BTC into WBTC’s contracts, and WBTC will issue Bitcoin in exchange.

The advantage is that users of Bitcoin can participate in DeFi, which is virtually entirely based on Ethereum.

WBTC has a market capitalization of around $500 million. It’s a custodial product, with BitGo, a Silicon Valley-based crypto prime brokerage firm sponsored by Goldman Sachs, keeping custody of the Bitcoin. Non-custodial products will be available soon.

What is the best way to get started with DeFi?

So you’re interested in giving DeFi a shot? This is what you must do.

To begin, obtain an Ethereum wallet that can connect to several DeFi protocols via your browser. MetaMask is a popular option.

Second, purchase the coin that corresponds to the DeFi protocol you intend to employ. Most DeFi protocols are currently based on Ethereum, so you’ll need to purchase ETH or an ERC-20 currency to use them. (If you wish to utilize Bitcoin, you’ll need to convert it to an ETH version of the cryptocurrency, such as Wrapped BTC.)

Third, try your hand at the DeFi game. There are a plethora of options available.

One option is to lend your cryptocurrency to others. Yearn.finance, which provides them all in one spot, is a straightforward approach to see how to get the greatest bargain.

By earning the governance tokens that are granted for lending out your cryptocurrency, you may become a “yield farmer.”

On sites like yieldfarming.info, you may learn more about the possible earnings from yield farming.

Another option is to deposit your assets in a decentralized exchange like Uniswap and earn fees by becoming a market maker.

You could even use them in SushiSwap, a contentious Uniswap competitor that allows you to earn yield-farming tokens for your market creating.

Third, you might put your money into one of the more irrational DeFi initiatives, such as Based.Money, whose token price “rebases” daily, skewing the market, or the popular variety of volatile meme coins, such as $YAM, $TENDIES, $KIMCHI, $SHRIMP, and so on.

However, one thing to keep in mind is that the space is full of dangers, scams, and mistakes. Within crypto, which is a highly experimental and hazardous field, this is a highly experimental and risky space.

People frequently uncover vulnerabilities in smart contracts that disclose how the token creators control all the power, and fraudsters, exit scammers, and “rug pulls” are common (and the project is not decentralized at all, after all). Take care.

What is the best way to use a decentralized exchange?

Uniswap, a decentralized exchange, is one of the most prominent DeFi systems.

Once you’ve figured out how to trade on Uniswap, you’ll be ready to take on everything DeFi devs can throw at you.

Here’s a basic primer on how to get started. We’ll keep things easy and show you how to swap ETH for DAI, a decentralized stablecoin.

First, we’d like to transmit our ETH to Uniswap, which we’ve already purchased from Binance.

To accomplish so, we’ll need to first connect a wallet. We’ll use MetaMask, a popular browser wallet that works with nearly all DeFi applications.

To do so, go to Uniswap and click “Connect to a wallet” in the upper right corner (through a desktop browser).

Then, click MetaMask.

You should have a wallet address in MetaMask once everything is set up.

So, from wherever you keep your ETH, you’ll need to send some to that MetaMask address.We’ll send some because ours is on Binance.

We sent MetaMask $5, then $20.

Here’s an example of one of those deals. It’s worth noting that you’ll have to pay a transaction fee.

We paid $11 to send $25 in ETH from Binance to MetaMask in two transactions.

As Ethereum’s price has increased and DeFi apps have taken hold, these “gas costs” have soared in response to increasing demand.

That’s how it looked like.

The transaction took a few minutes to reach our MetaMask address due to the slowness of blockchains.

Let’s transfer ETH to DAI with the remaining ETH we have.

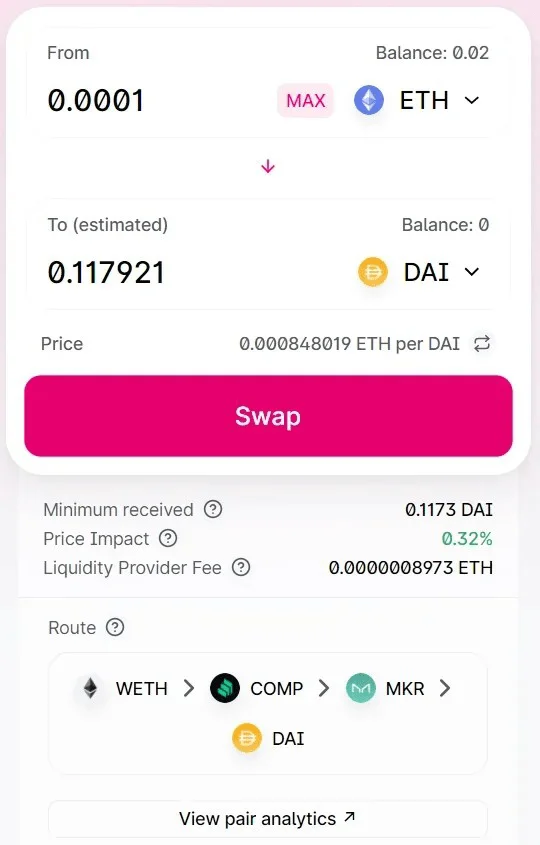

Let’s keep things simple for the purposes of this essay and exchange 0.0001 ETH for 0.117 DAI.

Because DAI is tied to the US dollar, this is the equal of $0.117.

So, we’ll click on trade, then choose ETH and DAI from the drop-down menu.

We’ll pay a tiny charge to liquidity providers—those who have put down collateral to make this transaction possible.

