On the heels of heavy sanctions being meted out to Russia by the West for invading Ukraine, the country is already exploring ways of circumventing the sanction by raising the likelihood of accepting Bitcoin payment for its energy to Turkey and China.

Pavel Navalny, the Russian Federation’s energy minister, has proposed accepting Bitcoin as payment for Russian oil and gas from “friendly countries” including China and Turkey.

He said that instead of using the international standard US currency, these countries should start paying for energy in Russian Rubles, Chinese Yuan, Turkish Lira, or even Bitcoin (BTC).

According to Russian news outlet RBC, Chairman of the State Duma Committee on Energy Zavalny announced at a press conference on March 24 that he and representatives from China and Turkey were negotiating adjustments to preferred settlement currencies for the country’s largest export.

“We have been proposing to China for a long time to switch to settlements in national currencies of rubles and yuan. With Turkey, it will be lira and rubles. The set of currencies can be different, and this is normal practice. If there are Bitcoins, we will trade Bitcoins.”

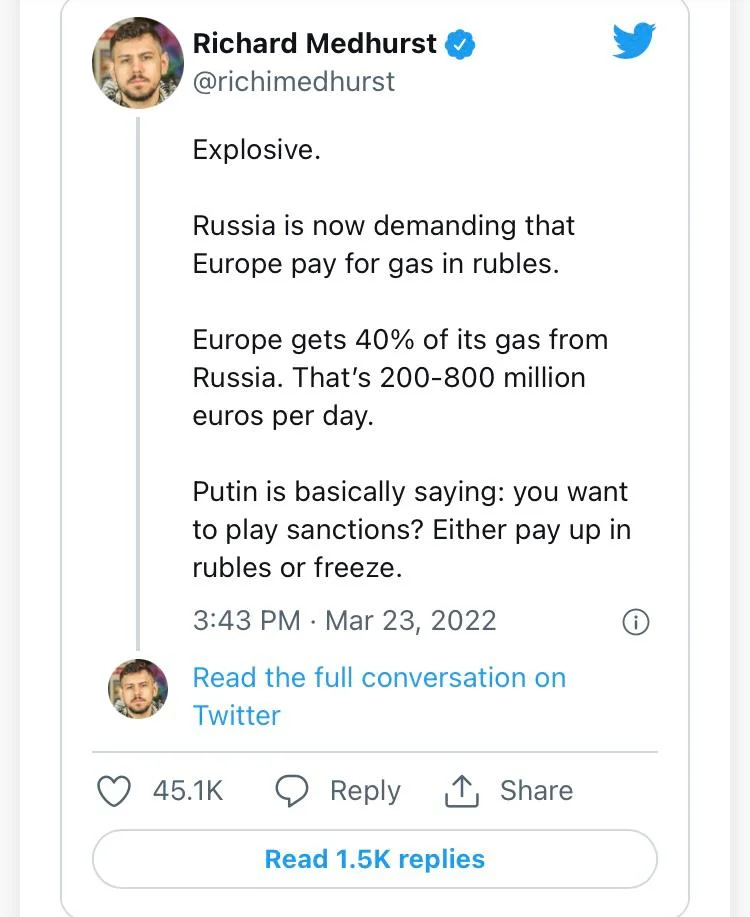

He also indicated that “unfriendly countries” may pay in Rubles or gold for their oil. However, it is unclear if Russia has the authority to change the terms of current contracts with countries that pay in Euros or Dollars.

Russia has been looking for ways to get over international economic sanctions imposed on it as a result of its invasion of Ukraine. Russian banks have been removed from the SWIFT system, making it impossible for them to settle cross-border payments, and most firms have been barred from doing business with Russia, except the oil and gas industry.

Energy is Russia’s single most important export, and it is a key energy source in Europe and other countries, which is difficult to replace. According to Reuters, Russia received $119 billion in earnings from the oil and gas trade in 2021.

Energy trade, which includes electricity, kerosene, coal, and natural gas, amounted to 53.8 percent of Russia’s total $388.4 billion in exports in 2021, according to Russia Briefing.

The news of BTC’s extended worldwide use case appears to have elicited a positive reaction from the crypto market. According to recent data, Bitcoin has gained 2.5 percent in the last day and is now trading at $43,917, surpassing 30-day highs.

Blackrock’s CEO Larry Fink, the world’s largest asset manager, maybe see his prediction of a new digital payment system materialize right before his eyes. Global political instability, Fink wrote in a letter to shareholders on March 24, might pave the path for states to adopt digital currencies as international settlement tools.