Bitcoin (BTC) has plummeted from its 2022 highs and is currently stuck in a trading pattern seen for most of the year. But Long-term traders with large holdings are taking advantage of the token’s lower valuation by buying dips.

BTC is trading at about $40,000, down, and has dropped over 11% in the last seven days. The world’s largest cryptocurrency has been battered by inflation jitters, fears over a possible economic recession, and a hawkish Federal Reserve.

However, its latest round of losses has attracted a torrent of dip buyers, who are buying into the currency at lower levels. This could set the stage for another huge rally in BTC.

BTC sees a continued stream of whale trading

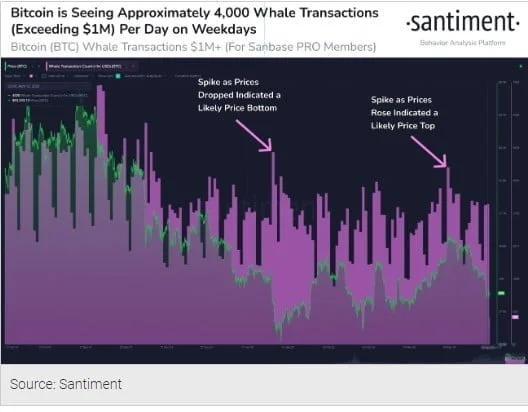

Data from blockchain analytics firm Santiment revealed that BTC was witnessing a steady number of roughly 4000 whale transactions above $1 million on weekdays, even as the price receded. It showed that even as the token’s price dropped, large players in the BTC market were still active.

Historically, a surge in whale transactions has predicted two key events- a price top and a price bottom. In this case, increased whale activity could signal that BTC has hit a bottom around $40,000 and that the token is primed for further increases. The token has also held around the $40,000 mark over the last two days indicating that a rebound is possible.

Large increases are what we are looking out for to foreshadow a price bounce after April’s retrace

–Santiment

Whales in accumulation trend

BTC isn’t the only token attracting more whale interest due to a price drop. Popular memecoin Shiba Inu (SHIB) saw a massive amount of whale purchasing in recent sessions which aided the token’s strong recovery.

Proof-of-stake mechanism token Cardano (ADA) also saw whale accumulation hit a two-year high, as the token logged severe losses.

Short-term holders were also suspected to be behind BTC’s recent price drop, according to recent data. Whales, who usually tend to be long-term holders of the token, were either seen holding it or buying more of it.