Sino is a well-known crypto investment company based in Asia. It holds many of the tokens that lost the most value when Sam Bankman-FTX Fried’s crypto empire fell apart. FTX was also a key partner in a large fund that Sino put together with money from outside investors.

Sino Global Capital, which is led by Matthew Graham and is one of Asia’s biggest and best-known crypto investors, tweeted this week that its “direct exposure to FTX exchange was limited to mid-seven figures held in custody.”

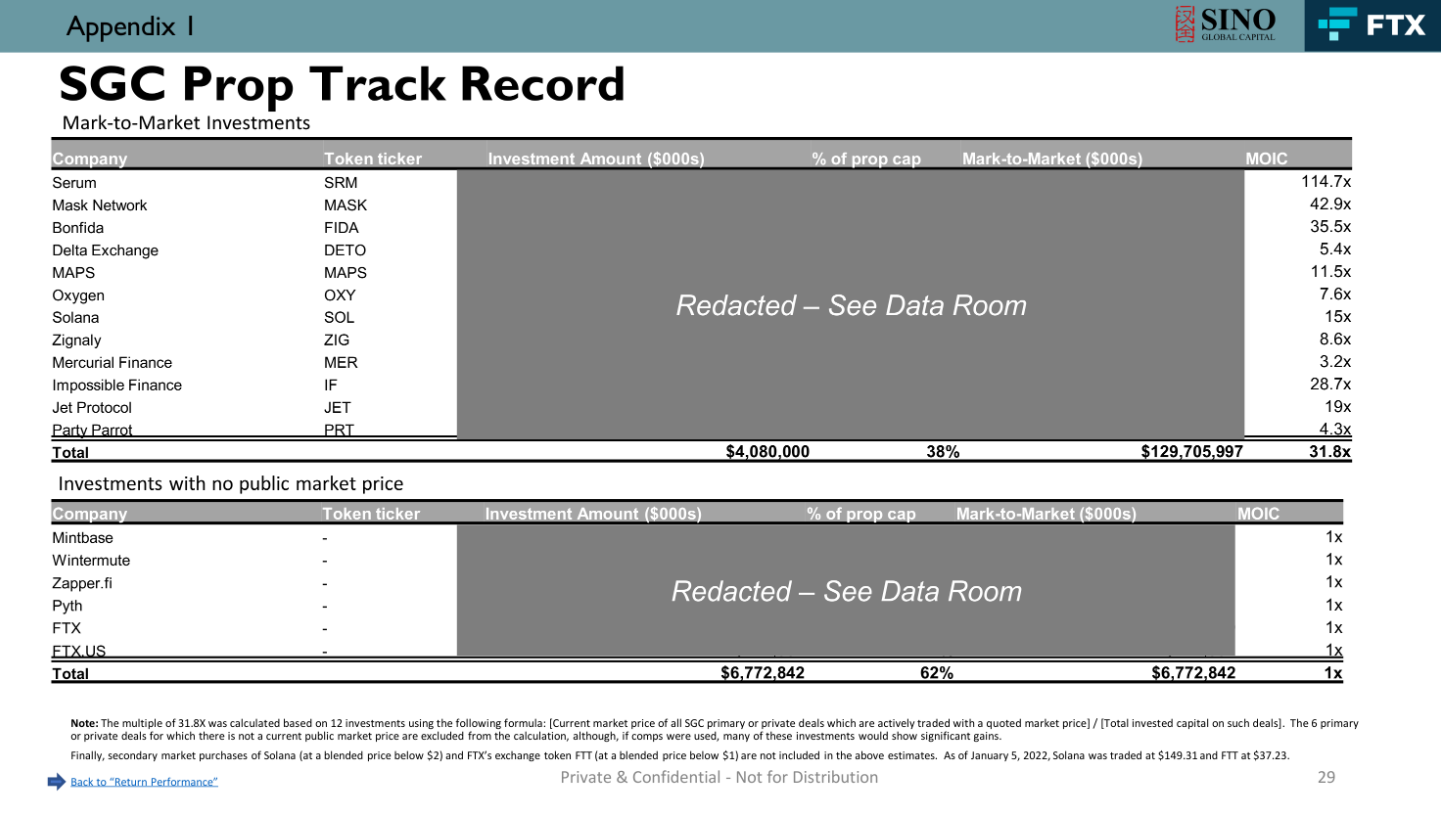

The way the statement is written makes it unclear how big the firm’s indirect exposure might be. This includes a portfolio of digital tokens worth $129 million as recently as early this year, according to investor documents. Many of those tokens, like the Solana blockchain’s SOL, were closely linked to Sam Bankman-Fried, the once-billionaire crypto whiz kid-turned-pariah who ran FTX.

