Five of the six days after the Federal Reserve announced new interest rates, the price of BTC went in the opposite direction.

This year, the price of bitcoin has changed direction five out of six times after the U.S. central bank made a decision about interest rates.

On three occasions, the price of BTC fell after rising sharply on the day that the Fed raised interest rates, and on two other occasions, it rose after falling on the day that the Fed also raised interest rates. One time, the price of BTC went up on the day that the Fed raised interest rates and kept going up the next day.

Analysts say that the quick changes show that investors want to take profits quickly or get out of riskier assets when the economy as a whole is unstable. These investors have been trying to guess where the crypto markets will go after Fed decisions, which can have a big effect on the economy.

Bob Iacchino, the co-founder of Path Trading Partners and chief market strategist, said, “Most of the time, the first move is not the move that lasts, because that’s when people are adjusting their positions.” “In other words, people take positions based on what they think the outcome will be, and they leave those positions when the outcome is exactly what they thought it would be.”

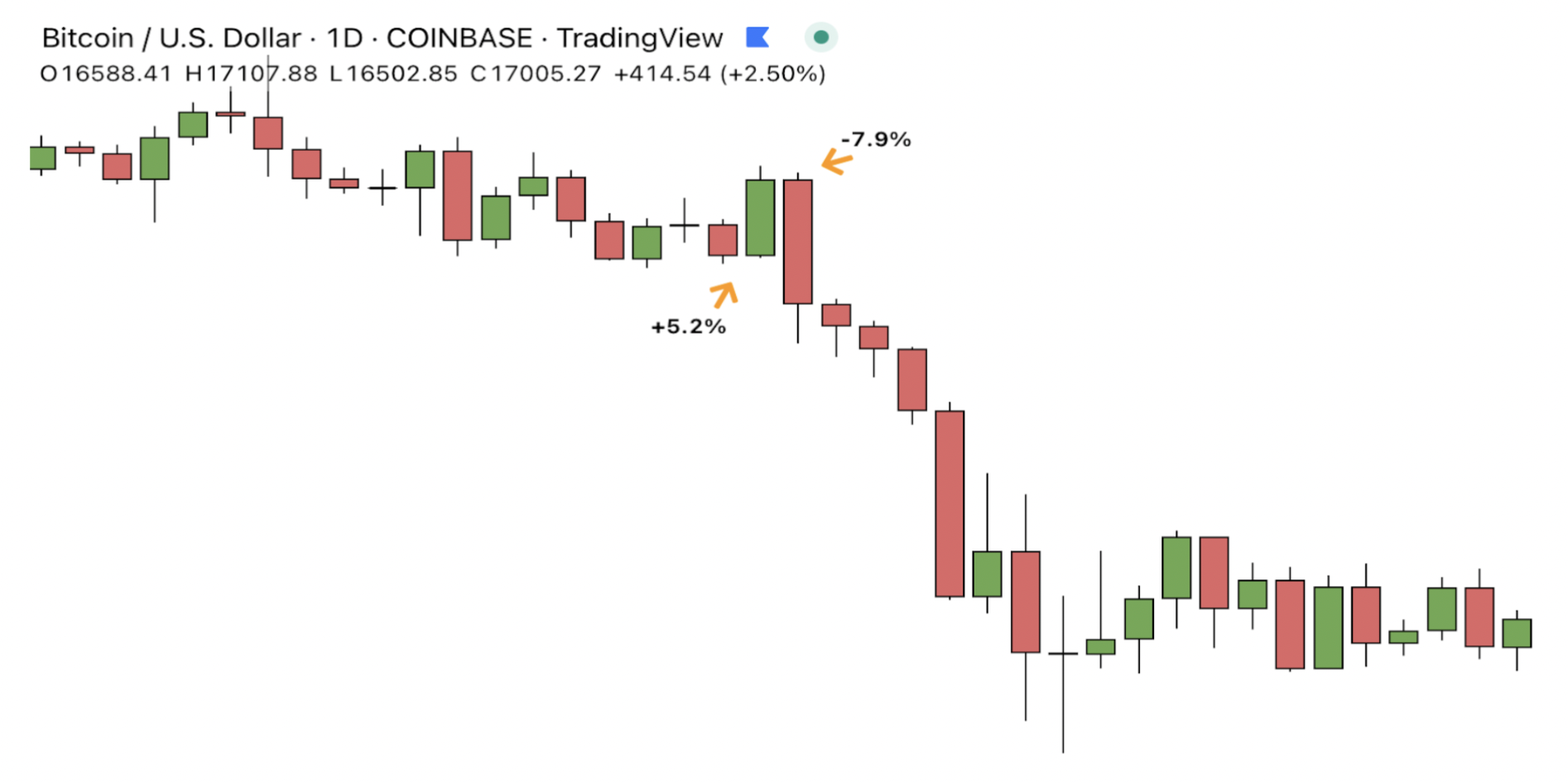

On May 4, for example, when the Federal Open Market Committee (FOMC) said it would raise interest rates by 50 basis points, or 0.5 percentage points, bitcoin went up 5.2% because traders liked that the Fed was being tough on inflation. But the next day, bitcoin dropped by 8%.

