Arkham Intelligence, a blockchain research platform, has successfully identified the on-chain addresses of several spot BTC exchange-traded funds (ETFs) backed by Bitcoin in the United States.

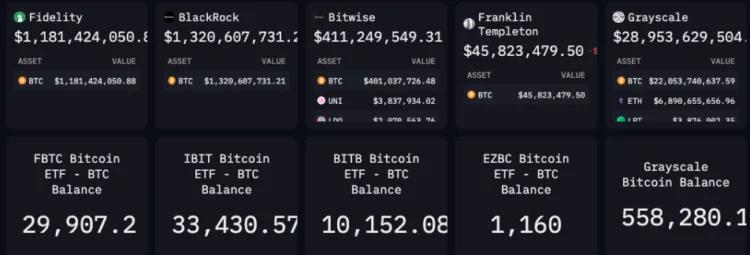

Including Bitcoin ETFs issued by BlackRock, Bitwise, Fidelity, and Franklin Templeton, Arkham announced on X on January 22 that it had located the on-chain locations of four such funds.

By utilizing the data provided by Arkham, it is possible to examine the transaction hashes executed by the four spot Bitcoin ETFs directly on the Bitcoin blockchain.

According to the data, a BlackRock iShares Bitcoin Trust (IBIT) currently holds 33,430 BTC, or approximately $1.3 billion. The details align with publicly available information regarding IBIT holdings on the BlackRock website.

The most recent disclosures occurred several months after Arkham asserted in September 2023 that he could ascertain the Grayscale Bitcoin Trust (GBTC) addresses. On January 10, 2024, U.S. securities regulators granted historical approval for the GBTC’s conversion to a spot Bitcoin ETF. When writing, GBTC, the most prominent spot Bitcoin ETF among the approved funds, held 558,280 BTC, or nearly $29 billion.

When verified, Arkham has yet to ascertain the addresses of five additional spot Bitcoin ETFs presently operational in the United States. These include WisdomTree, VanEck, Valkyrie, ARK Invest, and 21Shares managed funds.

Numerous cryptocurrency fans have demanded that spot Bitcoin ETF issuers disclose the Bitcoin addresses that support their funds, as this would guarantee the security of the underlying BTC. Some industry observers have even speculated that spot Bitcoin ETF issuers may be required to reveal those addresses to increase competition.

Conversely, certain executives have issued warnings regarding the security vulnerabilities that may arise from disclosing on-chain addresses for spot Bitcoin ETFs. Grayscale declined to divulge information regarding on-chain wallets in November 2022, citing “security concerns.”

Ophelia Snyder, co-founder of 21Shares and 21.co, opined that disclosing storage addresses for spot Bitcoin ETFs might result in “unintended consequences.”

“Be extremely cautious about how you accomplish that,” Snyder stated in an early January interview with Cointelegraph. “By exposing wallet addresses, for instance, you are introducing several issues about the trading infrastructure that have unintended repercussions,” she explained.