Bitcoin miner, Core Scientific will shut off thousands of mining rigs tied to Celsius Network as a part of the firms’ bankruptcy proceedings.

Celsius Network, a defunct cryptocurrency lender, has agreed to let Bitcoin (BTC $16,829) During the miner’s bankruptcy procedures, Core Scientific turned off more than 37,000 mining equipment it had been hosting for Celsius.

Core Scientific filed a revised proposed order on Jan. 3 that incorporated “revisions acceptable to Celsius” stating “all Celsius rigs will be powered down effective January 3, 2023 and will not be restarted during the transition period.”

On October 19, Core Scientific charged Celsius with not paying its electricity bills; later, the Bitcoin miner filed for Chapter 11 bankruptcy on December 21 after alleging the non-payment as a major contributor to liquidity problems.

On December 28, Core Scientific submitted a motion asking for permission to reject Celsius’ contracts on the grounds that the company had broken the terms of the agreements by failing to pay its electricity bills.

The court documents state that the Bitcoin miner would be able to make $2 million per month in revenue from the area now occupied by Celsius’ mining rigs if the arrangement were to be terminated.

Due to the terms of the hosting agreement, Core Scientific was able to transfer some of the power costs to Celsius. Since Russia’s invasion of Ukraine, these costs have significantly increased.

According to the rejection motion, covering the increased power fees cost Core the Bitcoin mining firm almost $7.8 million as of Dec. 28 and the miner noted it “cannot afford to continue shouldering the burden of Celsius’ unpaid power costs.”

The cost of production has gone up for miners even if the value of Bitcoin has gone down, which has hurt their profits and caused the “hash price”—the amount of money miners can make for each unit of hash rate—to drop by almost 75% by 2022.

By the end of 2022, many Bitcoin miners were struggling due to their lack of profitability and the expenses related to their expansion plans. As a result, the value of their stock fell.

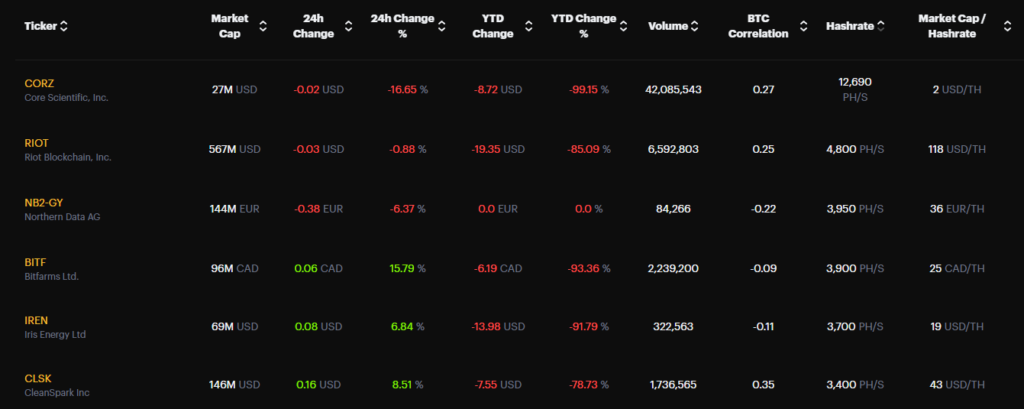

Over the course of the year, the share price of Core Scientific has decreased by 99.15%, while that of Iris Energy and Riot Blockchain has decreased by 91.79% and 85.09%, respectively.