One of the primary reasons investors around the world seek to diversify traditional assets into cryptocurrency is to combat the prevailing fiat inflation.

According to a new study, there has been a staggering increase in crypto adoption across Nigeria, which has been fueled by Africa’s limited access to affordable fiat-based financial services.

According to KuCoin’s “Into the Cryptoverse Report,” many Nigerian citizens have begun to use cryptocurrencies as a viable alternative to store and transfer assets.

According to the report, 33.4 million Nigerians, or 35% of the population aged 18 to 60, have owned or traded cryptocurrencies in the last six months. Nearly 17.36 million (or 52% of Nigerian crypto investors) have allocated more than half of their assets to cryptocurrencies.

One of the primary reasons that investors around the world seek to diversify traditional assets into cryptocurrencies is to combat rising fiat inflation. For example, a survey of UK investors was conducted last month, and the majority believed that tokens were safer and more secure than traditional investments such as gold, oil, stocks, and real estate.

According to the KuCoin report, peer-to-peer trading is the most popular method for Nigerian investors to convert fiat into crypto assets. Increasing their cryptocurrency investments over the next six months, roughly 23.38 million Nigerians, or 70% of existing crypto investors, will double down on the crypto adoption spree.

The value of the naira, the country’s fiat currency, has fallen by more than 209 percent in the last six years, which is one of the main reasons why local investors are interested in deflationary assets like Bitcoin (BTC).

According to the report, while the majority of Nigerian crypto investors began their journey many years ago, 26 percent began investing in cryptocurrencies just six months ago — owing to the 2021 bull run, which saw BTC prices briefly cross the $69,000 mark.

Nigerian President Muhammadu Buhari introduced the eNaira, the country’s central bank’s digital currency, in October 2021. Many governments around the world intend to use CBDCs as a digitized fiat replacement, primarily to reduce operational costs and accelerate cross-border payments.

In PwC’s recently released “2022 Global CBDC Index,” the pair received a score of 95 out of 100 in both the retail and wholesale categories.

Earlier this month, a study released by cryptocurrency exchange Gemini confirmed a massive increase in global cryptocurrency investors in 2021.

India, Brazil, and Hong Kong had the highest levels of crypto adoption, with more than half of the respondents admitting to investing in cryptocurrencies.

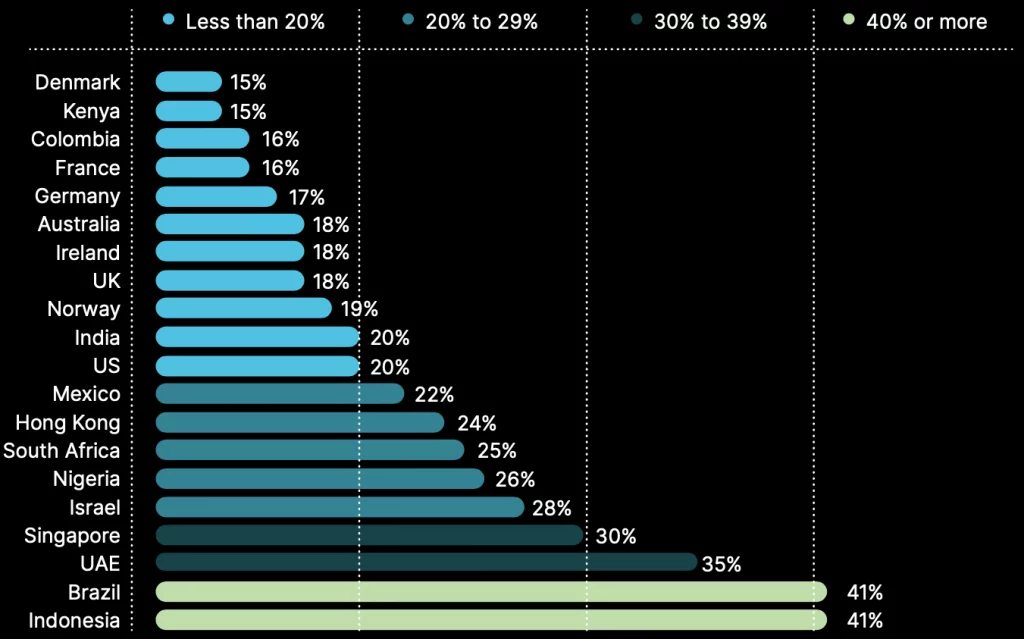

According to Gemini’s report, Indonesia and Brazil have the highest proportion of cryptocurrency investors among the general population.