Microstrategy CEO Michael Saylor faces the wrath of investors on Twitter over his investment advice as the crypto market bleeds

Michael Saylor Faces Prison Threat

Michael Saylor, the company’s CEO, is receiving a lot of flak on Twitter. He’s allegedly accused of deceiving people by persuading them to sell their property, including their homes, in order to obtain Bitcoin.

Bitcoin has now crashed, and many are now in the red. There’s even a video of him saying it, and the poster, Live Monitor, wants Saylor imprisoned as a result of it.

The crypto market, on the other hand, is recognized for being a volatile environment, and investors are usually urged to conduct their own research before investing in cryptos.

Aside from conducting personal research before investing, BTC is dubbed to be suitable for long-term rather than short-term investments.

Despite this Twitter erupted over MicroStrategy CEO Michael Saylor as the company lost Bitcoin worth $713 million during the “Red Monday” as reported by Coinscreed.

Microstrategy Lost 18% of BTC on Red Monday

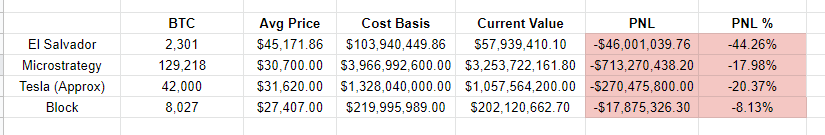

Microstrategy’s Bitcoin (BTC) holding has lost more than $713 million, or 18%, as the BTC price fell in the last 24 hours. The company, led by Michael Saylor, hasn’t sold any of its Bitcoin yet, but it faces a margin call if the price of Bitcoin falls below $21,000.

MicroStrategy’s CFO Phone Le previously stated that if a margin call was issued, the company would have to either put up more collateral for the loan or sell some of its bitcoin holdings.

The company has 129,218 BTCs worth nearly $3.97 billion at an average price of $30,700. However, the value dropped to $3.25 billion after the price of Bitcoin (BTC) fell below $25k on Monday.

Wrath of Investors Over Saylor’s Investment Advice

The crypto market’s descent into the red zone is causing misery for investors, particularly those looking for short-term returns. As a result of this, Michael Saylor faced the wrath of investors on Twitter.

@Mayhem4Markets said: “Where are all the laser-eyed crypto pumpers who promised $100k Bitcoin and protection against inflation with these Ponzi coins?”

@KryptoCarm said: “They should stop gambling tax money and start investing in something productive. Hodl for life and become rich is the dumbest thing for a speculative asset. They will get rekt along with @saylor”

@MomAngtrades says: “Getting ready for a rug pull? Laser eyes will fool them for sure.”

It’s all about keeping afloat for long-term investment firms like MicroStrategy and surfing the wave until the storm passes. Staying afloat, on the other hand, necessitates coping with current market shifts that imperil investments.

Michael Saylor Still Stands Firm Despite Crypto Crash

MicroStrategy is a long-term investment firm, and the company’s CEO in tough times updated his profile photo and shared a tweet showing he stands strong.

The company has made a significant investment in Bitcoin. Over 129,000 bitcoins are believed to be held by the company. Especially in 2020, the corporation was one of the largest accumulators.

At the moment, the average buying price for Bitcoin is below $25,000 per coin. As a result, the recent price drop isn’t beneficial for the company.

BTC Below $21k Is Bad For MicroStrategy

As cryptocurrency prices plummeted in May, the corporation took out a $205 million loan with $820 million in BTC as security.

That figure has been halved as a result of the price drop. Phong Le, the company’s president, said in May that BTC’s price would have to fall by half before the company faced a margin call.

As a final point, he mentioned the $21k pricing. To avoid a margin call, he stated that the corporation would amass more BTC and put up more collateral.

Things have changed now, and BTC has dropped by half. At the time of publication, the coin was trading at roughly $22,700, barely $1,700 below Le’s reported price.