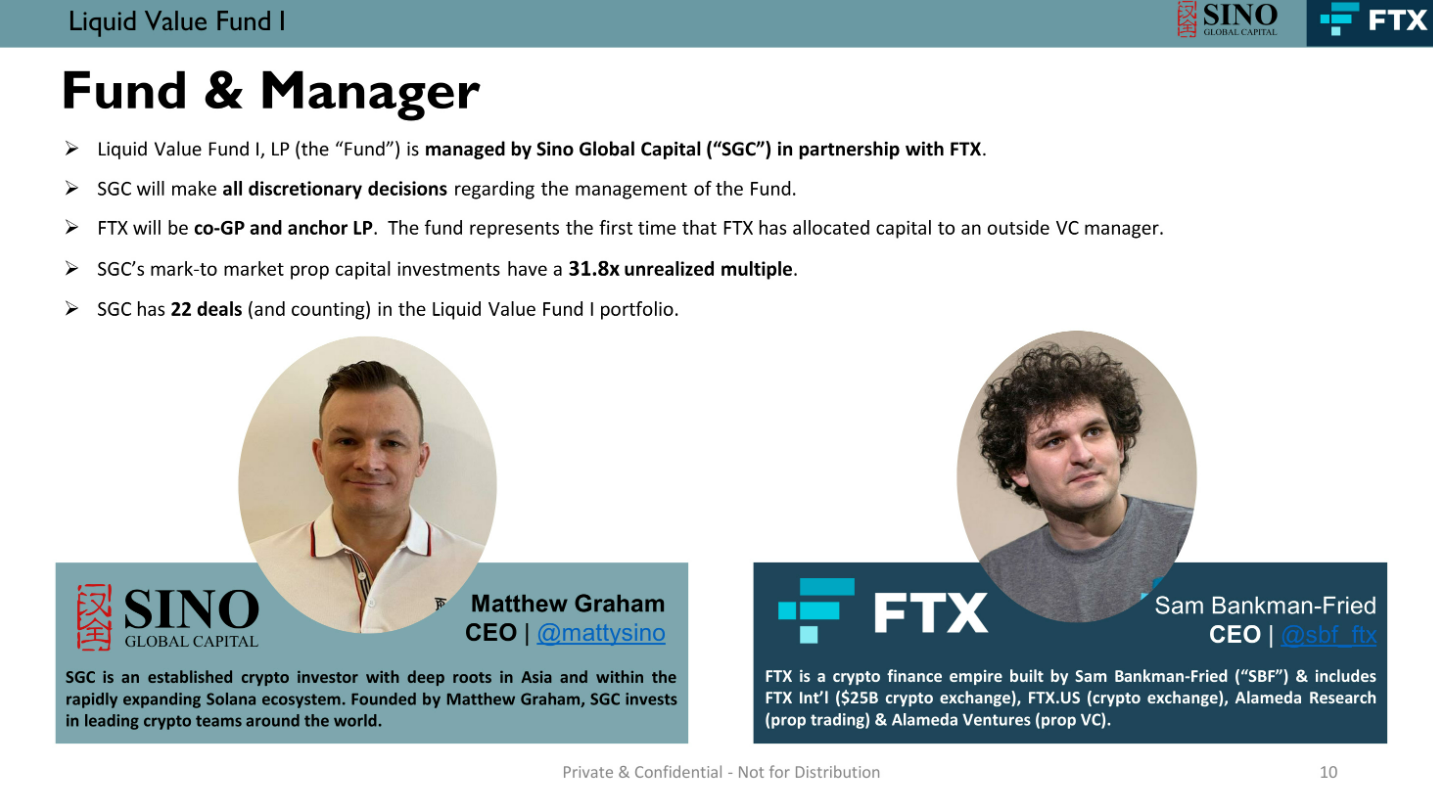

What’s causing more scrutiny now is the appearance of a slide deck that Sino showed to investors earlier this year when it was trying to raise money for a crypto investment fund with a goal of as much as $200 million. The slide deck was posted on a public website, but a person who knows about the situation confirmed that it was real.