And according to Uniswap, the cheapest option to complete this transaction is to convert from ETH to WETH to COMP to MKR to DAI.

Excellent. So, go ahead and swap your MetaMask address.

Oops. Because we must pay Ethereum miners to process this transaction, it will cost $15.67.

The gas fees for Ethereum are always changing. They’re sky-high on busy days.

They’re as low as a couple dollars on slower days.

Let us, however, confirm this transaction for the sake of education.

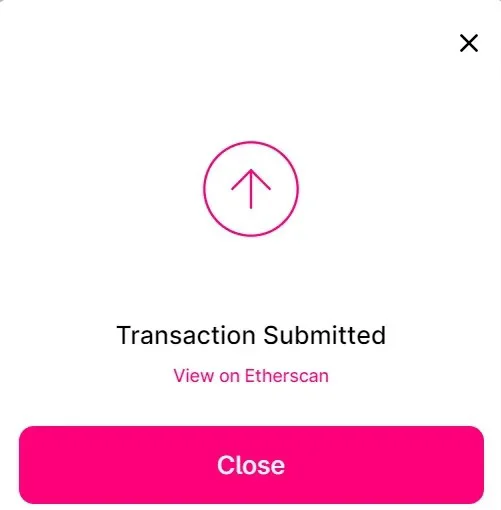

Our gentleman’s agreement has been submitted and is awaiting Ethereum miners’ approval.

And there you have it! Our DAI purchase has been verified on the blockchain and is ready to use.

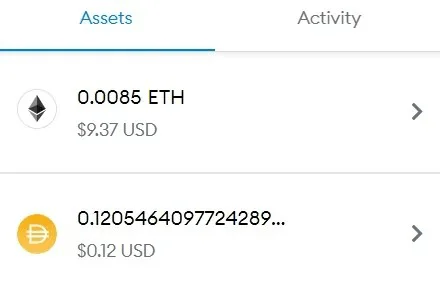

The appeal of DeFi. And the transfer of $0.12 only cost $25! It’s a real steal. But look at how lovely everything is.

Then we returned our ETH to Binance, where it was safe and sound.

A further $1.5, bringing our total to $26.5.If we had done this trade on Binance, it would have cost us next to nothing.

However, our $0.12 is now ready to be applied to any DeFi protocol, resulting in a sweet, sweet yield.

That is, if we deposit enough ETH to cover the gas fee.

DeFi in the Future

Few could have expected DeFi’s meteoric growth, and even fewer can forecast its future.

There are a couple of apparent directions it may go.

More blockchains will be added to the sector.

All of the major DeFi projects are based on Ethereum as of September. Other blockchains, on the other hand, are constructing projects.

A few things are likely to happen.

First and foremost, DeFi initiatives will become more interoperable

More initiatives to enable cross-blockchain compatibility are in the works, most notably Tendermint’s Cosmos, additional work by Ren, and the Polkadot project.

Bitcoin can already be used on Ethereum in the form of Wrapped BTC, and more initiatives to enable cross-blockchain compatibility are in the works, most notably Tendermint’s Cosmos, additional work by Ren, and the Polkadot project.

DeFi will also expand to other blockchains in the future. Other blockchains are eyeing DeFi, which was once the realm of Ethereum.

Huobi, Conflux, Binance, and other exchanges are developing DeFi incubators and platforms, many of which are unrelated to Ethereum.

Finally, DeFi will have an impact on centralized financing.

What if your credit score was connected to a decentralized financing system?

What if you could use your home as security for a cryptocurrency loan?

What if you could buy and hold decentralized stablecoins through your high-street bank?

All of this is currently in the works.

Institutional investors may pump money into its protocols, causing the employment market to boom.

There’s a key word there: “could.”

This “early trial,” according to Itamar Lesuisse, co-founder and CEO of DeFi-friendly crypto wallet Argent, is “only the start,” he told Decrypt in July 2020.

“We look forward to it solving significant problems for mainstream users around the world in the years ahead,” he said. “In many areas, we’d argue the user experience is already better than traditional finance.”

DeFi projects will draw a lot of funding, according to Jason Wu, CEO and cofounder of DeFiner.

“With the funds received, DeFi projects will be able to develop new apps to meet demand and create next-generation financial networks,” he said.

A fourth, less definite question is if we’re in a DeFi bubble, and if so, how long will it last?

At the end of August 2020, Vitalik Buterin, the co-founder of Ethereum, warned that the current DeFi mania is unsustainable.

“Seriously, the sheer volume of coins that need to be printed nonstop to pay liquidity providers in these 50-100 percent/year yield farming regimes makes major national central banks look like they’re all run by Ron Paul,” he tweeted, evoking the Republican Congressman who called for the Federal Reserve to be abolished.

“We’re nearing the apex of ponzi economics, rug pulls, and “yield” hopping, and ETH fees are going to eat too heavily into non-whale profits,” Ryan Selkis, CEO of crypto data analytics startup Messari, stated in a since-deleted tweet in September 2020.

“DeFi is essentially one enormous pool of wealth sloshing around a small group of insiders and mercenaries who will run out of victims to scam shortly,” he continued.

Others believe that even if the “bubble” bursts, the DeFi industry will continue to develop, although at a lower profit margin from things like yield farming.

In September, Binance CEO Changpeng “CZ” Zhao stated that while he sees “plenty of bubbles in DeFi presently,” he believes “the essential notion of “staking coins to provide liquidity and earning a return” will remain.

These extraordinarily high yield returns supported by fresh tokens, on the other hand, will not.