By the end of June 2022, Tether plans to lower USDT’s commercial paper backing to $8.4 billion, and then remove it entirely.

Tether, a popular stablecoin firm, hopes to someday eliminate commercial paper backing for its US dollar-based stablecoin Tether (USDT).

Tether issued an official statement on Wednesday denying claims that its commercial paper portfolio is 85% backed by Chinese or Asian commercial papers and is trading at a 30% discount.

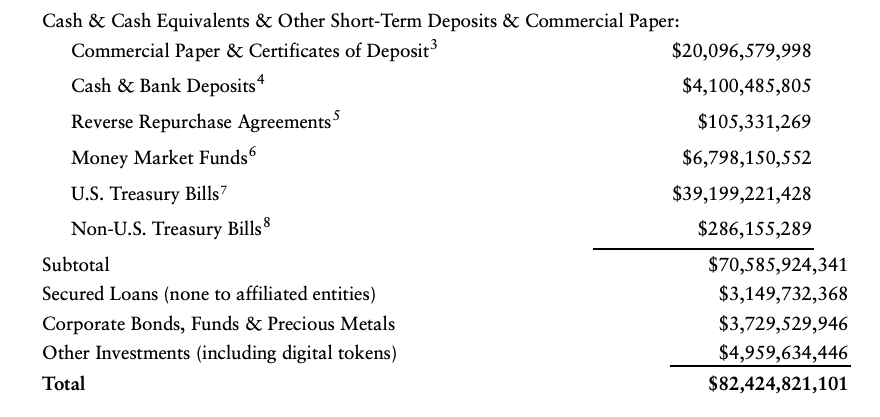

The stablecoin company declared such charges “absolutely incorrect,” stating that “United States Treasuries” currently account for more than 47 percent of total USDT reserves. Tether claimed in its most recent assurance opinion, issued in May, that commercial paper accounts for less than 25% of USDT’s backing, totaling roughly $21 billion as of March 31.

The stabelcoin’s current portfolio of commercial paper has been reduced to $11 billion, according to the most recent announcement. The firm plans to lower it further to $8.4 billion by the end of June 2022, eventually seeking to clear off its commercial paper backing, according to the statement:

“This will gradually decrease to zero without any incurrences of losses. All commercial papers are expiring and will be rolled into U.S. Treasuries with a short maturity.”

Tether also highlighted the current Celsius lending platform incident, adding that the Celsius stake had been liquidated without no losses to the stable coin. “Aside from a tiny investment made using Tether equity in the company, Tether has currently minimal exposure to Celsius,” the firm stated.

The stablecoin claims that it had loan exposure to the cryptocurrency venture capital firm Three Arrows Capital are “categorically untrue.”