In the slide deck, FTX was called a “partner” in the fundraising, and it was said that they could unlock “significant strategic value.” As of January, the fund had already raised $90 million, with FTX acting as an anchor investor.

Sino wanted to show off how good it was at investing, so it made a long list of its own investments, which were worth about $129 million and were called “mark-to-market investments.” They included Solana’s own SOL tokens as well as Serum (SRM), Maps (MAPS), Oxygen (OXY), and Jet Protocol (JET).

As Bankman-crypto Fried’s empire fell apart, including the recent bankruptcy of FTX, the prices of each of these tokens dropped by 80% or more.

It’s not clear if Sino still owns the tokens that made up the proprietary trading book as of January, how much the new fund manages right now, or what the fund owns.

CoinDesk couldn’t find any recent documents about the fund that showed how it was doing or what it was holding. Sino didn’t answer when asked for more recent documents that showed how the fund had done.

If the investments haven’t been sold yet, one worry might be that what little value is left in Sino’s token holdings would drop even more if he tried to sell them. Tokens aren’t traded much, so there probably aren’t enough buyers at the already low price.

Sara Gherghelas, a blockchain analyst at DappRadar, said, “There isn’t enough liquidity to sell all the tokens.” “The team could be able to sell if they used some of their own tokens to make sure there was enough cash on hand. If this happens, it will cause the price to drop by a lot.”

Late in 2021, when the bull market was at its peak, the Liquid Value I fund was launched with the goal of getting $200 million. It was the first time Sino had used outside capital in a formal fund vehicle. Before that, Sino had mostly only invested as a principal.

Sino Global listed a $6.8 million portfolio of assets for which there was no market price. This was one of its major investments. Among these were shared in FTX and FTX.US, the American branch of FTX.

The fund wasn’t open to regular investors; instead, it was marketed to people with a lot of money.

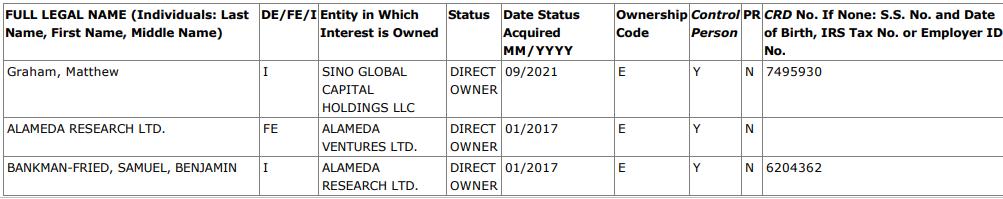

In February, the U.S. Securities and Exchange Commission (SEC) said that Bankman-Fried was an indirect investor in the general partner of the Liquid Value I fund through his trading firm Alameda Research and a company called Alameda Ventures.

Sino Global listed a $6.8 million portfolio of assets for which there was no market price. This was one of its principal investments. Among these were shared in FTX and FTX.US, the American branch of FTX.

The slide deck doesn’t say exactly what investments would be made in the new fund, but it does say that the “Liquid Value Fund I could have a similar breakdown” to Sino’s proprietary investments.

