The loan would allow Core Scientific to keep its mining and hosting operations afloat while it restructures.

A bankruptcy court in the United States has given Bitcoin (BTC $16,805) miner Core Scientific temporary permission to obtain a $37.5 million loan from current creditors to fund it in the midst of liquidity concerns.

One of the biggest cryptocurrency mining firms in the country, Core Scientific, filed for Chapter 11 bankruptcy on December 21 due to growing energy costs, decreased revenue, and the expected decline in the price of bitcoin in 2022.

That same day, Core Scientific revealed its plans to “move expeditiously through the restructuring process” while maintaining its mining and hosting operations in a public announcement.

It was agreed to offer debtor-in-possession (DIP) facility commitment loans up to a total of $75 million by a group of creditors that control more than 50% of Core Scientific’s convertible notes, according to court documents.

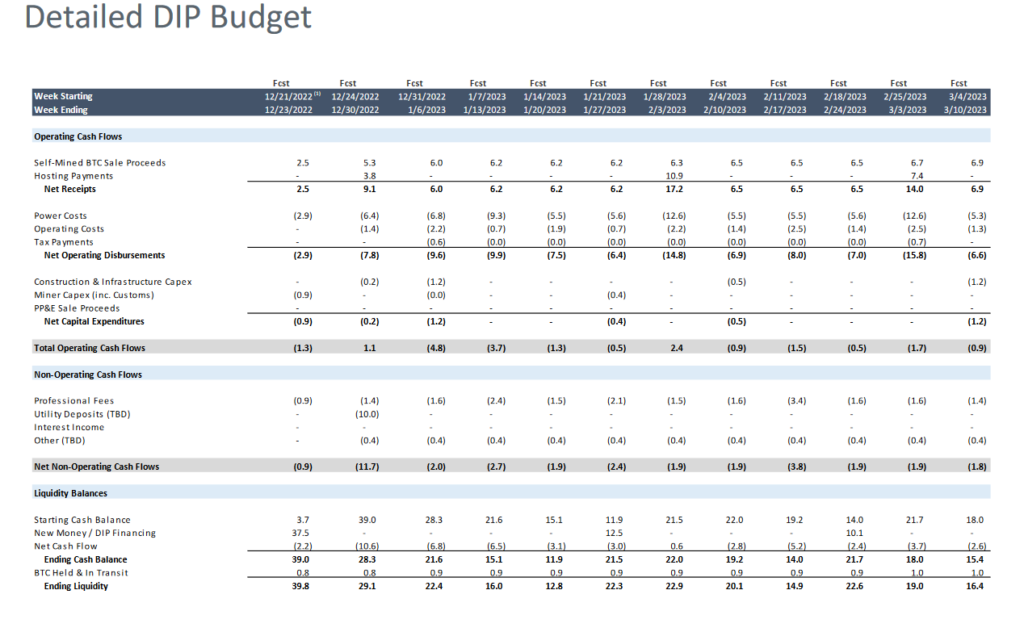

On December 22, the firm’s application was authorized, and according to court documents, the DIP loan will have an interest rate of 10% annually. According to Reuters, which cited a corporate attorney, Core Scientific will be able to access $37.5 million right away to keep the lights on and plans to ask for access to the remaining $37.5 million in January.

However, it was anticipated in the first DIP budget that Core Scientific would submit a $12.5 million application by January 21.

According to the Reuters article, the creditors are considering a long-term strategy with Core Scientific and are aware of the difficulties presented by the bear market.

According to Kris Hansen, a spokesperson for the creditors, the current shareholders “have faith” in the company’s future despite its recent problems. According to Core Scientific’s third-quarter financial report, as of September 30, it had $1.4 billion in assets and $1.33 billion in liabilities, demonstrating a solid balance sheet despite the bull market.

Notably, the company reported a loss of $434.8 million for the third quarter, bringing the year’s total losses to $1.71 billion. As a result, the company warned in late November that, absent a fresh infusion of capital, it was probably on the verge of bankruptcy.

In contrast to the 5,769 BTC mined in 2021, the company has reportedly produced almost 12,000 BTC this year. Of course, this hasn’t been able to rescue the mining firm from its financial problems.