This week, Bitcoin (BTC) recovered from a one-month low, reclaiming a key support level as investor sentiment strengthened. However, the token’s forward trades displayed little bullish sentiment, implying that it may be headed for further losses.

BTC has risen about 7% since its April lows, and was last trading around $41,000. Big traders amassing more BTC at lower prices accounted for the majority of the token’s gains.

Large liquidations in the futures market, particularly in long positions, were driven by the token’s wild swings. However, the mass liquidations highlighted another aspect of BTC positioning-a large number of traders looked to be avoiding the world’s largest cryptocurrency.

BTC funding rates are dwindling

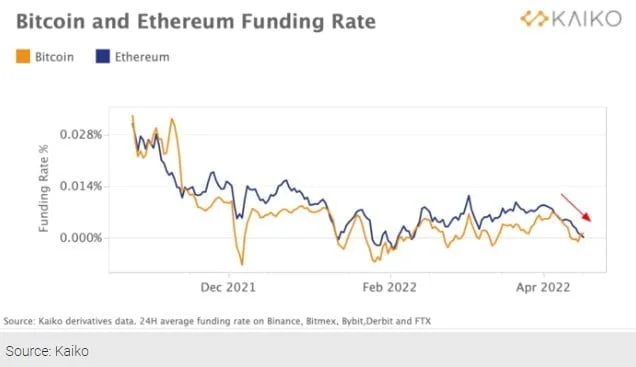

Perpetual futures markets showed little bullish demand for BTC positioning, according to data from blockchain analytics firm Kaiko. The analytics firm observed in a tweet that funding rates for both Bitcoin (BTC) and Ethereum (ETH) had been declining since late-2021.

The firm took an average of funding rates from five derivatives- Binance, Bitmex, Bybit, Derbit, and FTX. The funding rates for both BTC and ETH fell to a two-month low.

Coinglass data also shows that most token funding rates are largely negative. A negative funding rate indicates that traders broadly expect the crypto market to decline.

CME Group futures also predict a drop in the token over the next few months

Is Bitcoin in for more losses?

BTC’s latest recovery, according to technical indicators, may only be temporary. The token is likely to fall further after a brief bounce.

A recent study showed BTC is potentially forming an impulsive wave pattern and could rise as high as $45,000 shortly. However, the token is projected to fall much below $40,000 towards the end of the pattern. A drop in BTC is expected to ripple across the crypto market.

Concerns over increasing inflation and a hawkish Federal Reserve dragged the world’s largest cryptocurrency down from 2022 highs earlier this month.