The two primary firms supporting the Terra blockchain’s development have invested a total of $200 million in AVAX, and Near Protocol is said to be releasing a new stablecoin.

The Avalanche Foundation has announced that Terraform Labs (TFL) and the Luna Foundation Guard (LFG) have purchased a total of $200 million in AVAX tokens from the Avalanche Foundation.

TFL, the firm in charge of the Terra blockchain’s development, exchanged $100 million worth of Terra’s native token, LUNA, for AVAX tokens to “strategically align ecosystem incentives,” according to Terra’s Twitter.

LFG, a non-profit company tasked with accumulating reserves for Terra’s algorithmic stablecoin UST, utilized its UST holdings to purchase an extra $100 million in AVAX from the Avalanche Foundation.

These purchases are intended to strengthen the stability of Terra’s native UST stablecoin, which had a market cap of $16.7 billion at the time of writing.

Do Kwon, the founder of Terraform Labs, told Bloomberg that LFG chose AVAX for its UST reserves because of the blockchain’s ecosystem’s stable growth as well as its users’ unwavering commitment.

“Avalanche is still a growing ecosystem — a lot of it is fueled by loyalty to the AVAX token and users feel a lot of affinity with an asset that aligns itself with AVAX…whereas for the average Ethereum user, aligning yourself with Ether doesn’t mean that much.”

As Terra continues to enhance UST’s position, competitors seek new strategies to dethrone the stablecoin. Near Protocol (NEAR), a Layer-1 blockchain that competes with both Ethereum and Terra is said to be releasing a stablecoin named USN, as well as a decentralized finance protocol capable of offering users a 20% annual percentage yield (APY) on their USN deposits.

This is analogous to the Anchor protocol in the Terra ecosystem, which currently provides customers a 19.49 percent APY on UST deposits.

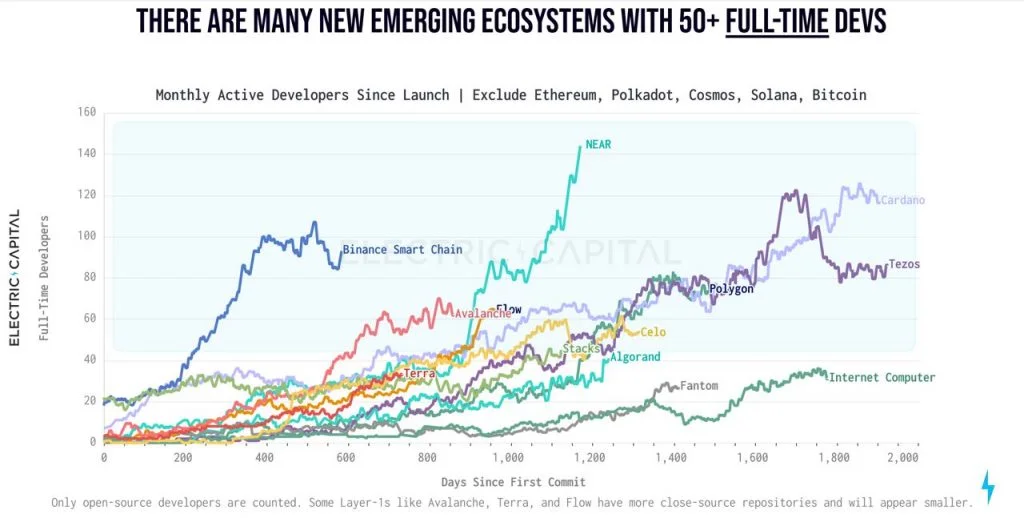

In a Substack post outlining what he knows about the plans, Crypto Insiders Telegram group founder Zoran Kole stated that Near Protocol was superior to both Ethereum and Terra, citing data from Electric Capital that demonstrated Near Protocol’s significant rise in terms of development.

Kole concluded that Near Protocol’s network growth, together with its soon-to-be-released USN stablecoin and following DeFi protocols, might eventually allow Near Protocol, which has a market cap of $11.7 billion, to catch up to and then overtake Terra, which has a market cap of $37.2 billion.

“This will lead to a comparison of Near to Terra ($LUNA) as the narrative for attractive stablecoin yields proliferates.”