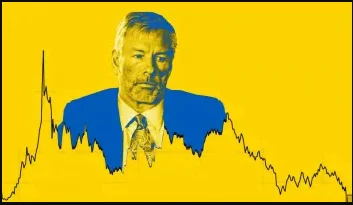

Michael Saylor, a crypto evangelist, is stepping down as CEO to a deputy and this might positively affect the price of Bitcoin.

One of the most well-known proponents of bitcoin, Michael Saylor, will hand up leadership of the company to a deputy.

Michael Saylor resigns as MicroStrategy’s CEO

Michael Saylor, who has been the chief executive officer of MicroStrategy since 1989, has announced his retirement, which will take effect on August 8.

This is unquestionably one of the most unexpected resignations in the crypto industry to date.

“I will remain an executive officer of the company and chairman of the Board of Directors, as well as assuming the chair of investments committee and leading our bitcoin acquisition strategy. My focus is bitcoin advocacy and education, like with the Bitcoin Mining Council, and being spokesperson and envoy to the global bitcoin community.”

The enthusiastic proponent of bitcoin said that it took the board leadership at least seven years to decide to restructure MicroStrategy’s management team.

Phong Le, president of MicroStrategy, will succeed Saylor as CEO. In contrast, Saylor will assume a new position as executive chair of MicroStrategy, the publicly listed business that now has the largest BTC treasury in the world.

Saylor said during a Tuesday earnings conference call that dividing duties would enable him to concentrate more on the company’s bitcoin stockpile.

Will this have any impact on bitcoin?

Phong Le joined MicroStrategy in August 2015 and was immediately given the title of chief financial officer. Le has been the business intelligence firm’s president since July 2020. He will continue to oversee daily business operations as the company’s president and CEO.

Le expressed his opinion that he had no big changes planned as “this is a business-as-usual transition” when questioned about the adjustments he hoped to make as the new CEO.

While the news of Saylor’s resignation may have come as a shock to some bitcoin evangelists, the fact that one of the most outspoken bitcoin investors and evangelists is shifting his focus to the cryptocurrency market should be seen as a major win for bitcoin since he will be able to more carefully manage MicroStrategy’s portfolio and possibly make more BTC purchases in the future.

In the latter half of 2020, MicroStrategy became the first Nasdaq-listed firm to include bitcoin on its balance sheet, opening the door for other American tech titans like Tesla and Square to do the same.

MicroStrategy has stayed strong despite the 2022 crypto collapse, which saw the leading cryptocurrency lose over 50% of its value since the year’s beginning, even as Elon Musk’s Tesla liquidated a significant portion of its BTC stockpile.

As of June 29, MicroStrategy had 129,699 BTC, or $2.98 billion. Since MicroStrategy paid around $4 billion for the coins, it has suffered a significant loss on its investment.