Buying NFTs could turn out to be one of the greatest investments you could make this year. However, if it turns out that you have bought fake NFTs, you are going to lose the huge amount of money you spent on getting them. In this guide, we will show you how to detect counterfeit NFTs.

Since its introduction in 2021, Non-fungible Tokens (NFTs) have grown into a multibillion-dollar sector of the crypto economy. Rare pieces from the Crypto punks, The Sandbox, Doodles, Cool Cats, Decentraland, and Bored Ape Yacht Club collections, for example, sell for up to $30,000 or more. This isn’t surprising.

On the one hand, creators are selling NFTs for thousands to millions of dollars due to a simple demand and supply mechanism in this DeFi commodity. The demand for NFTs is at an all-time high, which explains their skyrocketing pricing. Despite this, if a creator is offering an NFT for free or at a ridiculously low price, the bargain is almost certainly too good to be true.

How do you spot fake NFTs? As NFTs continue to take over the art world, this has become the question on the lips of many art enthusiasts as well as investors. Plagiarism and fake NFTs are a growing concern, regardless of how NFTs help make art viable for many traditional and digital artists.

There are several ways to spot fake NFTs, and each of these ways will be explained in this article. So, it is in your best interest to make sure you read this article to the end.

what you need to know about fake NFTs

To begin, the rule of thumb to what you need to know about fake NFTs is this:

- Incredibly cheap prices

- Unauthentic seller ID

Incredibly cheap prices

Deals on NFTs that appear to be too good to be true. This frequently happens when a vendor offers an absurdly low price for a piece of art that is worth far more than the asking amount you’ve been given. Keep in mind that NFT pricing is determined by supply and demand. It’s possible that you’re buying fake NFTs if the prices are incredibly cheaper than that of similar NFTs from the same collection.

Unauthentic seller ID

Regardless of how sophisticated these scammers have become in hiding their identities, it is wise to verify the authenticity of fake NFTs. To do this, you can run a reverse Google image search.

Also, the platform can authenticate collections and artists. If it’s the actual deal, a blue checkmark will display next to its title.

Finally, choosing the correct platform, preferably one with human moderators, is one of the best ways to find out if you’re buying fake NFTs.

Common NFT scams and how to avoid them

Here’s a comprehensive list of 10 common NFT scams and how to avoid them

- NFT rug pulls

- Fake NFT websites

- Phishing scams

- Incredibly good offers

- NFT airdrop scams

- Social media impersonation

- Bidding scams

- Pump-and-dumps

- Investor scams

- Discord hacks

1. NFT rug pulls

An NFT rug pull is a malevolent cryptocurrency developer abandoning a project and fleeing with investor monies. Malicious individuals generate a token and list it on a DEX, then couple it with a major cryptocurrency like Ethereum.

As a result, the price of the NFT plummets to zero, causing investors to lose money on the NFT. A variation occurs when the developers of an NFT disable the ability to sell the token, preventing purchasers from doing so because the developers have included code that disables this ability.

The first thing to look at in such cases is the project’s developers to determine whether they are genuine developers who have received positive reviews on social media. It might be a red flag if they have a high following but limited participation. Burner wallets allow you to set a limit on the amount of money you wish to commit to a certain purchase, including bitcoin for transaction fees, lowering your risk.

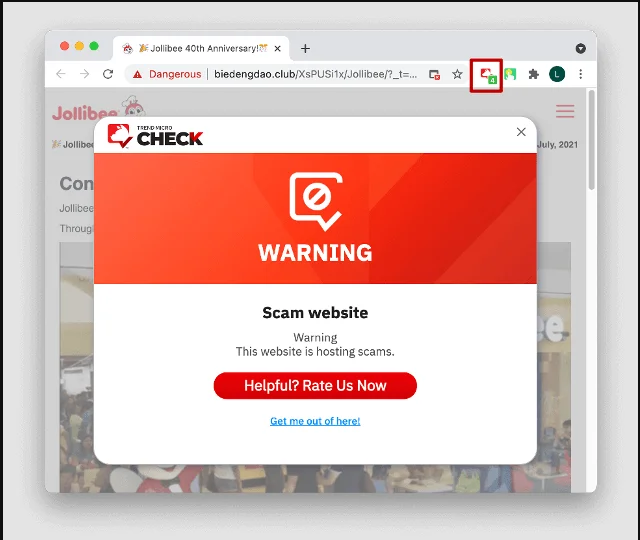

2. Fake NFT websites

Sophisticated NFT fraudsters can imitate prominent NFT websites and markets like OpenSea or Rarible in order to deceive consumers into giving over their account details and consequently purchasing fake NFTs.

