Fidelity Investments has filed trademark applications for Web3 goods and services, nonfungible token (NFT) marketplace, and financial investment services, and crypto trading services in the Metaverse.

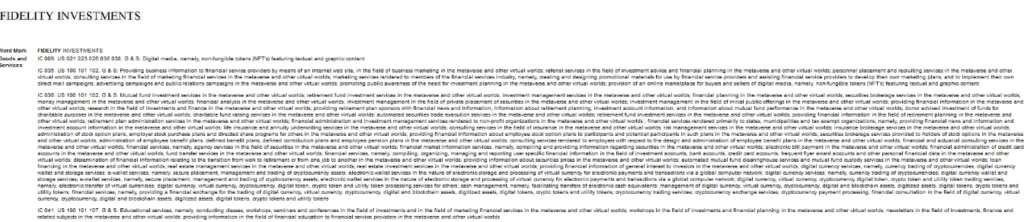

Three trademark applications were filed to the USPTO on December 21 by Fidelity Investments, which were noted by accredited trademark lawyer Mike Kondoudis in a tweet on December 27.

Fidelity has indicated that it may be able to provide a broad variety of investing services inside virtual worlds, including mutual funds, retirement funds, investment management, and financial planning. This looks to be one of the firm’s primary areas of interest.

The “financial management of credit card accounts in the metaverse and other virtual worlds” as well as electronic bill payments, money transfers, and other payment services seem to be in the works for the metaverse.

According to the documents, the company may provide virtual currency wallet services in addition to trading and administration services in the metaverse.

The filing describes “digital currency, virtual currency, cryptocurrency digital token” as “electronic wallet services in the type of electronic storage and processing of virtual money for electronic payments and transactions across a worldwide computer network.”

Furthermore, according to Fidelity, it may provide educational services in the metaverse by “offering courses, workshops, seminars, and conferences in the area of investing and in the field of marketing financial services.”

According to one filing, “Providing business information to financial service providers through an internet website, in the field of business marketing in the metaverse and other virtual worlds; referral services in the metaverse and other virtual worlds for investment advice and financial planning.”

An “online marketplace for buyers and sellers of digital material, particularly, non-fungible tokens,” according to the investment management Fidelity, is also in the works. However, nothing is known about this.

The most recent filings from Fidelity demonstrate that the company is seeking to expand its exposure and products in Web3 rather than being alarmed by the severe bear market in 2022 and the recent FTX catastrophe.

When responding to a letter from crypto-hating senators Elizabeth Warren, Tina Smith, and Richard Durbin on November 21 asking Fidelity to reconsider its Bitcoin retirement products due to the “volatile, tumultuous, and chaotic” nature of crypto assets, the company essentially outlined as such and called for stronger regulation.

The business “has always emphasized operational excellence and consumer security,” a Fidelity representative said at the time, adding that “recent developments” in the cryptocurrency market have only “underscored the need for standards and protections.”

It’s also important to remember that Fidelity allegedly planned to add 100 new personnel to its cryptocurrency division in October, which stands in sharp contrast to the many crypto companies that have cut a sizable number of staff members this year.