Peter Brandt, a renowned market trader, has slammed Ethereum as an inefficient and irrelevant cryptocurrency, in contrast to other bullish predictions. He argues that Bitcoin is far superior to Ethereum as a store of value and investment asset.

Ethereum, the second-largest cryptocurrency by market capitalization, has faced harsh criticism from Peter Brandt, a veteran market trader and analyst. Brandt, who is known for his blunt and controversial opinions, has cast serious doubt on Ethereum’s future prospects, especially in comparison to Bitcoin, the leading cryptocurrency.

Brandt’s comments come when Ethereum is receiving positive attention from other market experts and institutions, such as JPMorgan, who have predicted that Ethereum could soon surpass Bitcoin in terms of market share and adoption.

These optimistic forecasts are largely based on Ethereum’s upcoming EIP-4844 upgrade, also known as Proto-danksharding, which aims to improve the scalability, security, and efficiency of the Ethereum network.

However, Brandt is not convinced by these arguments. He has challenged the assumption that Ethereum is a better investment than Bitcoin, citing several reasons why he thinks Ethereum is doomed to fail. He has also questioned the logic behind investors’ preference for Ethereum over Bitcoin, which he considers a more reliable and valuable cryptocurrency.

High gas fees and structural issues

One of the main issues Brandt has raised about Ethereum is its high transaction fees, or gas fees, which he claims are a major drawback for investors and users. Gas fees are the amount of Ether users must pay to execute transactions or smart contracts on the Ethereum network. These fees vary depending on the network congestion and the complexity of the transaction.

Brandt has argued that these fees are too high, making Ethereum an inefficient and costly cryptocurrency. He has compared Ethereum to a “gas-guzzling” car that consumes more fuel than it produces. He has also suggested that these fees reduce Ethereum’s attractiveness as an investment asset, as they eat into the profits of investors and traders.

Moreover, Brandt has expressed skepticism about Ethereum’s structural and functional aspects, such as its consensus mechanism, programming language, and security.

He has implied that Ethereum is a flawed and outdated cryptocurrency that will not be able to keep up with the innovation and competition in the crypto space. He has even predicted that Ethereum will lose its relevance and significance within the next decade as newer and better cryptocurrencies emerge.

Bitcoin vs Ethereum

Brandt’s negative view on Ethereum contrasts sharply with his positive view on Bitcoin, which he regards as the superior cryptocurrency in every aspect. He has praised Bitcoin as a store of value, a medium of exchange, and a hedge against inflation and currency devaluation.

He has also highlighted Bitcoin’s scarcity, decentralization, and network effect as factors that give it an edge over Ethereum and other cryptocurrencies.

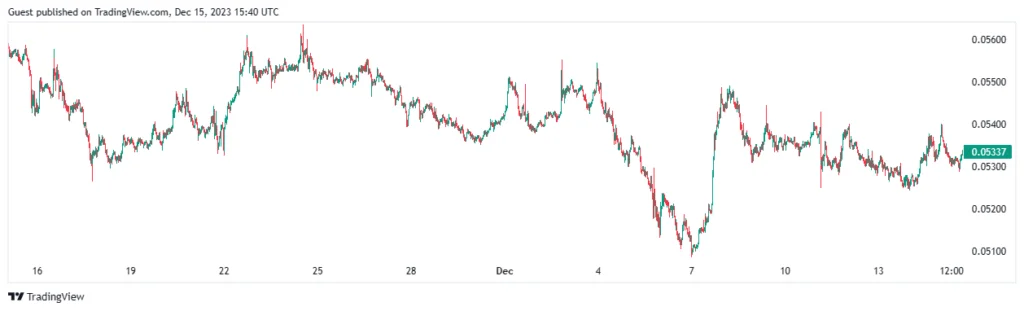

Brandt has also emphasized the importance of the ETH/BTC price chart, which shows the ratio of Ethereum’s price to Bitcoin’s price. He has stated that this chart is the key indicator of Ethereum’s fate, as it reflects the relative strengths and weaknesses of the two cryptocurrencies.

He has pointed out that Ethereum’s future depends on whether it can sustain above the 0.04803 level, which he considers to be a critical support level. Brandt has warned that Ethereum could face a “funeral” and a steep decline if this level breaks. On the other hand, if this level holds, Brandt has conceded that Ethereum could delay its demise, but only for a short while.

Brandt’s criticism of Ethereum is not new. He has previously expressed his disdain for Ethereum, calling it a “piece of crap” cryptocurrency and questioning its decentralization and legitimacy.

He has also clashed with other prominent analysts, such as Raoul Pal, who has a more bullish outlook on Ethereum. Brandt has acknowledged his respect for these analysts but has not changed his mind about Ethereum.