These sites might appear to be almost identical to the originals, fooling even the most seasoned NFT buyer into paying enormous sums of money on fake NFTs that are worthless.

Even experienced NFT owners may struggle to discern the difference between a real and a counterfeit page due to the degree of detail they apply. Scams like these may cost a person thousands of dollars in counterfeit digital artwork, rendering it unusable on the NFT market.

So, how can you prevent falling victim to this well-crafted con? Before attempting to log in or make purchases on the NFT marketplace website, double-check the URL.

On OpenSea’s official website, for example, the NFT known as ApeGang #4510 is presently valued at 10 ETH, or around $39,428.10.

Fake NFT websites may display an inaccurate minting address, whilst a genuine one will display the precise location of the coin’s minting.

So be sure to double-check the contract addresses on the official site of the NFT developers you’re interested in.

3. Phishing scams

The NFT phishing scam asks customers for their private wallet keys or 12-word security seed phrases via fraudulent adverts on false websites and pop-ups. Scammers will hack into your wallet once they have your wallet’s keys and deplete all of your crypto and NFT holdings.

How can this be avoided? As a general rule, you’ll only need your seed phrase to create a physical backup of your cryptocurrency wallet or to restore it. For any crypto transactions, always go to the verified website directly rather than utilizing links, pop-ups, or your email to provide your information. Write down your seed phrase on paper and keep it private. Don’t even save a snapshot of it in your phone.

On pop-ups or questionable websites, never give up your wallet’s keys. For crypto transactions, only utilize trusted websites; never use links, pop-ups, or your email to enter your wallet’s key information.

4. Incredibly good offers

Offers on NFT that seem too good to be true. This commonly occurs when a dealer offers a ridiculously cheap price for a piece of art that is worth considerably more than the asking price. Remember that the price of NFTs is controlled by supply and demand.

If an NFT is substantially cheaper or more expensive than similar NFTs from the same collection or category, it is wise not thread carefully so that you don’t become a victim of fake NFTs.

5. NFT airdrop scams

Scammers frequently use social media to promote fake NFT giveaway programs, commonly known as airdrop scams, by impersonating real NFT trading platforms. If you share their message and join up on their website, the fraudsters will give you a free NFT.

After getting access to your account, they encourage you to link your Metamask wallet credentials in order to claim your prize. During this time, they record everything you enter and begin stealing your library of NFTs.

To avoid this type of scam, check the account’s social media page for verification and/or make sure the link supplied to you matches the NFT company’s URL to prevent this NFT fraud.

6. Social media impersonation

Another NFT fraud that is intended to deceive NFT owners is social media impersonation. Cybercriminals establish an online profile to convince others of their legitimacy and sell them fraudulent NFT artworks, using the same amount of care as they would for a false NFT homepage.

Scammers can persuade users of their validity by using these fake accounts and then offer them fraudulent NFT artworks. It’s just another opportunity for them to benefit from selling bogus artworks.

These bogus social media profiles can also offer bogus giveaways, putting unsuspecting consumers in danger. We’ll talk about it a bit later.

To avoid being fooled by fraudulent accounts, look for a verification tick next to the username. This tick isn’t present on all authorized NFT social media profiles, thus its absence isn’t necessarily a dead giveaway.

Use the blue verification tick next to the seller’s profile to verify their identification and prevent this NFT scam.

You could also run a fast Google search for the NFT creator’s social media profiles to see if there are any other accounts with a similar name and a lot more followers, since this may be the genuine page. You may also look at the NFT creator’s other accounts to see if they have any other social media profiles linked to them.

You may come across fraudulent NFT artist accounts in addition to bogus NFT corporation accounts. Scammers will pose as well-known NFT artists and attempt to sell consumers fake replicas of well-known NFT artworks at much cheaper costs.

7. Bidding scams

When investors wish to resell their bought NFTs on the secondary market, they fall victim to bidding frauds.

