FOMC may further catalyze BTC/USD price action

Major cryptocurrencies have still outperformed the traditional assets of Bitcoin as an acceptable payment method by mainstream players. Bitcoin is being increased. But Bitcoin Bulls are under pressure after six consecutive months as the BTC/USD battles to trade back above the psychological level at which bulls continue to stand at $60,000.

Although the inherent value of BTC/USD remains a controversial topic, speculation and crowd psychology remain the primary catalysts for Bitcoin price action as a retest of last month’s cannot be ruled out. However, given the fact that Bitcoin prices surged approximately 1121 percent between the March 2020 low and the March 2021 record high of $61,759, the ability for bulls to maintain the upward trajectory remains questionable.

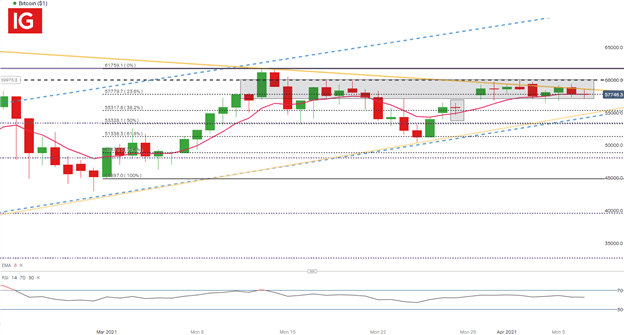

BITCOIN (BTC/USD) TECHNICAL ANALYSIS

Recently Bitcoin traded within a defined range, with price action consolidating between $53,395 and a psychological obstacle of $60,000 (Fibonacci’s 14.4% retracement level in 2020–2021).

Bitcoin(BTC/USD) Daily Chart

The imminent move is to keep Bitcoin within a close span, with recent price action bounced from a previous $57,779 support (a 23. 6 percent retracement on the March 2021 move) to $60,00. The symetrical triangle is formed on a daily timeframe.

It looks as though US Treasury Yields stabilization has impeded BTC/USD progress, allowing bugs to lower prices and to reach a next key level of $55,000. The FOMC meeting minutes can help to catalyze the short-term move with prices that are just over the 8-period EMA.