Huobi Global has launched a new investment arm focused on decentralized finance (DeFi) and Web3 initiatives, demonstrating the growing interest in the blockchain economy among venture capitalists.

According to a Huobi spokeswoman, the new investment arm, dubbed Ivy Blocks, has over $1 billion in crypto assets under control to deploy. The funds will be used to “discover and invest in innovative blockchain startups,” according to the company.

Ivy Blocks will provide a variety of services to selected companies, including an asset management platform, a new blockchain incubator, and a dedicated research arm, in addition to funding.

According to Lily Zhang, Huobi Global’s chief financial officer, the firm’s asset management department will make “liquidity investments” to enable DeFi and Web3 initiatives to get up and running.

Capricorn Finance, an automated market maker built on the Cube blockchain, was the first project to secure funding, according to Ivy Blocks. The company’s interest in DeFi comes at a time when the sector’s overall worth has dropped by more than half from its peak.

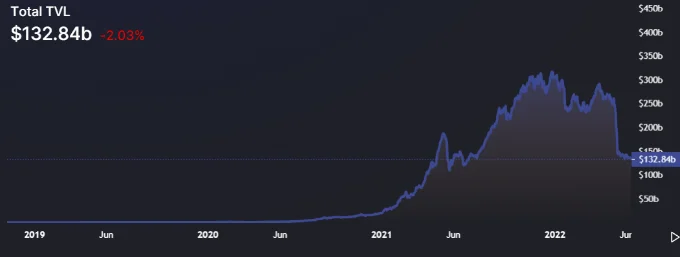

According to industry estimates, the DeFi business is currently worth just about $133 billion in total value locked, or TVL. In December 2021, DeFi TVL reached a high of $316 billion.

DeFi’s problems are a sign of the market’s so-called crypto winter, which has been sweeping the industry since the beginning of 2022.

Market-cleansing down cycles, according to analysts, are beneficial since they frequently follow “irrational” periods in which asset values are aggressively bid up.

Despite the downturn, venture capitalists continue to pour money into the crypto space, with Web3 and metaverse play receiving the most attention.

According to Cointelegraph Research, $14.6 billion was invested in blockchain and crypto projects in the first quarter alone. To put it in context, total venture capital investment in 2021 is expected to be around $30.5 billion.