Goldman Sachs disclosed $718 million in Bitcoin ETFs in a November 14 SEC filing, despite previously criticizing cryptocurrencies.

The big global investment bank, Goldman Sachs, which was previously dismissive of Bitcoin, has revealed that it has considerable stakes in exchange-traded funds (ETFs) that are based on it.

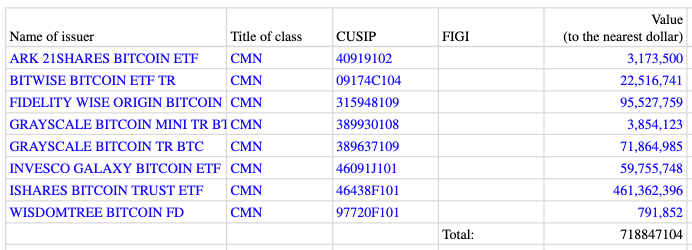

In a document it submitted to the United States Securities and Exchange Commission (SEC) on November 14, Goldman Sachs disclosed that it held approximately $718 million in eight Bitcoin exchange-traded funds (ETFs).

Goldman Sachs jumped into Bitcoin ETFs in Q2 2024

The report states that BlackRock’s spot Bitcoin exchange-traded fund, the iShares Bitcoin Trust ETF (IBIT), received a total investment of $461 million. According to the most recent quarterly holdings report, the financial institution has increased the amount of Bitcoin exchange-traded funds (ETFs) in its portfolio by 71%, bringing the total amount to $300 million.

They revealed its initial $418 million purchase of a Bitcoin exchange-traded fund (ETF) in August as part of its entry into the spot market.

In addition to its investment of $461 million in BlackRock’s Infrastructure Bitcoin Investment Trust (IBIT), Goldman Sachs currently has $96 million in Fidelity’s Wise Origin Bitcoin Fund, $72 million in the Grayscale Bitcoin Trust Exchange Traded Fund (ETF), and around $60 million in the Invesco Galaxy Bitcoin ETF.

In addition, it has approximately $800,000 invested in the WisdomTree Bitcoin Fund, $22.5 million worth of equity in the Bitwise Bitcoin Exchange-Traded Fund (ETF), $3 million in the ARK 21Shares Bitcoin ETF, approximately $4 million in the Grayscale Bitcoin Mini Trust ETF, and some other investments.

Not only did it disclose huge investments in Bitcoin exchange-traded funds (ETFs), but it also disclosed $22 million in investments in Ethereum exchange-traded funds (ETFs). These investments included a $22.6 million investment in the Grayscale Ethereum Mini Trust ETF and a $2.6 million investment in the Fidelity Ethereum Fund.

The cryptocurrency industry knows Goldman Sachs, one of the world’s largest financial firms, for criticizing Bitcoin. The investment firm Goldman Sachs criticized Bitcoin and other cryptocurrencies in the year 2020, stating that they are “not an asset class” and “not a suitable investment” for the company’s customers.

Despite the fact that Goldman Sachs had started its limited BTC derivatives trading desk in May 2021, certain executives within the company, such as Sharmin Mossavar-Rahmani, the chief investment officer for Private Wealth Management, continued to maintain a critical stance on cryptocurrency.

Despite the fact that there has been a significant bull market this year, Mossavar-Rahmani stated in an interview with the Wall Street Journal in April that Goldman Sachs’ clients had not shown a significant amount of interest in exposure to cryptocurrency.

Mossavar-Rahmani made the comparison between the present enthusiasm for cryptocurrencies and the tulip frenzy that occurred in the 1600s. “We do not think it is an investment asset class,” she stated. After that, she continued, “We are not believers in crypto.”