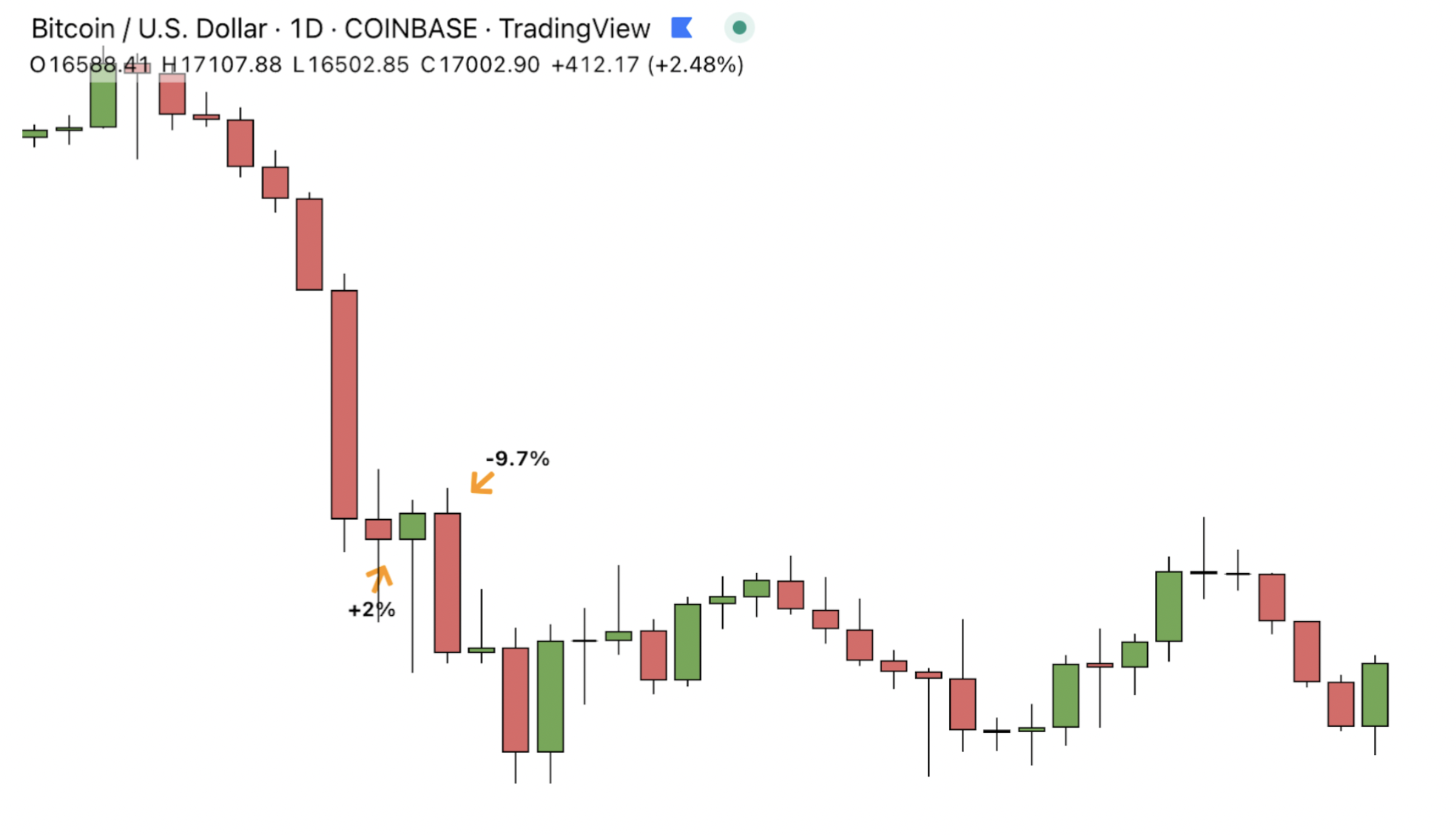

On June 15, bitcoin went up by 2% after the Fed raised interest rates by 75 basis points to fight inflation. On June 16, however, BTC fell 9.7%.

On days after the Fed raised interest rates, the crypto markets turned the other way, which was different from how the stock markets did on those days.

This year, for example, the S&P 500 only changed the next day on two of the six days when the Fed made a decision. Those two days were in June and July. Other than that, the S&P has stayed on the same track.

Iaccino said, “The S&P 500 is much more involved in day-to-day investing, so it’s a lot less volatile.” On the other hand, he said, people who trade in crypto are “deeply emotional about what this asset is.”

All asset classes have been more volatile than usual before and after Fed days, said Oanda Senior Market Analyst Edward Moya. “Usually, people don’t say much before the Fed makes a decision, but this year was different because everyone was trying to guess when the Fed will change its mind,” he said.

Moya said this is likely to stay the case until most people think the Fed is done tightening.