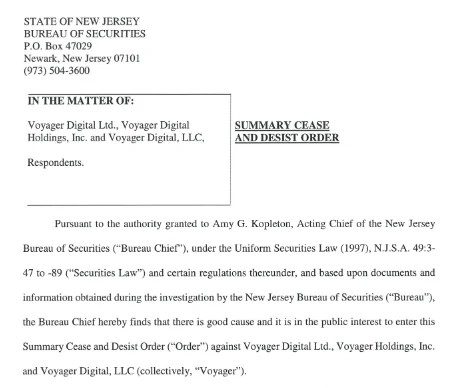

New Jersey Bureau of Securities has issued Voyager Digital a cease and desist order for marketing unregistered securities through its Voyager Earn program in the United States

Voyager Digital (VGX) a crypto-based staking, trading, and lending network that is centralized. The order contends that each of the crypto staking and lending accounts issued through the scheme since 2019 are unregistered securities because of the promise of interest rates as high as 12 percent.

The messages on Voyager’s webpage, which encourage users to “grow your portfolio” and “journey to the new frontier of investing” are cited by the Bureau as proof of the claim.

New Jersey states that its residents have 52,800 accounts and $187 million in assets on Voyager, out of a total of 1.5 million active accounts and $5 billion in assets.

About the order issued

According to the order, this “creates a false impression about Voyager Digital, LLC’s regulatory status.” The program’s marketing tactics were also questioned, with regulators claiming that ads for the program neglected to disclose that Voyager Digital LLC, the program’s parent firm, is a publicly-traded corporation in Canada, not the United States.

While Voyager claimed to be licensed, the Bureau claims that it was only licensed in a few jurisdictions to serve as a “money services firm,” which does not allow for the sale of unregistered securities.

The assertion “may provide the false impression to inexperienced investors that Voyager is “licensed” to offer and sell such products,” according to the company.

At least five other states, including Alabama, Oklahoma, Texas, Kentucky, and Vermont, have issued various orders or requested that Voyager explain how it is not issuing unregistered securities if it wants to stay in operation.

This is the latest in a long line of such cases or orders against crypto firms that provide consumers with interest-bearing accounts.

Other exchanges face similar order

BlockFi, a crypto lending platform, received a similar cease and desist order and a $100 million fine from Washington state in February for marketing unregistered securities in the form of its interest-bearing accounts.

The Securities and Exchange Commission (SEC) threatened to sue Coinbase if it launched its long-awaited Coinbase Lend program in September of last year.

Coinbase CEO Brian Armstrong termed the SEC’s actions “very shady” at the moment, citing the threat’s lack of legal legitimacy.