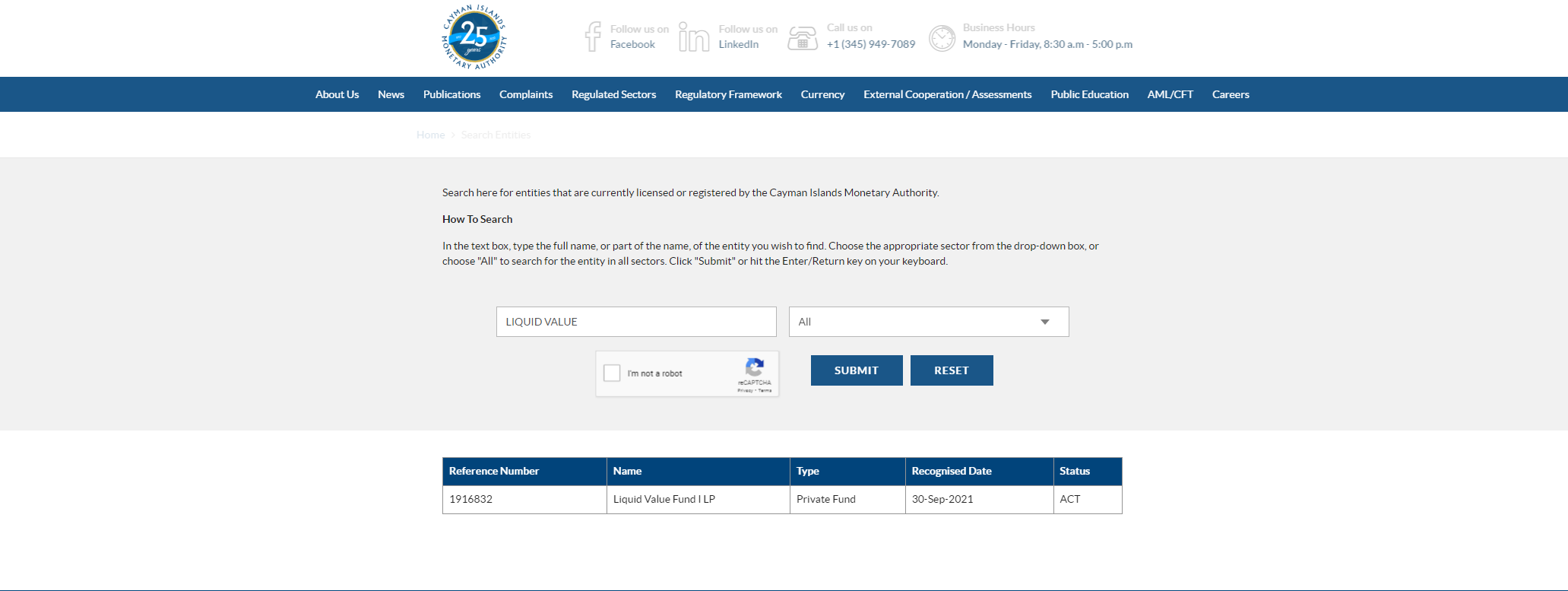

A filing with a Cayman Islands fund directory shows that Liquid Value Fund I is currently in operation. Its registration date is set for September 2021.

Patrick Loney, the firm’s general counsel and head of investor relations, told CoinDesk in an email that he would get back to them soon about the Liquid Value I fund. He copied Mona Hamdy, who is in charge of strategy. As of press time, there were no other comments.

If the token investments in Liquid Value Fund I were similar to the ones that Sino made for its own investment portfolio, that could be a bad sign for the fund, since the prices of many of those tokens have dropped sharply this year, just like they have in Sino’s portfolio.

Data from CoinGecko shows that only about $250,000 worth of MAPS, OXY, and JET are traded every day on digital asset markets.

Ajay Dhingra, the head of research and analytics at Unizen, said, “If someone executes a market sell order of 1 million MAPS, it can easily wipe out the buy-side books with slippage of 25-30%.”

Investors Wiped Out?

Sino said in a statement this week, “We trusted FTX to be a good actor committed to moving the industry forward,” and “We deeply regret that misplaced trust.”

“Sino Global Capital is running as usual and is still making investments as a fund,” the statement said. “Fund investments are balanced across ecosystems, and we don’t use leverage or short-term trading strategies.”

But at a basic level, the fund’s own strategy and operations were so closely tied to FTX’s that it is likely to be hard to break away quickly, even if there were no losses.

Some of Sino’s holdings may have been sold to make a profit or reduce risk. But even if they had been sold before the big drop in the last two weeks, the returns would have been questionable because of the price drops in crypto markets earlier this year.

The Tom Brady connection

A person who knew about the situation told CoinDesk that FTX and Bankman-Fried were a big part of the fund’s marketing.

The January slide deck had a lot of information about Bankman-Fried and FTX.

Also mentioned was FTX’s “rapidly growing brand recognition in the US through high-profile sponsorships of Miami Heat Arena, MLB, and star athletes like Tom Brady, Steph Curry, and Lewis Hamilton.”

Graham, who works for Sino, was supposed to talk about the “outlook for digital assets” this week at an investment conference in Singapore with Matthew Heller, who works for FTX.

A new version of the agenda showed that the two men were taken off the panel later.