Due to a traditional bearish reversal pattern, the SOL price faces a major market decline in the next weeks.

While facing worries about recurrent network disruptions and centralization, Solana is following larger crypto market developments.

Future SOL price adjustment of 35%?

SOL price has been depicting a rising wedge on the three-day chart, which is supported by two ascending, convergent trendlines and concurrently declining trade volumes.

When an asset’s price breaks below the lower trendline, rising wedges usually collapse and resolve. If the price moves in the breakdown direction, it might drop as far as the upper and lower trendlines of the wedge.

As shown in the chart below, SOL is far from being in a breakdown range and instead trades inside a falling wedge range. The intermediate downside objective for the token is the lower trendline, which is roughly $45. The token anticipates a swift drop from the wedge’s top trendline.

If the price drops below the lower trendline as trading volume increases, it runs the danger of dropping near $30. So, a 35% price decrease by September.

On the other hand, SOL may aim for quick recovery into the wedge’s apex point at around $53.50 if it bounces off the lower trendline.

If SOL climbs to the 50-3D exponential moving average (50-3D EMA; the red wave) at $58 it would invalidate the bearish reversal scenario with a clear breakthrough above the top trendline.

Overcoming FUD

As it struggles with a flurry of unfavorable incidents, like persistent network failures, centralization issues, and a massive exploit that targeted Solana wallets, Solana’s increasing wedge collapse setup becomes apparent.

Nevertheless, the SOL price increased by about 40% in August, following the trend of other crypto assets, which have generally increased by roughly 11% month to date.

A portion of Solana’s winnings also came when its staff swiftly stated that Slope, a supplier of Web3 wallets, was entirely in charge of the $8 million crypto wallet attack that affected all of them, including Solana’s.

In a similar vein, Solana responded to claims that its network is highly centralized by releasing its first “Validator Health Report” on August 10. It is said that there are more than 1,900 block-producing nodes operating globally on Solana’s proof-of-history (PoH) blockchain.

The research also said that about 88% of such nodes are run by independent organizations.

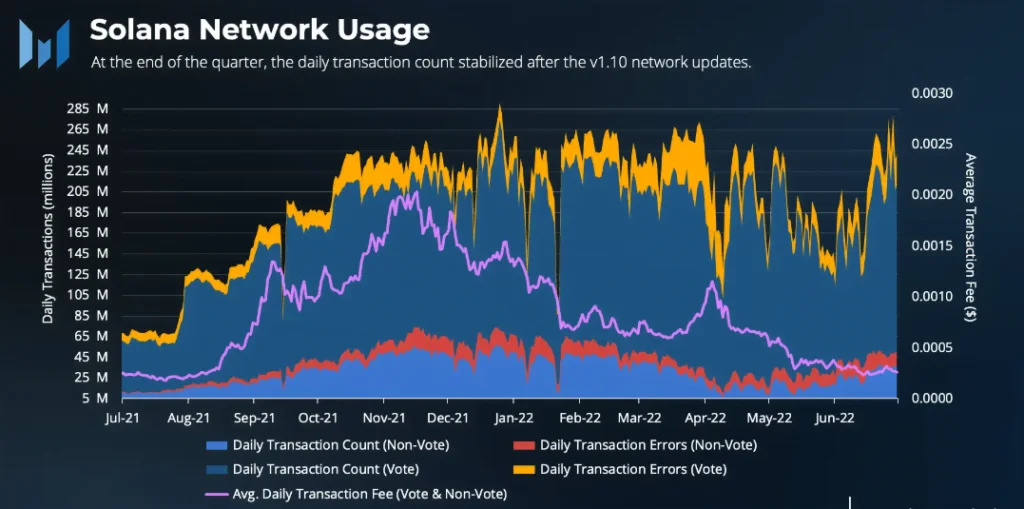

Additionally, Solana developers concentrated on putting the first phases of their Mainnet Beta v1.10 series into practice in May. To protect the network against possible outages, they introduced QUIC and Quality of Service (QoS) packets by stake weight and charge priority.

The transactions per second (TPS) of Solana increased as well, rising from a low of 700 during network failures to record highs of 3,000 following the rollout of v1.10. Trautman continued:

“If implementations of v1.10 and subsequent versions continue to drive stability along with successful ecosystem growth strategies, fundamentals will likely move in a positive direction, and network value may too.”