Bidders may exchange your preferred currency with low-valued cryptocurrencies without alerting you after they offer their NFT for sale in an NFT market, resulting in possible losses for you. As a result, instead of 10 ETH (about $25,000), you may receive $15 USD.

To prevent falling victim to this NFT scam, double-check the currency utilized during the transaction and never accept bids that are lower than you expected.

8. Pump-and-dumps

Pump-and-dumps is a deceptive method in which fake recommendations are used to artificially inflate the price of a stock or instrument.

These suggestions are based on assertions that are untrue, misleading, or substantially overstated. The perpetrators of a pump-and-dump plan already have a holding in the company’s shares, which they will sell after the hype has caused the stock price to rise.

Experienced NFT fraudsters utilize “pump and dump” strategies to artificially inflate the price of an NFT, which is inspired by a type of securities fraud. They achieve this by placing many bids in a short period of time to give the impression that the NFT is popular. They’ll cash out and sell to the highest bidder once it gathers traction and the selling price reaches a level they’re comfortable with.

Review the transaction history of the intended NFT to avoid this NFT fraud. A pump and dump plan might be indicated by a series of transactions focused on a single period.

9. Investor scams

Since people may stay anonymous when interacting with cryptocurrencies, investor scams are widespread with NFTs.

Scammers sometimes take advantage of this by creating schemes that look to be worthwhile investments, then disappearing with the funds they acquired from interested parties.

How to Avoid Investing Scams: Make sure you can verify the project’s originator and have their contact details. Investigate to determine if there have been any previous complaints about transactions with others.

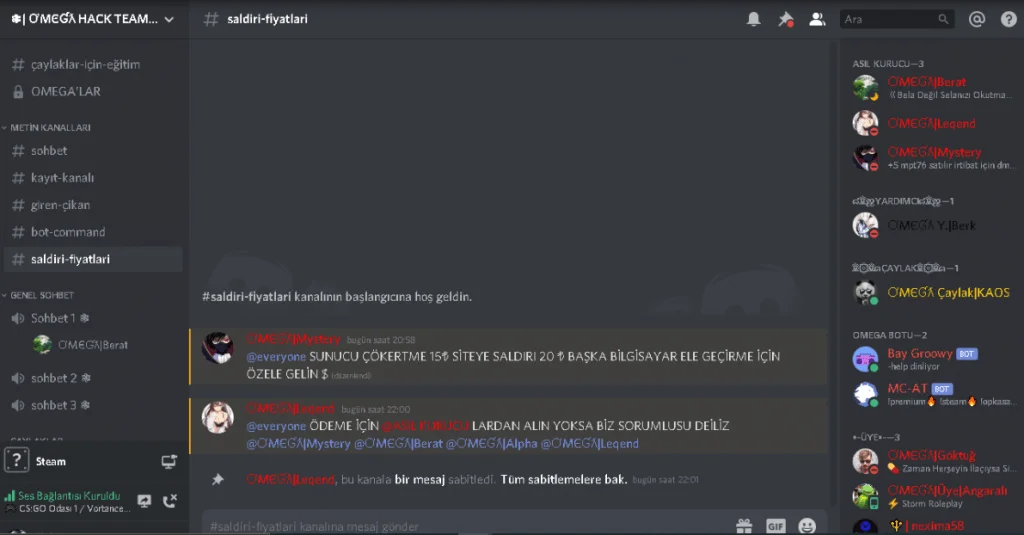

10. Discord hacks

One of the most popular NFT frauds is Discord hacking. When hackers get administrator access to a Discord server, they post a bogus minting link in the announcements channel.

The messages will generally appear to be from a project organizer and will offer a bargain that is too good to be true, such as “Due to demand, we’re releasing 1,000 extra NFTs, as a result of their ability to create demand, hackers frequently seek for sold-out collections.

How to protect yourself against Discord hacks: If you leave Discord by following a link that brings you somewhere else, the other site may be able to access your personal information. Before clicking on any strange links.

We also recommend running them via a site checker like Sucuri or VirusTotal. You might also want to run any shortened URLs through a URL expander to make sure you know where you’re going.

Conclusion

While NFTs have become one of the most popular inventions of the 21st century with wide acceptance, it is important for collectors as well as individuals planning to start collecting them to beware of scams, fake NFTs are beginning to populate the market. To be on the safe side, do your own research before jumping on any NFT.