After ending the hosting deal for bitcoin mining rigs, Stronghold Digital won’t have to pay Northern Data up to $25 million in profit shares.

In its latest attempt to fix its troubled balance sheet, Stronghold Digital Mining (SDIG) ended a hosting deal with miner Northern Data (NB2X: GER), which cost the miner money, and paid off some of its debts.

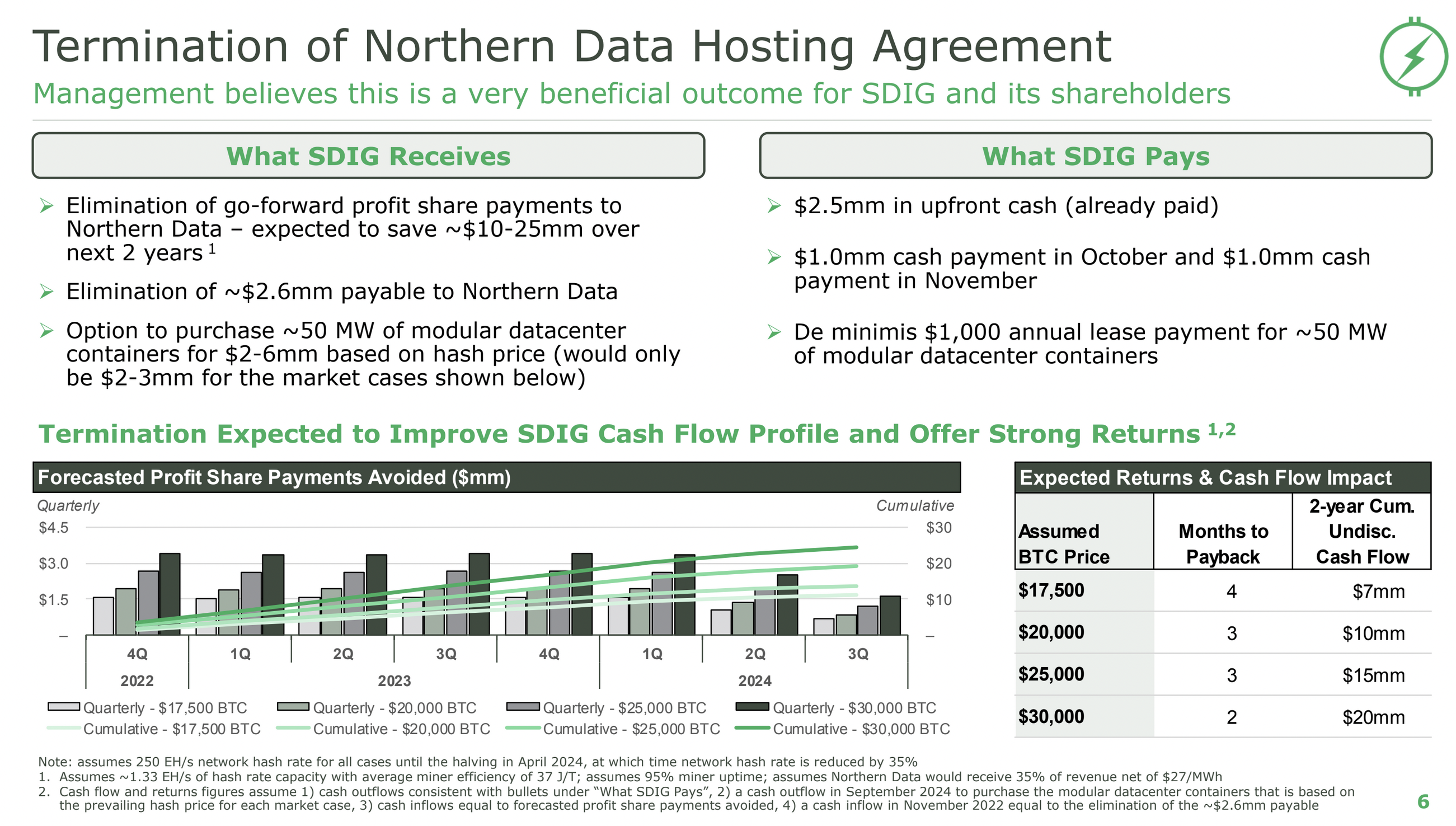

According to a statement released on Friday, the end of Stronghold’s deal with Northern Data will end all profit-sharing obligations, which the company estimates would have been between $10 million and $25 million (depending on the price of bitcoin) until September 2024.

According to the statement, the cash outflow under the old deal would be about 35% of the miner income, with fewer power costs of $0.027 per kilowatt-hour (kWh). On top of that, Stronghold no longer has to pay Northern Data about $2.6 million.

Hosting is a service that data centers offer to crypto miners so that customers like Stronghold can store their mining rigs and mine their favorite digital assets for a fee or a share of the profits without having to build the infrastructure themselves.

Norther Data both mines bitcoin for itself and runs a data center that other miners can use.

Stronghold’s problems started earlier this year when it didn’t meet Wall Street’s earnings expectations and cut its own hashrate expectations for 2022. Since then, the company has had more and more problems as the crypto and stock markets keep going down.

But the miner has been working hard to improve its balance sheet and turn the company around by reorganizing its debt, cutting costs, and getting more money. In a presentation on Friday, the miner said that since May, the principal amount of its debt had gone down by nearly 60% to $59.1 million.

Stronghold’s co-chairman and CEO, Greg Beard, said in a statement that getting out of the deal gives the company “better operational control of our bitcoin operations” and a “substantial boost” to cash flow for the next two years, as well as flexibility. “Overall, we think we’re making a lot of progress toward improving our balance sheet, liquidity, and cost structure so that we can bring value to our shareholders,” he said.

Under the terms, Stronghold will also get the right to run about 50 megawatts (MW) of Northern Data’s bitcoin mining containers for $1,000 per year for two years. Stronghold will also have the option to buy the containers at the end of the two-year period for between $2 million and $6 million.

Stronghold has to pay Northern Data $2 million to get out of the deal. This is on top of the $2.5 million it has already given to its hosting partner. The miner has already given Northern Data 2,675 mining machines back, so Stronghold no longer has to pay the data center operator about $8.8 million.

Stronghold has also been able to get rid of $65 million in loan obligations. This was part of a deal with lender NYDIG in which Stronghold gave NYDIG 26,000 mining rigs in exchange for debt relief.

The presentation said that another $2 million would be written off as soon as the Bitmain mining rigs are let out of customs. At this year’s sharply falling market prices, the miner thinks they could buy these machines for less than $40 million.

Stronghold and other bitcoin miners have been having a hard time because the price of bitcoin is low, and the cost of energy is high. Since bitcoin’s value has dropped by more than 50% this year, the mining industry has been trying to cut costs and stay afloat.

The miner’s stock has lost about 93% of its value this year, while the stocks of larger bitcoin miners like Marathon Digital (MARA), Riot Blockchain (RIOT), and Core Scientific (CORZ) have all dropped by more than 70%.

Northern Data has also had a hard year. In a letter to shareholders on September 19, the company said it would stop hosting clients because self-mining has been more profitable and predictable for the company. The company also cut the number of mining rigs it thought would be in use by more than half by the end of the year to no more than 42,000 and announced a “tighter investment strategy.”